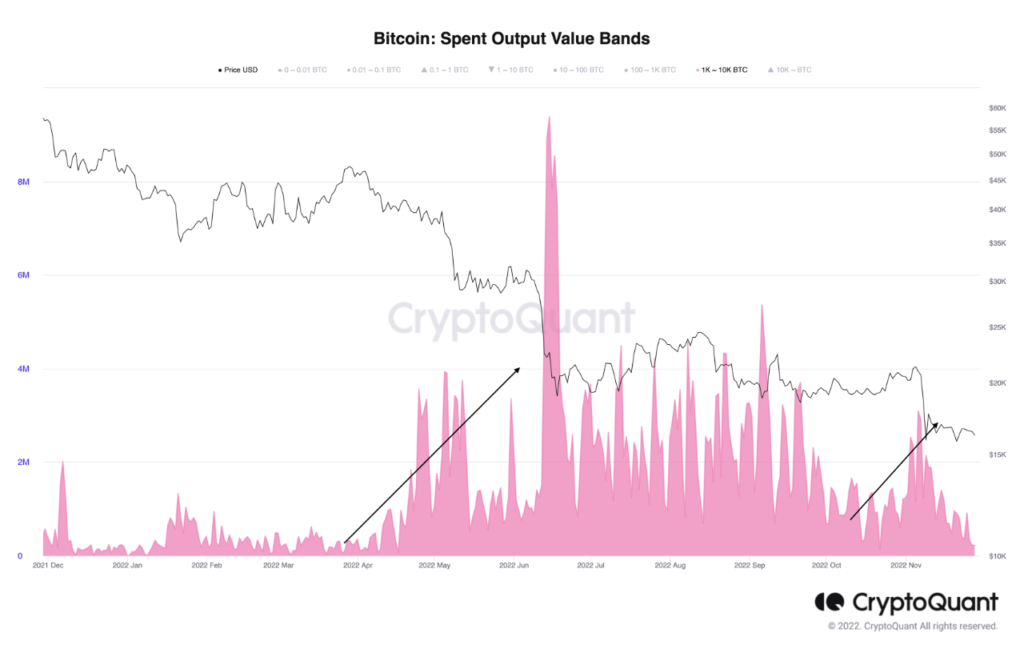

Bitcoin miners continue to use BTC at their expense due to adverse market conditions. On-chain data shows that loaded Bitcoin is flowing from miner wallets to exchanges.

More than 10,000 Bitcoin (BTC) flowed to exchanges

Bitcoin price started to rise after Fed Chairman Jerome Powell suggested that interest rate hikes will gradually decrease in December and the coming months. Its trading volume increased by over 200%, while its price reached $17,194. However, on-chain data shows that miners are selling Bitcoin due to financial difficulties. This causes the Bitcoin hash rate to drop continuously.

According to data provided by Whale Alert, miners transferred a total of 10,050 BTC to Coinbase on Dec. This means a transfer of more than $ 171 million on a fiat basis. However, there has been a large amount of BTC sales transactions in the last 24 hours.

On-chain analyst IT Tech confirms the sale in the chart with 10,000 Bitcoins coming out of the wallet of BTC miner Poolin. If miners transfer some of their reserves at the same time, the BTC price will face selling pressure.

Whales worried about miner sales prefer to wait

Amid increasing selling pressure from miners, whales have restricted their purchases. Thus, the leader crypto has to keep his rallies around 2% during the day. In fact, miners who sold 4,000 BTC this week were one of the factors behind the drop. On-chain data shows that miners are moving more Bitcoin to exchanges after BTC dropped from $20,000 to $16,000.

The last few months have seen a 13,000 BTC drop in reserves held by miners. BTC price is currently at the same level it was at the beginning of 2022 as a result of the decline. Also, as a result of less mining activity, the Bitcoin hash rate continues to drop. Investors are now expecting over $20,000 from the leading crypto ahead of the new year.

Can BTC get a chance to rise while interest rates fall?

Bitcoin price had an opportunity to briefly climb above $17,000 on December 1. The move up began after Fed Chairman Jerome Powell spoke of slower rate hikes from December in his most recent speech. Now technical indicators are showing that the bearish trend in Bitcoin is exhausted. However, some experts have urged caution as Bitcoin’s price action has yet to meet all the necessary conditions to confirm a bear market bottom and a bullish rebound. Markus Thielen, research and strategist at Matrixport, noted in his recent analysis:

As we’ve seen three startups fail at the end of this year, we need to wait for Bitcoin price to trade above $20,851 to call for a sustained rally and a cyclical decline.

Also, Caleb Franzen, founder of research firm Cubic Analytics, stated that there will be a bull rebound when Bitcoin registers a positive “Heikin Ashi” candle on the monthly chart. Heiken Ashi and traditional candles are created using the opening, high, low and closing prices of a crypto for a given period. But Heiken Ashi is an average version of traditional candles. Therefore, it helps cut through the noise and facilitates better measurement of trend reversal than traditional candles.

Heiken Ashi historically marks the end of the bear market

Caleb Franzen shared in his tweets on Monday what the Heikin Ashi candle has historically said. Bitcoin is currently producing the 12th consecutive red monthly Heikin Ashi candle, while “After 5+ months of red candles, a green monthly candle always marks the end of a bear market”. Franzen says we could be at the end of the bear market if 12 consecutive red Heiken Ashi candles turn green.

Today is the final day of November and #Bitcoin is going to produce the 12th consecutive red monthly Heikin Ashi candle.

After 5+ months of red candles, a green monthly candle has marked the end of each bear market.

Each red streak has been longer than the last. #Patience pic.twitter.com/BbHdBQ0SRf

— Caleb Franzen (@CalebFranzen) November 30, 2022

cryptocoin.com As you follow, Bitcoin price fell below $17,000 again today. The RSI on the weekly chart shows the bullish divergence. This divergence occurs when the RSI does not confirm a new low/cyclical price drop. In other words, the RSI stays flat or rises while the price is falling. Technical analysts see this as an early sign of an impending positive trend change.

“It is interesting to see that the RSI has already peaked in January 2021 for this cycle. It is surprising to note that Bitcoin has not confirmed its second peak at 22,” he says. According to Matrixport’s research and strategist, Bitcoin needs to close the week above $20,851 for a sustainable rally.