NFT coins gained popularity in 2021, especially after artist Beeple made history by selling his NFT for $69 million. Since then, NFTs have rocked the digital world with artists, celebrities, global brands, tech platforms and more. Originally, NFTs were an experimental technology and a way for creators to take control of their work, NFTs became mainstream. But what exactly is an NFT? How does it work?

What are NFTs?

A non-fungible token or NFT is an asset attached to a digital or physical object and stored on the Blockchain. It serves as an authentic proof of ownership. We can view NFTs as claimable and transferable digital certificates for media files. They are essentially cryptographic signatures of images or other media types. The most important features are as follows:

- Cannot be changed

- Still

- Traceable

Because each NFT has unique characteristics, each token is different. These tokens are not exchangeable and are not interchangeable. They offer unprecedented value in tokenized data and property rights that could revolutionize many industries.

How do NFTs work?

Every NFT has a code, a unique ID and metadata that no other token can match. They reside on a Blockchain that acts as a decentralized ledger that tracks the ownership and transaction history of each NFT. An NFT can have only one owner at any one time. Smart contracts determine ownership. It manages the “transferability” of NFTs. They also create the unique identity and metadata that govern the ownership of an NFT. When you mint (create) an NFT, a code stored in the smart contract is executed and the information is added to the NFT’s Blockchain. The minting process follows three main steps:

- Creating a new block.

- Confirmation of information.

- Saving information to Blockchain.

NFT coins can be transferred using the same principle.

How do NFT coins make money?

Before we move on to how NFTs make money, we need to understand what gives them value. Consumer interest increases the value of an NFT. An unchangeable token is practically worthless if no one is interested in purchasing it. There are several factors that affect the value of an NFT.

- NFT rarity:Because investors like to own something that no one else has, rarity increases value.

- Use:Investors prefer NFTs that can provide real-world uses and benefits.

- social proof: Popular NFTs or NFTs with celebrity endorsements are sold at higher prices.

- Ownership history:NFTs created by major brands/prominent or notable previous owners have a higher value than others.

But how can you make money with NFTs? Let’s look at six ways to make money from NFTs.

- Mint your own NFTs: Issuing NFT means issuing a unique token on a Blockchain. It can be sold on an NFT market and allows you to monetize your work.

- Copyright: When printing NFT, the creator can set the royalty percentage, which means any secondary market sale will provide a payment to the original creator. Most royalties are between 5-10 percent.

- Buying and selling NFTs: Buy and sell is a method of buying low and selling high, resulting in a positive return. It is a very short-term approach while often requiring expertise in the NFT market.

- NFT trading: NFT trading is geared towards incremental capital gains over the long run. This method focuses on buying low value NFTs and selling them at the appropriate time, which requires patience and market expertise.

- NFT HODLing: HODLing is about buying and holding an undervalued NFT and selling it only when it gains in value. It is not a guaranteed approach to making money. Sometimes NFT holders get airdrops.

- NFT staking: Staking an NFT is an ideal way to earn a passive income without selling your NFT. You can get rewards by locking your token on a DeFi platform.

Like many other investment areas, making money from NFTs has its own risk. For this reason, every investor should invest in line with his own research.

Are NFT coins bad for the environment?

One of the most common criticisms of NFTs is that their use of cryptocurrency has a negative environmental impact. The most widely used blockchains work with a proof-of-work (PoW) consensus algorithm. Although they are quite efficient, they harm the environment. Ethereum is the dominant network of NFT activity and trading. Prior to the Ethereum merge, Ethereum’s energy consumption was quite high when combined with Bitcoin. However, cryptocoin.com As we reported, Ethereum’s energy requirements have dropped by 99.5 percent since the merge. In the past, many have argued that blockchain increases the overall carbon footprint as they promote the use of NFTs.

Additionally, several Blockchains are already taking steps to solve the Blockchain energy problem. Solana uses a unique combination of proof-of-history (PoH) to control energy use. For example, Tezos’ Liquid Proof of Stake (LPoS) system consumes almost two million times less energy than Ethereum before the nerge. That is, NFTs based on Proof-of-stake have a significantly lower environmental impact.

Are NFTs expensive right now?

The popularity of NFTs skyrocketed last year, with total sales of NFTs hitting $25 billion. Some NFTs have generated millions of dollars in auctions or direct sales. However, the NFT market is not as robust as it used to be. The price of many NFTs has dropped significantly. Many even dropped to zero.

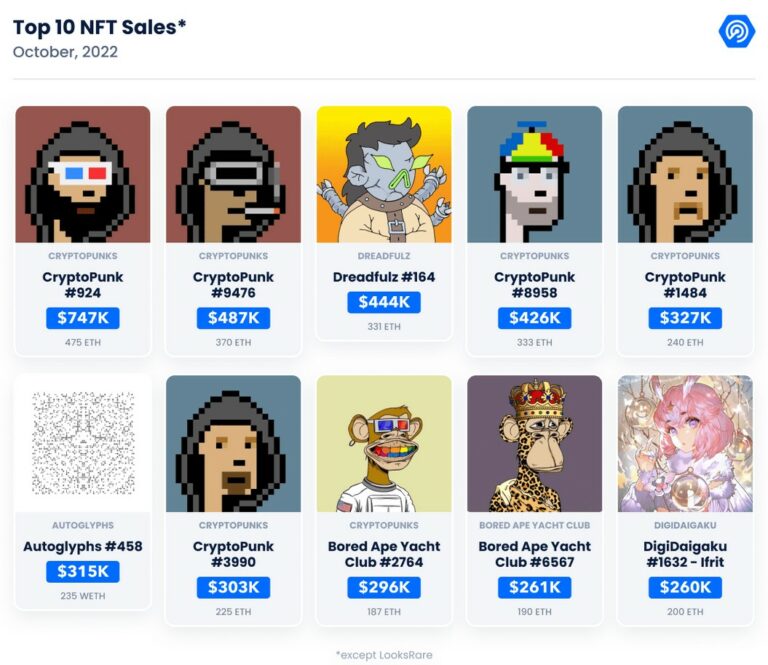

The first tweet of Twitter founder Jack Dorsey was translated into NFT and sold for $2.9 million. However, it currently only has a $97 top offering. Logan Paul spent $623,000 on an NFT Bumblebee last year. It’s only worth $10 now. So, NFT sales fell. However, this does not mean that there are no high-value trades in the space. Here’s how you can see the top 10 NFT sales from last month:

Popular NFTs like CryptoPunks are still being sold for insane amounts. So not all NFTs have become worthless. Those with real uses or private communities retained their value. Although the hype has contributed to the value of NFTs, the real benefit will be the catalyst for mainstream adoption. As a result, NFTs remain risky. Only when they go beyond their current stage and increase their uses will organic growth occur.