Many economic indicators now point to relatively mild price action in the short term for crypto markets.

The U.S. Federal Reserve’s likely 50 basis point rate hike at its next Federal Open Market Committee (FOMC) meeting on Dec. 14 would be an encouraging retreat from the more hawkish 75 bps increases that resulted from the FOMC’s last four meetings. Inflation has been declining, although 50 bps is hardly dovish enough to return consumers wholeheartedly to riskier investments.

Yet, a decline in savings may offer even more compelling evidence of cryptos’ likely, continued calm.

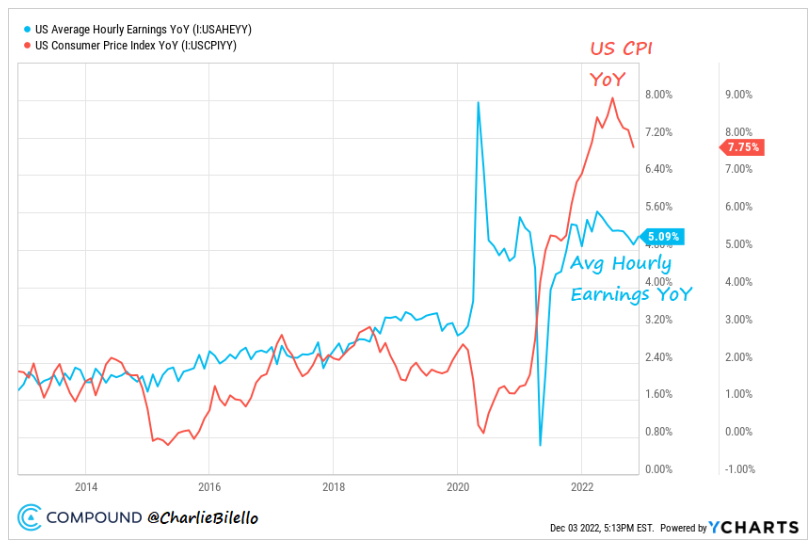

Inflation growth has exceeded wage increases for nearly two years.

As shown in this graphic from Compound Advisers, prices continue to increase at a faster pace than incomes. Not surprisingly, this trend has led to sharp increases in U.S. revolving debt balances. In turn, the personal savings rate in the U.S. has fallen to its second-lowest rate in close to 60 years.

Earnings vs. inflation (Compound Advisors/Charlie Biello)

As retail investors comprise a sizable portion of crypto investors, the continued erosion of buying power will likely weigh upon bitcoin and ether prices. We face a cocktail of higher interest rates, decreased buying power and increased levels of debt.

I’d love to be able to write something other than “bitcoin prices look poised to trade in a range,” but that’s where we are. Over the past week, BTC and ETH prices have stabilized at about $17,000 and $1,300, respectively. Volatility for both (as measured by the Average True Range) has fallen 47% and 45%, respectively.

Momentum for both, as measured by their Relative Strength Index readings, is neutral as well, with both sitting at 50. Volume for both assets have trailed their respective 20-day moving averages, which implies a lack of trading interest.

So for all the noise and uncertainty surrounding crypto markets following the collapse of crypto exchange giant FTX and other industry debacles, crypto prices have remained quiet.

Whale investors to sell?

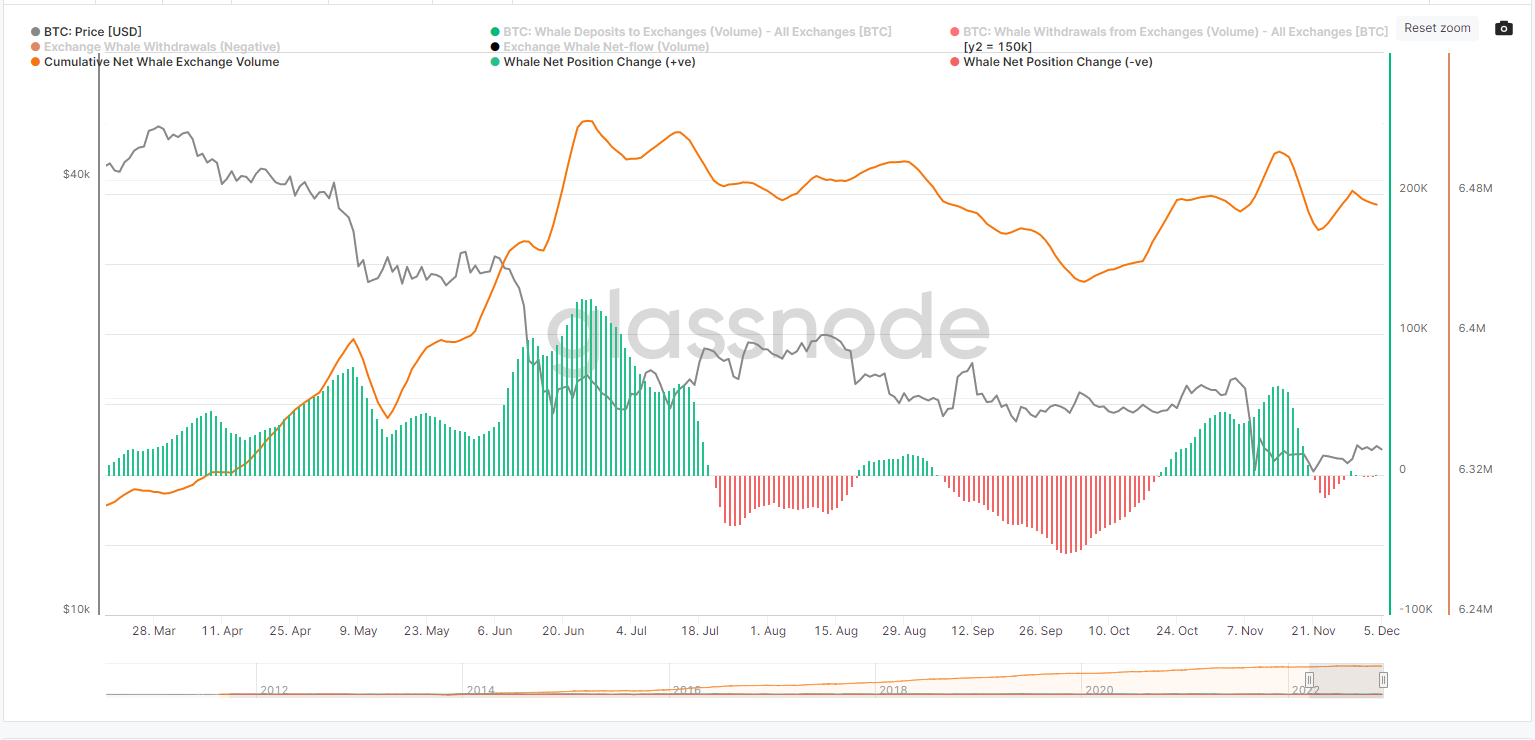

Part of that quiet is evident on-chain, when looking at the behavior of whale investors – those investors holding at least 1,000 BTC on centralized exchanges.

For example, upticks in whales sending BTC to exchanges between March and June, and October and November this year coincided with 50% and 14% decreases in BTC’s price during those periods.

Recently, whale net positions have flattened. This latest trend does not foreshadow bullishness in BTC prices but suggests that they will remain stable.

Whale net volume to exchanges (Glassnode)