AXS, the native token of blockchain-based play-to-win game Axie Infinity and a metaverse coin, bounced back from 17-month lows this week. The couple came out of oblivion with a price rally. So what happened? Will the rise continue?

Traders worried about metaverse coin AXS

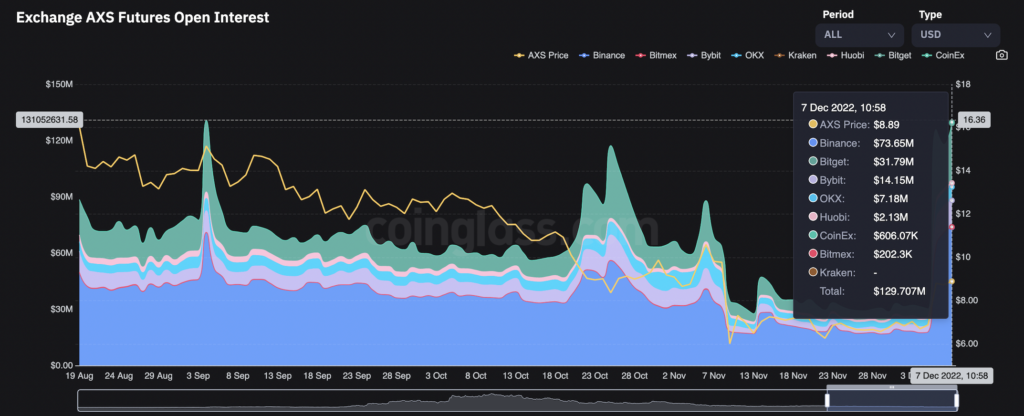

Leveraged traders seem skeptical as to whether AXS’s return from 17-month lows will be sustained. This is because, according to data source Coinglass, the open interest or dollar value locked in the number of active standard futures and perpetual futures contracts tied to AXS rose to a three-month high of $129.70 million, while funding rates remained negative.

cryptocoin.com As we have also reported, funding rates are the cost of holding bullish long positions and bearish short positions in the perpetual futures contract market. The negative ratio indicates that short positions pay long positions to keep their positions open, and leverage is skewed in the bearish direction. The combination of rising open interest and negative funding rates indicates a new downward flow of money, a sign that traders are shorting in the rally.

“In an environment conducive to alternative cryptocurrencies, an increase in open interest means there is a greater likelihood of increased short selling,” said volatility trader Griffin Ardern of crypto asset management firm Blofin. According to Ardern, the negative funding fees indicate that traders have not given up on the downtrend yet.

Short squeeze may come

AXS jumped to a three-week high of $10.40 on Monday after Axie Infinity announced its plans to phase out the game. In the post titled “Axie Contributor Initiative Start,” Axie Infinity said the decentralized strategy will focus on creating a situation where community members with meaningful contributions will play a pivotal role in the decision-making process.

“The AXS leap is focused on this event,” Ardern said, referring to Axie’s announcement of community decentralization. Currently, the token has changed hands at $8.4, representing a weekly gain of about 22 percent. The persistent bearish sentiment in the futures market can be attributed to the FTX crisis and macroeconomic uncertainty, which has put heavy pressure on crypto prices this year.

However, a continued rise in AXS could force traders to reassess their commitment to bearish trading and pave the way for a long rally fueled by the resolution of open interest that we have seen similar in US equities recently. “Given the current low liquidity in alternative cryptocurrencies, short squeeze cannot be ignored,” Ardern said.