Senior market analysts and crypto traders have made alarming predictions about Bitcoin amid the ongoing recession. Some experts expect the leading crypto to drop to 4-digit prices.

Peter Schiff says Bitcoin price will break $10,000

The famous Bitcoin critic and gold advocate claimed that Bitcoin is still very expensive. The famous economist says that the leading crypto should reach prices well below $ 10,000. According to him, the dangerous low of $5,000 is fair value for Bitcoin.

According to Schiff, Bitcoin has a downside risk of much more than 70%. The veteran investor says that even though Bitcoin has crashed from $69,000 to about $15,000, it is still not at the bottom.

#Bitcoin has far more downside risk than 70%. After such a decline Bitcoin will still be way over-priced, so $5,000 will not even be close to the bottom. https://t.co/VGj6ZPuwvi

— Peter Schiff (@PeterSchiff) December 5, 2022

Despite Schiff’s anti-crypto approach to his analysis, Bitcoin’s behavior in the market has been uncertain for the past few months. Events such as the collapse of FTX and the bankruptcy of major companies in the industry caused unpredictable declines. The economist advises his followers to exit the cryptocurrency market as soon as possible due to its instability, lack of regulation and the extent of manipulation that the cryptocurrency market has to face.

Some analysts are confident current levels are bottoms.

Unlike Peter Schiff, veteran analyst Charles Edwards from the Capriole Investments fund claims that the market presents an ‘extraordinary opportunity’ for Bitcoiners. On December 6, the on-chain analyst released the highly anticipated Bitcoin Bottom Signal Series to explain why the worst may be behind for Bitcoin bulls.

Bitcoin Bottom Signal Series.

A thread of on-chain signals which suggest the Bitcoin bottom is in, or very close. In my opinion, these are the most important on-chain metrics today. Based on Bitcoin's 13 year history, they are telling me this is an extraordinary opportunity. pic.twitter.com/5io6WD2ELo

— Charles Edwards (@caprioleio) December 6, 2022

According to their analysis, BTC adoption is at ATH based on the number of wallets holding at least 0.1 Bitcoin. Also, BTC price is below the Global Bitcoin Electrical Cost indicator, which has historically been a reliable hopium signal for bulls. Bitcoin’s “energy-driven price cut” was only greater in 2020 and 2015, when it dropped to $160. Also, Bitcoin miner surrender may be over. According to this volume indicator, Bitcoin has never been cheaper in the last seven years. The Russia-Ukraine war and the bankruptcy of crypto companies were the main reasons for the downturn.

Edward Moya does not expect positive action in the short term

OANDA’s senior market analyst commented on the relationship between crypto and traditional markets. According to Moya, “Inflation will likely be more sticky. The service part of the economy will refuse to weaken. The risks that the Fed may need to do more remain high. This is why this economy has to go into recession.” The analyst also says that we will not see a rise in the crypto money market for a while in this environment:

Bitcoin’s previous gains evaporated after a hot ISM services report boosted claims that the Fed could tighten much more than the markets are currently pricing in. Crypto headlines weren’t too surprising as they focused on how much money was lent and likely lost. It’s fascinating to see how resilient Bitcoin has performed over the past few days, but a sustained rise seems unlikely.

On the other hand, according to Glassnode, Bitcoin is undergoing a capital reset. “After one of the biggest leverage events in cryptocurrency history, Bitcoin Realized Cap has dropped so much that all capital inflows have flown since May 2021,” the on-chain analytics firm said. The leverage event the firm is referring to was the explosion of FTX, formerly led by Sam Bankman-Fried.

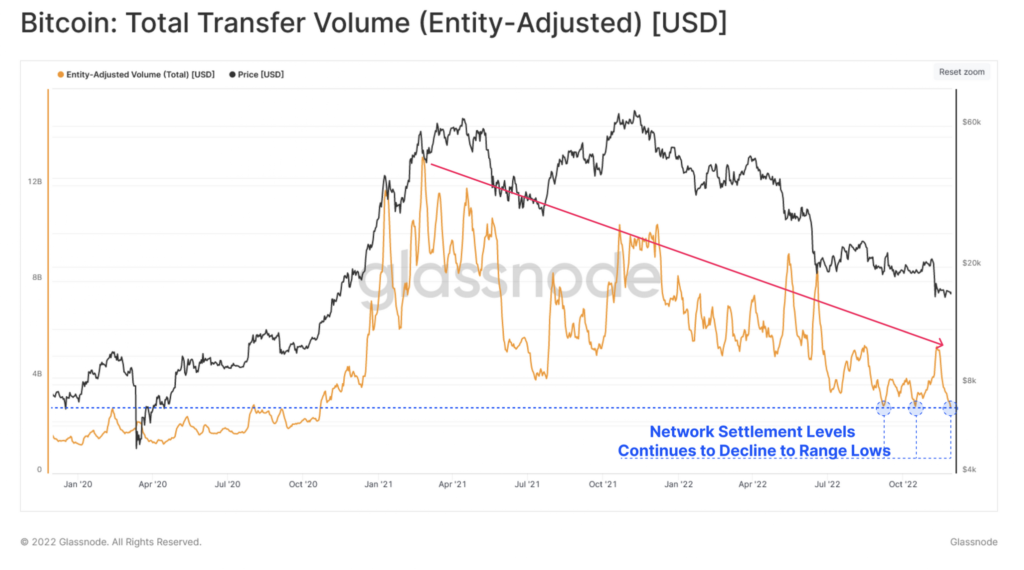

However, Glassnode noted that the “seriousness” of the losses has waned in recent weeks. There has been a positive change in both network activity and block space demand. “However, this change in structure is not supported by increased transfer volumes, which continue to weaken during lower cycles and suggest a high level of participation at the individual investor size,” the firm analysts add.

What Twitter analysts are saying about Bitcoin price

Well-known crypto analyst Justin Bennett said that despite the decline in stocks seen on Monday, Bitcoin is “doing well.” “This crypto aid rally is not over,” the technical analyst wrote on Twitter.

#Bitcoin is again holding up well against today's pullback from stocks.

This #crypto relief rally isn't over, IMO.

— Justin Bennett (@JustinBennettFX) December 5, 2022

Michaël van de Poppe said he expects Bitcoin to test the $16,500 level in the coming days. It is also watching for a potential “bottom test” and retracement of the $16,900 region.

Few things I'd be looking at with #Bitcoin coming days;

– Potential test around $16.5K for longs.

– Potential sweep of the lows and reclaim of $16.9K.

Fow now I'm calm and probably waiting for that HL to happen before triggering positions. pic.twitter.com/cb2MUBBWMl

— Michaël van de Poppe (@CryptoMichNL) December 5, 2022

David Gokhshtein says Bitcoin price has finally bottomed out

The former US congressional candidate said in a recent tweet that Bitcoin has finally bottomed out. Gokhshtein thinks that the leading crypto has finally bottomed out and will now slowly start to reverse and rise.

I’m glad #bitcoin finally bottomed out. 🙏

— David Gokhshtein (@davidgokhshtein) December 6, 2022

However, he admitted in an earlier tweet that he does not believe Bitcoin will reach $1,000,000 in the next few years. Instead, he gave a much more modest price estimate for Bitcoin: $250,000.

Bloomberg analyst Jamie Coutts updates BTC forecasts

The seasoned analyst predicts that the next 2023 may continue to be problematic for cryptocurrencies as the recession may continue. However, as global liquidity measures begin to reverse, a tailwind and a “temporary start” could be created for Bitcoin.

2023 may well still be a problematic year for risk assets (recession), but our global liquidity measures are starting to turn around, and this creates a tailwind for #Bitcoin and the tentative beginning of a new cycle 🧵 pic.twitter.com/UjzqgR5xla

— Jamie Coutts CMT (@Jamie1Coutts) December 5, 2022

cryptocoin.com As you follow, Eric Robertsen, head of research at Standard Chartered Bank, said that Bitcoin could continue to decline in 2023. Robertsen predicts that the leading crypto will drop as low as $5,000 as a price prediction.

Finally, prominent venture investor Tim Draper, known for his support of Bitcoin, recently updated his estimates of $250,000 in BTC. Previously, he claimed that BTC would go this high in 2022. Now, it wants a 6-month maturity for this period. It extended its forecasts to mid-2023. At the time of writing, on December 7, BTC price was trading in the region of $ 17,000.