The altcoin project, which made a quick start to December with new staking pools, is on the decline after the news flow. Before the launch of staking, we mentioned that whales showed great interest.

This altcoin expires days before its staking launch

Chainlink had a busy start to December when it comes to development launches. cryptocoin.com We have included Chainlink Staking v0.1 access dates in this article. Historically, such news has caused alarm among investors. Data from analytics firm Arkham shows the news to be effective this time around:

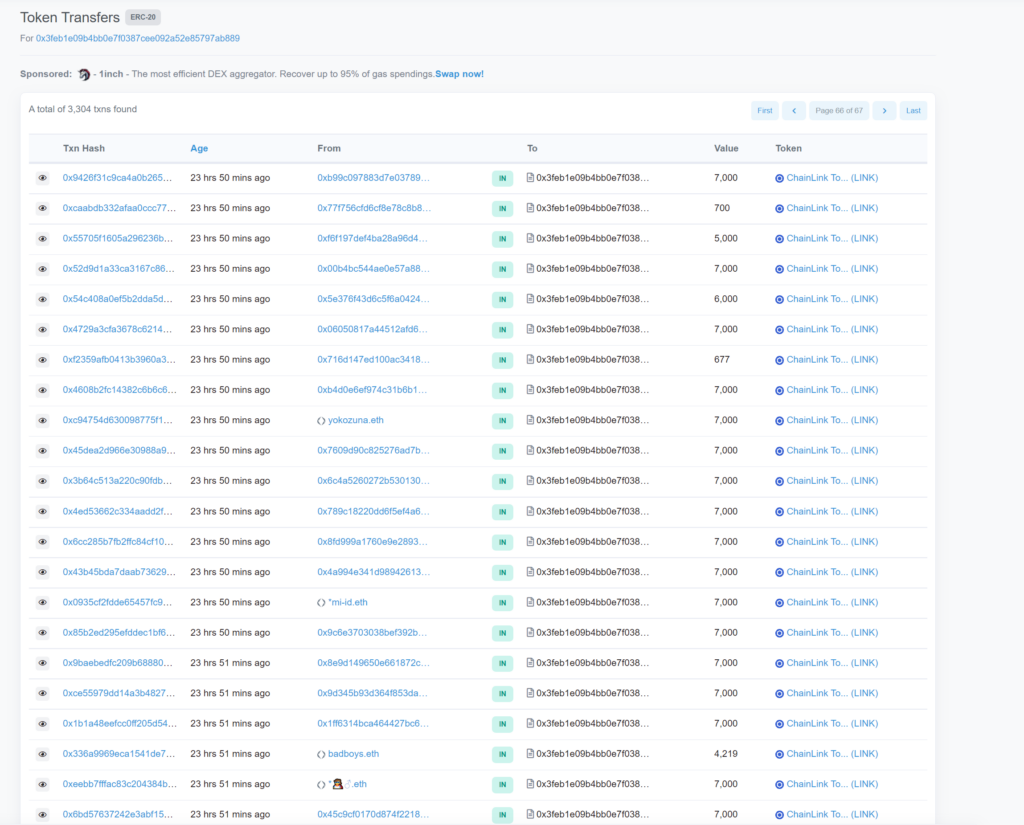

Chainlink Staking went live 19 hours ago. LINK filled the contract with their deposit in excess of 11 million Chainlink. That is, more than $77.7 million LINK is currently invested in the contract. The first and largest deposit ever was 500,000 LINK, or $3.64 million.

Chainlink Staking went live 19 hours ago. $LINK marines have flooded the contract with their deposits exceeding 11M Chainlink tokens.

Meaning, over $77.7M of $LINK has been deposited in the contract currently.

The first, and largest, deposit so far was 500k LINK or $3.64M. pic.twitter.com/aB6elCM5PE

— Arkham | Crypto Intelligence (@ArkhamIntel) December 7, 2022

Node providers get access on October 3 on unlimited terms, while Chainlink’s early access program is capped at 7,000 LINK total staking per person. Despite this, the staking program garnered interest with more than 11 million LINK staked on December 6. The next staking phase will take place on December 8th and the minimum stake will be reduced from 1 to 0.1 LINK. The overall staking program is currently limited to 25 million LINK. Despite strong traction from its early public staking launch, LINK price has corrected, losing 4% since Dec. It has lost more than 10% since last week.

Santiment lists factors behind LINK sales

The on-chain analytics firm detailed the selling pressure on LINK in their December 8 tweet.

Chainlink climbed to $9.35 last month and dropped to $5.59. The wide price ranges, the hype around LINK staking v0.1, and the now live launch have all been bolstered by the community pool being half filled and the supply on exchanges plummeting.

🔗 #Chainlink has climbed to $9.35 and fallen to $5.59 in the past month alone. The wide price ranges have been spurred on by $LINK staking v0.1 hype & now live launch, half of the community pool filling, & supply on exchanges falling. Read our deep dive! https://t.co/no3FTOxplv pic.twitter.com/NhH9fF84ni

— Santiment (@santimentfeed) December 8, 2022

According to Santiment’s report, it is normal to see a price/volume difference as staking approaches. This shows that the demand for LINK is decreasing. Currently, most investors following the news have participated in staking. Since launch, the community pool is almost half full. The majority of LINK came within an hour of staking launch based on the historical balance of the contract.

Also, momentum seems to have slowed a bit. Initially, addresses often exceeded the initial staking cap of 7,000 LINK.

Higher LINK emissions scare altcoin investors

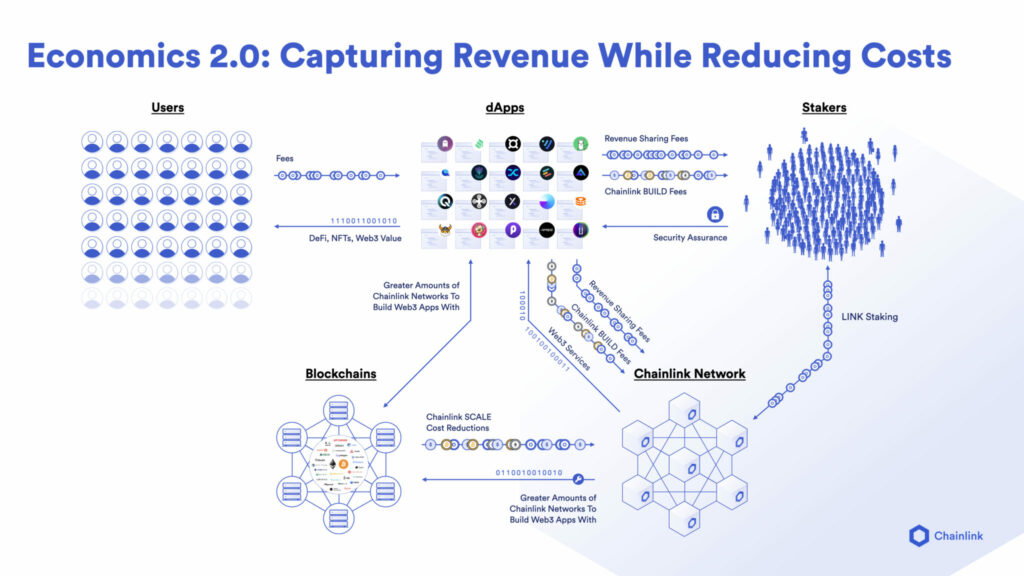

Chainlink has set a minimum amount of emissions in its program to encourage early adoption. Expected emissions mean community members in the staking program will receive a minimum yield of 5% per year, with 7% guaranteed for node operators. Community stakeholders are also expected to lose a 0.25% fee to node operators. Because of these circumstances, LINK has a chance to become hyper-inflationary without sufficient fees to support the rewards.

While staking rewards are locked for 9 to 12 months, LINK’s price hasn’t responded very well to development updates. Reaching a 30-day peak at $9.30, LINK dropped to $6.80 on December 7 after the launch of staking. The decline comes despite the huge rise in social media mentions. As a result, the staking program, while beneficial for Chainlink, is currently reacting negatively.