The 2022 bear market combined with the collapse of Terra and FTX has given Bitcoin miners a hard time. The new data shows that miners still have a long way to go.

Data shows Bitcoin bear market to prolong

Bitcoin miners are the backbone of the BTC and cryptocurrency ecosystem. The returns from miners provide insight into BTC’s price movements and the health of the broader crypto industry. During the year, it was revealed that miners were having a hard time in the current bear market. cryptocoin.com As we reported, Blockstream, a leading Bitcoin miner, recently raised funds with a 70% discount. The current mining activity shares similarities with historical BTC bear markets, with a few caveats.

What do these mean for the current Bitcoin cycle?

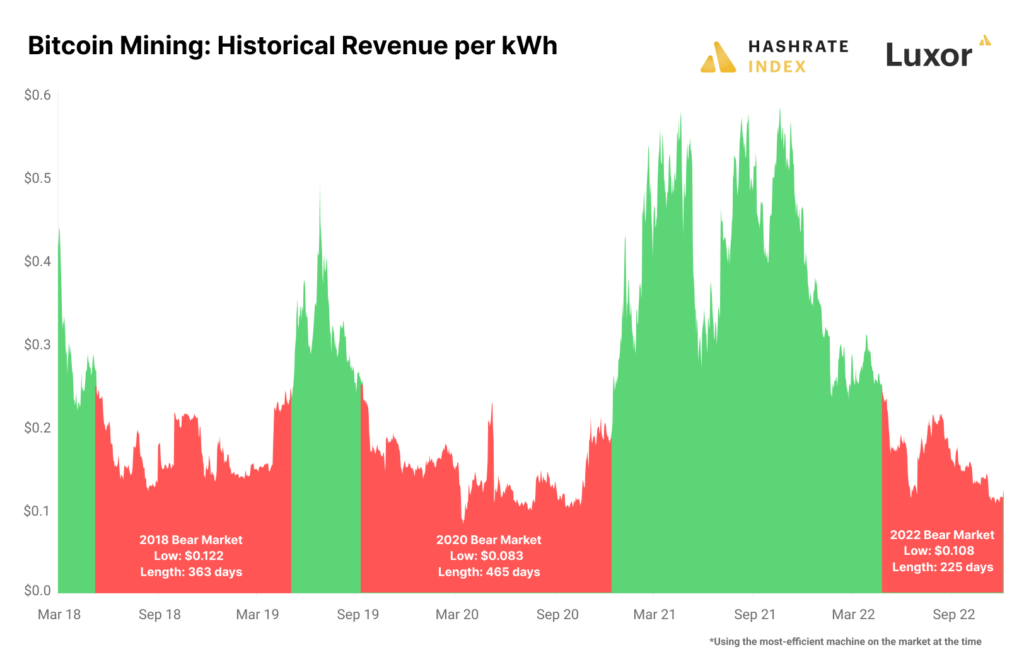

Bitcoin mining profitability can be measured by taking the miner’s revenue per kilowatt hour (kWh). According to Bitcoin analyst Jaran Mellerud, a BTC mining bear market has a sustained income period of less than $0.25 per kWh. According to his assumption, he calculates using the most efficient Bitcoin mining machine on the market.

The 2018 bear market lasted about a year. That sent kWh below $0.12. After the downtrend, a short bull market started until the 2019 bear market started. According to Mellerud, the 2019 bear market generated an all-time low of $0.083 per kWh. This took 463 days. During this period, the price of Bitcoin fell to $ 5,000. The latest mining bear market started in April 2022, according to Mellerud’s analysis of revenue per kWh. As of December 8, the current bear market lasted 225 days with a minimum revenue of $0.108 per kWh. The figure is higher than previous bear cycles due to higher energy prices.

When will the Bitcoin bear market end?

Analyzes compare current bear mining cycles, predicting a bear market to last at least 138 days. The difference between this period and past cycles was that previously miners were mostly self-financed. Now there are many miners who finance their rapid growth with debt.

Public mining stocks feel the pain: Pay attention to these 3 charts

At its peak, Bitcoin mining stocks reached a cumulative value exceeding $17 billion in the 2021 bull market. The bull market has increased investor interest. It then spurred growth in BTC mining stocks, which skyrocketed to $2 billion in November 2020. After reaching its bull market peak in 2021, crypto mining stocks are under a lot of pressure and many have dropped 90%.

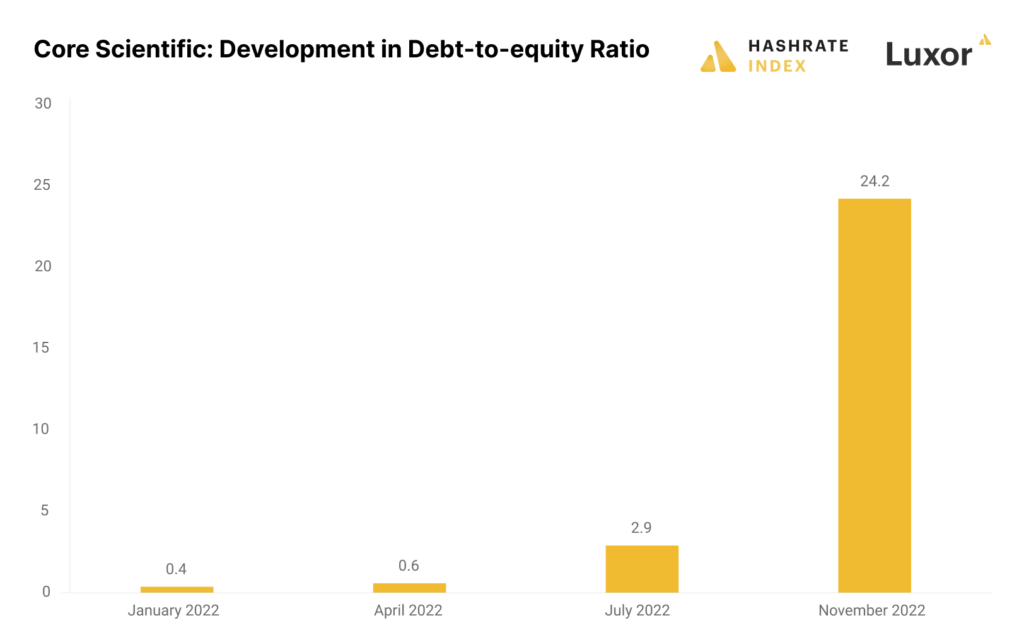

The massive amount of debt taken by public mining firms, taken at Bitcoin’s ATH level, creates an enormous debt-to-equity ratio.

Mirror, mirror on the wall, who are the strongest public #bitcoin miners of them all? pic.twitter.com/pnpypsxcAu

— Jaran Mellerud (@JMellerud) December 5, 2022

A great example of how the bear market has increased miners’ confidence in debt is Core Scientific data. Before the April mining bear market, Core Scientific’s debt-to-equity ratio was just 0.6. Since the beginning of the bear market, that number has grown from debt to equity to over 24.2.

While the Bitcoin mining bear market is expected to continue based on past BTC trends, more public miners will face equity pressures. Analyst Kyle White says we could see lower prices in this case:

As miner debt continues to rise, investors may fear and create even lower prices in the stock market.