According to the Whale Stats platform, which shares data on the largest Ethereum (ETH) whales, the four altcoins are in the focus of investors. While one of them is Chainlink (LINK), the other 3 coins consist of coins that are popular in the decentralized finance (DeFi) space. Here are the details…

Whales have Chainlink in their portfolio

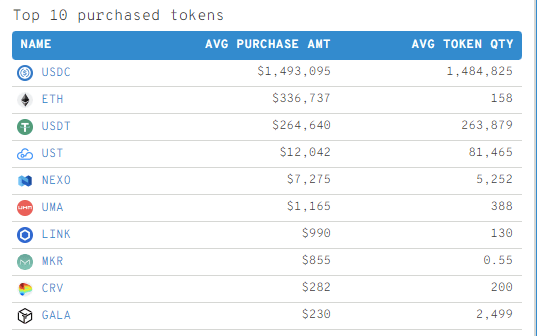

Whale Stats, which examines the transactions of whales, that is, the biggest investors according to the amount of coins they hold, on Blockchain, reveals interesting data. According to the platform, the top 100 Ethereum (ETH) whales have bought around 130 LINK. On the other hand, whales seem to have added decentralized finance-focused coins NEXO (NEXO), UMA (UMA) and Maker (MKR) into their portfolios. As

Kriptokoin.com , Chainlink is a Blockchain abstraction layer that provides universally connected smart contracts. Through a decentralized oracle network, Chainlink provides on-chain data, allowing blockchains to securely interact with external data feeds, events, and payment methods. On the other hand, NEXO is a lending platform, UMA enables the creation of synthetic assets, and Maker runs a DAI stablecoin-backed platform.

Which other coins are the most bought?

The management token of stablecoin-focused decentralized exchange Curve Finance (CRV) is on this list, with each whale purchasing an average of 200 CRV tokens for $282. Finally, the coin that completed the top 10 was Gala (GALA), the play-to-win platform that ETH whales bought for $ 230. USD Coin (USDC) and Tether (USDT) are the two most accumulated stablecoins among ETH whales.

Interestingly, the currently struggling algorithmic stablecoin TerraUSD (UST) was also on the list. The UST fell to levels well below $1 as it diverged from the US dollar peg last week. This drop also negatively affected LUNA, the Terra ecosystem token, and the token fell almost 100 percent. Ethereum ranks second overall, with whales spending an average of $336,737 to accumulate 158 ETH tokens.