The data shows that a centralized exchange sent 10,000 ETH to an Alameda-associated wallet in five transactions. No details have yet emerged about the nature and identity of the transfers.

This crypto exchange transferred 10,000 ETH to Alameda

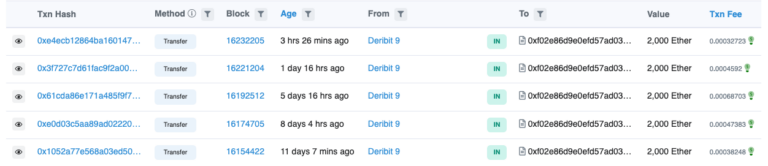

Data from Etherscan shows that an address tagged cryptocurrency exchange Deribit 9 transferred a total of 10,000 ETH to an address associated with Alameda. The address currently holds a total of 12,812.6 ETH. 10,000 ETH transfers took place in five transactions of 2,000 ETH, the first of which was sent on December 10. The Deribit address currently holds around 3,473 ETH and just over 766,351 USDC.

Deribit sends $12 million worth of ETH to Alameda

The above transactions have taken place since Dec. It’s worth close to $12 million at today’s exchange rates. Researcher Wu Blockchain shares details about the transactions:

According to Etherscan, since December 10, Deribit 9 (at 0x77…63) has transferred a total of 10,000 ETH worth approximately $12 million to wallet address 0xF02…0713 marked by Nansen as “Alameda Research: Wallet”.

According to Etherscan, since December 10, Deribit 9 (0x77…63de) has accumulatively transferred 10,000 ETH to the wallet address 0xF02…0713 marked by Nansen as "Alameda Research: Wallet", which is about 12 million US dollars. https://t.co/TRw73zuPN6

— Wu Blockchain (@WuBlockchain) December 21, 2022

In a report back in November, Nansen determined that 0xF02 was one of the wallets owned by Alameda. The multi-signature wallet was created after the FTX collapse began and its purpose is still unknown. Some analysts believe the wallet was created by white-hat hackers who wanted to collect what was left of Alameda’s scattered funds. Others point out that it may be a wallet set up by Bahamian regulators.

The nature of Deribit’s transfers to the Alameda linked address is still unknown. The Panama-based exchange has yet to comment on the transfers.

Deribit had denied any relationship with Alameda

Previously, the exchange claimed that it did not have “large and risky” positions with the bankrupt FTX’s sister firm, Alameda Research. The exchange also denied reports of holding assets on FTX or exposure to exchange token FTT. Additionally, he has officially stated that he is not investing in Solana, which is closely linked to FTX and Alameda.

FTX / Alameda update

Deribit does not have any special terms for Alameda or large & risky positions. Nor do we rely on their liquidity provision in any of our products.

Furthermore Deribit or group companies do not have assets with FTX or other exposure to e.g. FTT or SOL.

— Deribit (@DeribitExchange) November 9, 2022

In addition, Deribit reiterated that it does not have a trading desk or group entity that clears markets or executes deals on its behalf.

Alameda’s private equity portfolio

Surprise data shows that FTX and Alameda have their fingers in a bunch of different initiatives. Some are involved in non-crypto firms like Elon Musk’s SpaceX and The Boring Company. Many were geared towards the crypto market, mainly in the DeFi ecosystem.

Alameda has invested most of its unspent capital in crypto and other DeFi startups such as TrueFi, Magic Eden, Burnt Finance, Parallel Finance, Solfarm, Sundaeswap, Sahicoin, and others. Estimates are that the total investment value is more than $5.4 billion.

How is the Ethereum (ETH) price?

ETH price spent time in the $1,200-300 region on December 21. cryptocoin.comAs you follow, some analysts are expecting a decline in the short term.