Crypto 2022 will enter the history books as one of the toughest years ever. We saw a bear market colored by some external factors. For example, the Ukrainian-Russian war. There have been a few major events in the cryptocurrency itself as well. For example, the Terra Luna explosion and the FTX collapse. Still, some altcoins continued to build. Therefore, we will take a look at the 2022 DappRadar dApp industry report.

A panorama of 2022 for altcoins from DappRadar

An overview of the cryptocurrency market

cryptocoin.com As you follow, 2022 saw crypto enter a tough bear market. Macro factors played an important role in this. For example, the US Federal Reserve’s interest rate hikes and high inflation. Other external factors, such as the war in Ukraine, were also a factor. The crypto space has also had an eventful year with Terra Luna and FTX in the limelight.

🔹2022 was the year of rugs, bear market, and hacks. That is not all that we have witnessed. Many innovations were taking the blockchain industry to the next level!

Our yearly report for 2022 is now live!🎊

Hint: The dapp industry is always strong.

👉 https://t.co/Y6zElr9ruZ pic.twitter.com/IdPmlnibHj

— DappRadar (@DappRadar) December 21, 2022

However, we have also seen many positive developments. For example, The Merge was a big deal. This is where Ethereum reduces energy consumption by 99.9%. We’ve also seen the DeFi industry come with some interesting new features. ZK or zero knowledge became the new keywords.

We’ve also seen an increase in institutional adoption in crypto. Many household names or brands have entered the blockchain space. For example, Nike, Adidas, Starbucks and Disney are a few of them. Crypto has also sponsored major events such as World Championship football. We have also witnessed some big banks getting into crypto. For example, Fidelity, BlackRock, and Goldman Sachs have entered the crypto space.

A sector that is getting stronger despite current market conditions

Hence, many projects continued to build despite bear market conditions. This is a great development and these altcoins will reap the rewards when the next bull run starts. This shows us that the crypto market is showing resilience in this difficult year. For example, DappRadar has seen a record number of dApps shipped. Leading protocols for transaction counts were Solana and WAX. We also see WAX as a leading protocol in average daily Unique Active Wallets. They share this with BNB Chain.

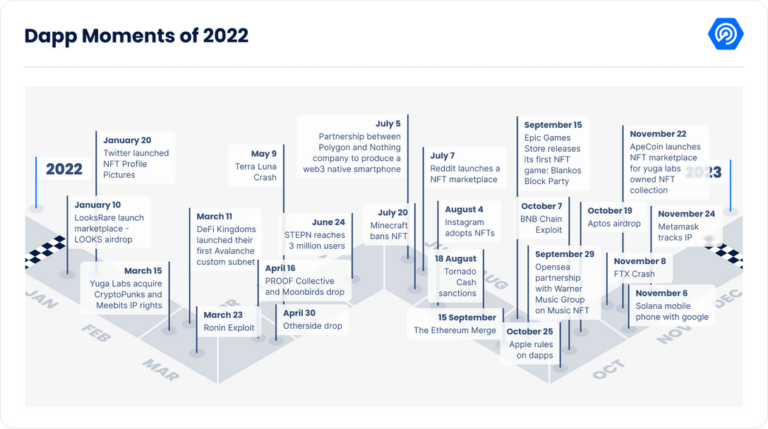

We saw a 50% increase in unique active wallets during 2022. As a result, the crypto industry could solidify its position. These are clear signs of a resilient industry maturing. The image below shows some of the key events in crypto in 2022.

Source: DappRadar 2022 report

Source: DappRadar 2022 reportOverview of DeFi dApps

DeFi also had a challenging year. Most importantly, we saw a significant drop in TVL. This happened after the Terra Luna collapse. It fell from 211 billion in January to $55 billion in December. This means a loss of 73.97%. Cryptocurrency prices also fell, which was another factor. On the other hand, we also saw growth and new features or dApps. For example, connecting TradFi (traditional finance) to DeFi. Big banks like JP Morgan, Société Générale, and DBS have entered the DeFi space.

While DeFi has lost TVL overall, we have also seen a DeFi sector gain in TVL. These are Tier-2 solutions. More specifically, Arbitrum, Optimism, and Immutable X filled the Terra Luna void. Arbitrum only lost 12% in TVL. They now have $1.27 billion TVL to show. Optimism, on the other hand, gained 127.6% on TVL. Polygon is down 79.6% on TVL and is now $1.69 billion. Phantom has lost 87.3% and $575 million is sitting on TVL. Cronos followed this trend and lost 57%. They now have a TVL of $558 million. However, Solana saw the biggest loss, down 94.95%. His TVL is currently $237 million.

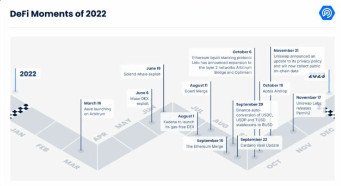

Despite all these negative numbers, the DeFi future looks optimistic. There’s plenty of venture capital (VC) interest. In the first 6 months of the year, VCs invested over $14 billion in crypto. This included various DeFi altcoins. The image below shows some of the highlights in DeFi this year.

Source: DappRadar 2022 report

Source: DappRadar 2022 reportAltcoins hit by scams and hacks in 2022

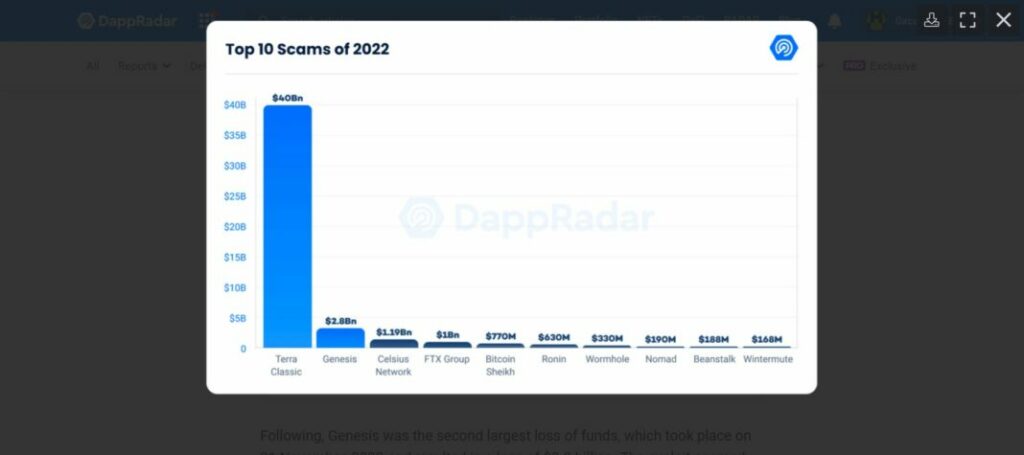

In 2022, a total of 312 scams and hacks were seen on DappRadar’s radar. This amounted to $48 billion. Terra Luna alone is $40 billion. That is 80% of the total. CEXs have seen the most attacks in this area. The FTX collapse put him in 4th place with $1 billion. In summary, the damage would not have been so great without Terra Luna. The image below shows the 10 biggest scams and hacks for 2022.

DappRadar 2022 report

DappRadar 2022 reportOverview of NFTs in 2022

NFTs continued to fluctuate throughout 2022. In fact, the first quarter saw the best NFT trading volume ever with $12.46 billion. However, it fell to $8.4 billion in the second quarter. The Terra Luna effect and macro conditions also knocked on the NFT door. In the 3rd and 4th quarters, the trading volume decreased further. The total amount was $4.4 billion. That’s almost peanuts compared to the 3rd and 4th quarters of 2021, with $23.2 billion in trading volume.

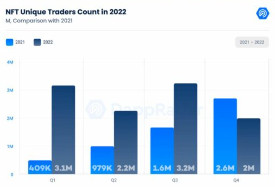

The number of sales increased in the first half of the year. First quarter with 483.13% or 28.44 million. In the second quarter, an increase of 73.87%, or NFT of 20.23 million, was sold. Still, Q3 and Q4 were less productive. They decreased by 54.89% and 58.15%, respectively. Trader count was another area where NFTs grew. First quarter, 675.88%, or 3.18 million traders. In Q2, growth increased by 130.42%, or 2.26 million traders, compared to Q2 2021. Q3 still saw an increase of 96.12% or 3.2 million traders. On the other hand, Q4 dropped 25.53%, or 2.7 million traders. See the picture below for this.

Source: DappRadar 2022 report

Source: DappRadar 2022 reportThe drop in cryptocurrency prices is one reason more people are getting into NFTs. But we’ve also seen mainstream NFT adoption and new markets emerge. The NFT market generated sales of $25 billion. This gives hope for even better numbers for 2023.

New NFT marketplaces

There were also several new NFT marketplaces. For example,

- LookRare: They see themselves as a community-driven NFT marketplace.

- x2y2: Their goal is to be truly decentralized and secure. They also put the interests of the creators first.

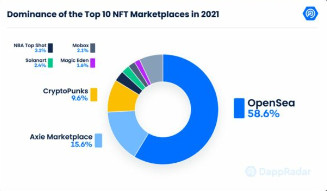

There are a few more and this is proving that competition in the NFT market is heating up. However, OpenSea is still the leader of them all. Transaction volumes increased by 26.22%, or $18.6 billion, from 2021. Second is Solana’s Magic Eden, which reached $1.54 billion, up 268.13% in trading volume. See the picture below.

Source: DappRadar 2022 report

Source: DappRadar 2022 reportCopyright

Collections may have copyright options on their NFTs for secondary sales. It ranges from 2.5% to 7.5% or more. Marketplaces reacted differently to this debate. OpenSea lowered their royalties and this caused a controversy. They have now made it optional. Magic Eden originally made royalty-free options. However, it has lost a large user base. Now, they’ve made it optional too and have regained 90% of their users. This is a complex debate that will continue for some time.