In the employment report from the US last Friday, we saw a weakening in salary increases and a contraction in the services sector. In fact, this was exactly the kind of development that the Federal Reserve (Fed) wanted to see.

Hello Coinkolik family,

This week in the economic calendar; Tuesday FED chairman Powell’s speech, Thursday US Consumer Price Index (CPI), Friday’s UK growth data. While the Fed’s tight monetary policy is based on reducing inflation to 2%, the markets will perceive the CPI data in line with or below expectations.

The positive effects continue in the crypto money markets. With the Shanghai upgrade, validator staking withdrawals are expected to open on the Ethereum network. While Solana was losing its two biggest NFT projects to its rivals and we were just seeing the bottom, BONK created a nice rising wave with the meme token, providing a 67% rise in the last 7 days. Metaverse tokens, on the other hand, witnessed the rises that we have been missing for a long time. The Cardano network, on the other hand, has increased its own coin, ADA, by 30% in the last 7 days, with the positive effect of HYDRA, which offers a stable cryptocurrency and layer 2 solution to be released soon.

Important Developments of the Week We Will Follow

Tuesday, January 10, 2023

FED Chairman Powell’s speech at 17.00 CEST

Thursday, January 12, 2023

US Consumer Price Index (CPI) (Annual) Expectation: 6.5% Previous: 7.1% EST – 16.30

US Unemployment Benefit Applications Expected: 220K, Previous: 204K CET – 16.30

Friday, 13 January 2023

UK Gross Domestic Product (GDP) – 10.00 TL

Bitcoin Technical Analysis

We entered the new week with a lot of green. Bitcoin is trading at $ 17,250. The bullish wave that came over the weekend continued, causing the price to close 4-hour candles in the black box region. As these levels continue to be maintained, the price could rise as high as the initial resistance zone of 18,200.

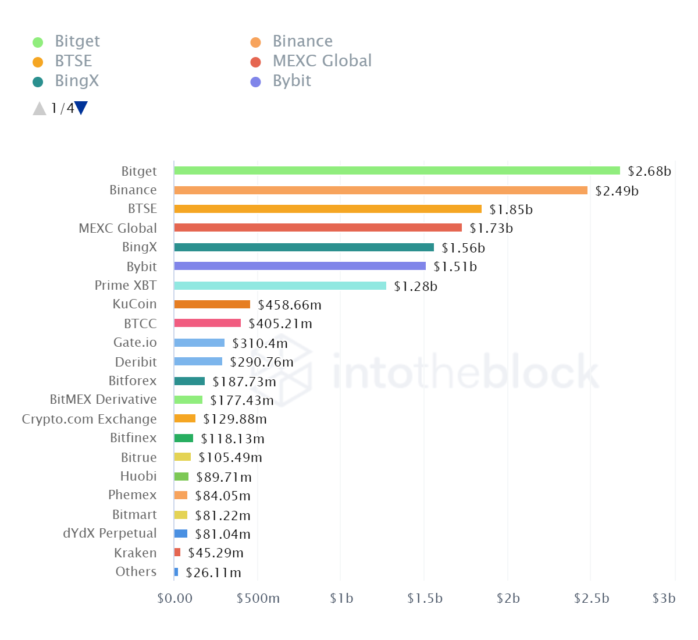

With The Open Interest Rank indicator, we can see the position ranking of the stock markets with open futures. This is advantageous for traders who want to open a position, as an excess of open interest in general indicates more liquidity.

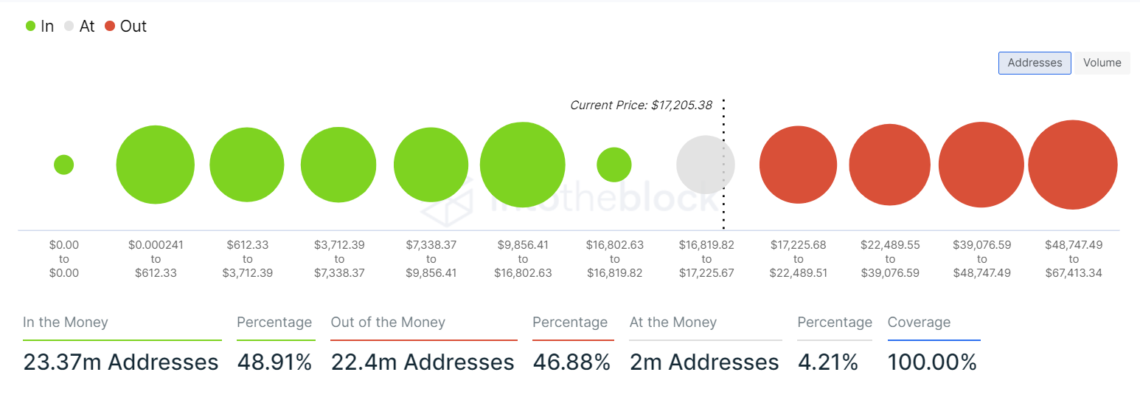

It provides a statistical breakdown of the positions of investors in a crypto-asset based on the current price, with In and Out Money analysis. It aggregates the locations of all addresses into clusters based on the number (or volume) of addresses previously purchased in a given price range. The larger these clusters, the more support/resistance zones there will be around these price levels.

Top 100 Cryptocurrencies In The Last Week According To CoinGecko Data

- Lido DAO (LDO) 76%

- Fading (LEFT) 62.3%

- Zilliqa (ZIL) 38.4%

- The Sandbox (SAND) 37.4%

- BitDAO (BIT) 35.4%

Last Week’s Featured Crypto News

Wallet Associated With Justin Sun Transfers $100M To Huobi

Wallets identified as belonging to Sun transferred $100 million USDC and USDT from Binance to the exchange. According to the data, the total amount of stablecoins in Huobi fell 9.5 percent in a week to $ 681 million.

Coinbase Has To Pay A $100 Million Bill!

Coinbase, which was determined to have violated the money laundering laws of financial regulators, agreed with the New York State Department of Financial Services to pay a $ 50 million penalty and will invest $ 50 million in improving the compliance process.

After Tax Decision, $3.8 Billion Crypto Moved From Indian Exchanges

India has imposed two taxes on crypto transactions since April 1, 2022. One of them is 30% capital gain and the other 1% transaction tax. With the enactment of new taxes, 90% of volume was lost on cryptocurrency exchanges compared to the previous year. Between February 2022 and October 2022 cumulative trading volume of $3.85 billion was transferred from Indian exchanges to foreign exchanges.

McKinsey report: “Metaverse could increase its value to $5 trillion by 2030”

According to the report published by McKinsey & Company, the metaverse sector could increase its value up to 5 trillion dollars in the next seven years. The report also mentioned the effects of the metaverse on individual and business activities. In addition, the McKinsey report also included statements such as “The Metaverse is too big to be ignored”. McKinsey noted that more than 50 percent of live events could be held in the metaverse by 2030.