New reports suggest that whales are abnormally moving Ethereum (ETH) from liquidity pools to Binance. Can we see a dump event for the leading altcoin, let’s answer…

On-chain data shows altcoin whales are piling ETH on Binance

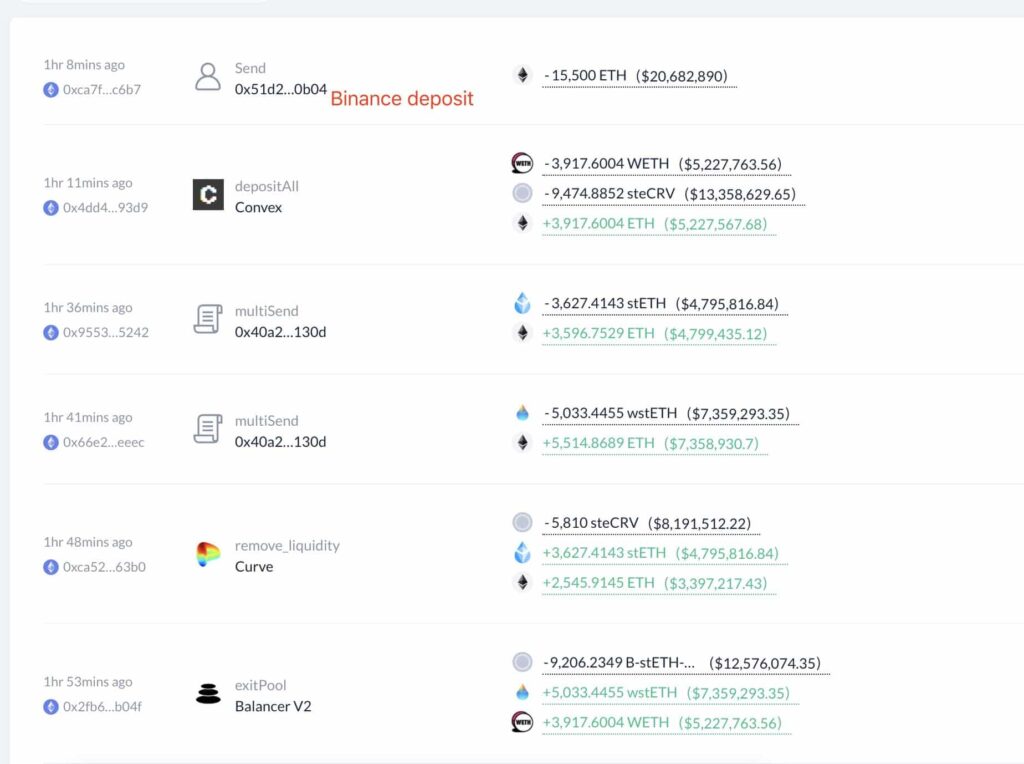

Whales pulled 15,500 Ethereum (ETH) worth $20 million from multiple liquidity pools and transferred it to Binance. On-chain analytics platform Lookonchain reported in a tweet on Jan. 11 that whales are draining their Convex, Lido, Curve and Balancer liquidity pools.

The whales then transferred a total of 15,500 ETH from these pools to Binance. Etherscan data also confirms a transaction of 15,499. Also, a different analysis revealed that a whale had 30,000 ETH in September last year. Now, the whale only has $19.58 worth of Ethereum. Thus, the whale sold all its holdings during the crypto winter.

Meanwhile, the same whale has transferred over 20,000 ETH to Binance in the last 10 days. According to some, this could be a harbinger of a drop in Ethereum price. Concerns are based on a lack of whale activity despite a slight crypto market rally.

Ethereum (ETH) can see dump

cryptocoin.com As you follow, ETH price has been trading under pressure compared to Bitcoin price in the last 24 hours. BTC price rose by about 2% on Wednesday, while ETH price remained stable. The leading altcoin is currently trading at $1,330. The 24-hour low and high are $1,324 and $1,342, respectively. In addition, the decrease in the transaction volume by 12% in the last 24 hours indicates that the interest rate has decreased.

Crypto analyst Michael van de Poppe predicts that the ETH price will drop below $1.3K in the coming days. Investors await Friday’s CPI data as prices enter resistance zones. However, he believes that the markets will likely continue their upward movement in the next 1-3 months.

Altcoin whales increase stablecoin transactions along with ETH

According to the data, exchanges have seen a tremendous increase in the number of stablecoins deposited over the past 24 hours. Data from crypto analytics platform Whale Alert shows that Binance, Bitfinex, Kraken and FalconX are among the top destinations for some stablecoin deposits made by market whales.

In one of the funds sent as stated by the analytics firm, 65,000,000 USDT worth $64,993,500 was transferred from an unknown wallet to Bitfinex. Binance recorded a series of these massive entries in different tranches, including a transaction of 50,989,985 BUSD worth $51,015,480 transferred from Paxos Treasury to Binance.

🚨 🚨 🚨 60,081,112 #BUSD (60,111,152 USD) transferred from Paxos Treasury to #Binancehttps://t.co/1BM4Falqlq

— Whale Alert (@whale_alert) January 10, 2023

Stablecoins are de facto fiat coins in the cryptocurrency market, and the movement of these funds could mean that the funds carried by these whales are to take positions in Bitcoin (BTC) or other altcoins. While the on-chain data does not provide specific insights into the actual use of these funds, it is also possible that these whales may have moved these funds to meet the payments of other debt obligations.

In a nutshell, exchanges are recording large stablecoin inflows, which may or may not be bullish. Ethereum, on the other hand, is facing potential selling pressure as it flows from the liquidity pool to exchanges.