Avalanche was introduced in early 2023 by adding Blockchain support to the Amazon Web Services (AWS) cloud. However, according to some experts, on-chain analysis shows that altcoin Avalanche’s price surge is likely due to a wider bounce that will end with the rest of the market. Here are the details…

Is Avalanche’s Amazon news exaggerated?

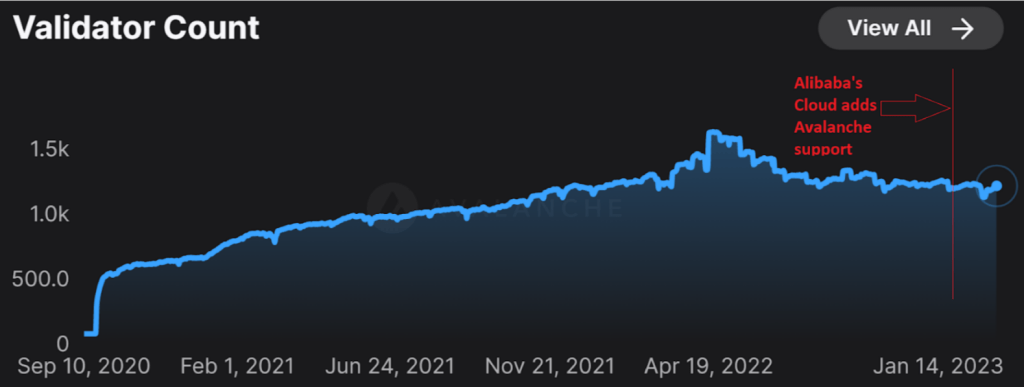

While the integration with the world’s largest blockchain service is a positive step for Avalanche, the results may be exaggerated for some. The evidence lies in a similar move by Avalanche’s team in December 2022. cryptocoin.com As we reported, Avalanche’s team entered into an agreement with Alibaba Cloud towards the end of 2022. The Asian-based cloud service has a 6 percent share in the industry globally. However, Blockchain’s validator count has remained consistent. This implies that not many users of Alibaba Cloud are willing to run an Avalanche node.

AWS generates revenue from users who want to use its Blockchain nodes, so it continues to add support for its various Blockchains. Amazon has been supporting an Ethereum node since May 2021. Therefore, according to analysts, the latest Amazon partnership announcement may mislead some investors.

Avalanche’s ecosystem development

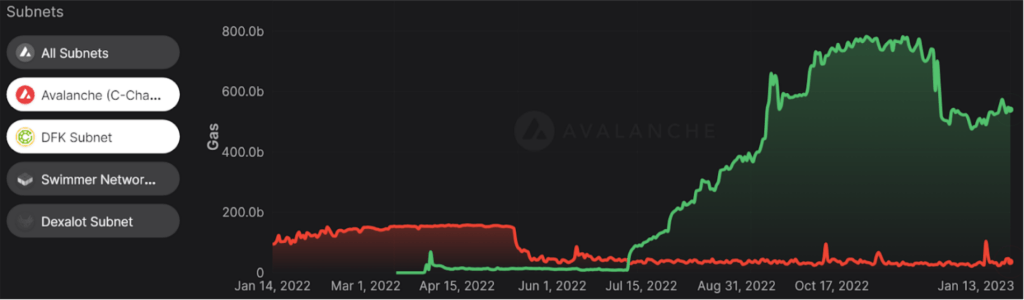

Avalanche’s Blockchain usage data is also not encouraging for some. Gas used in the blockchain declined rapidly after the crypto market crash in May 2021 and has not improved since. Total value locked in Avalanche’s DeFi ecosystem is close to $885 million, a two-year low, ranking sixth in the comparative liquidity of other chains. The project has had some success on gaming networks like DeFi Kingdoms and Swimmer Network. While the growth of these subnets enhances Avalanche’s ecosystem, it does not bring direct value to AVAX holders because the security and tokens of the subnets can be independent of the primary Avalanche Blockchain.

Avalanche validators only leverage subnets when they lease security from Avalanche validators or use the mainnet in the early stages to boot their projects before moving to standalone chains. A few game projects like Shrapnel and Ascenders work for this purpose. However, time will tell if they will bring enough activity and revenue to Avalanche validators.

What does AVAX stock market data show for altcoin?

According to analyst Nivesh Rustgi, Avalanche’s recent price rally is primarily driven by a hunt for liquidation of open interest in the futures market. Coinglass data shows that the funding rate for Avalanche perpetual futures contracts has remained negative since the FTX desertion in November. Crowded short positions allowed whale buyers to execute seller’s stop-losses. Funding rates have rebounded into neutral territory after last week’s price hike. It effectively drained the fuel that caused the current bull run.

The wallets, described by Nansen as “smart money”, invested $2.3 million in AVAX at the time. Additionally, venture funds and market makers such as Jump Capital, Wintermute Trading and Longling added $1.3 million to the net inflow. In the second week of January 2023, total AVAX inflows were $8.025 million. Avalanche’s price surged 40 percent in the second week of 2023, with stock market flow data posting a substantial inflow, possibly warning signs for buyers as investors move to sell.

Altcoin price in jeopardy if positive momentum connects to cooling

Technically, a break above the 50-day exponential moving average (EMA) above $13.40 keeps the possibility alive, labeling the 100-day EMA at $20.70, and the August 2022 peak at $31.45. However, time for buyers to show their hands is quickly running out. The MACD indicator is showing early signs of a top as the buying volumes are starting to drop. According to the analyst, the move in the AVAX/BTC pair faced resistance at the support and resistance level of 0.000834 BTC, which also includes the 100-day EMA.

If buyers fail to break this level, a drop towards 0.000642 BTC and a chance to reach 0.000465 BTC is expected. Also, the broader altcoin market cap (excluding Bitcoin) hit its bullish targets around the 100-day MA at $563 million. If the positive momentum starts to cool, the AVAX uptrend will reverse with it. Overall, Avalanche’s usage statistics have remained unchanged since the last quarter of 2022.