The cryptocurrency market managed to hold its gains on Thursday despite the weakness brought on by the latest economic data and the Fed’s hawkish comments. As Bitcoin continues to hold above $21,000, analysts are debating the timing of the rally.

Jim Wyckoff expects positive moves in the short term

In an afternoon speech at the University of Chicago Business School, Federal Reserve Vice Chairman Lael Brainard said the central bank must remain committed to making monetary policy more restrictive “to ensure inflation consistently returns to 2%.”

Meanwhile, technical analyst Jim Wyckoff described the sideways price action for Bitcoin over the past few days as “a normal pause after hitting a four-month high on Tuesday.” According to Wyckoff, Bitcoin bulls “have an overall short-term technical advantage amid the price uptrend on the company’s daily candlestick chart. This points even higher in the short term.”

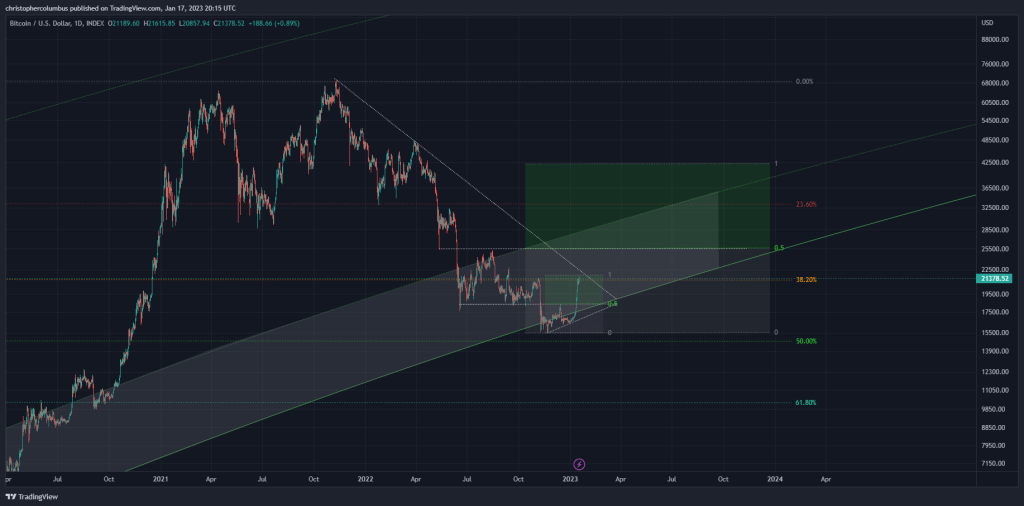

#BTC to take 28000$ in coming weeks

Here's why;

One of the principle of S&D states that a valid S/D zone will have a swift rejection and pull back to it for a confirmation.Right now #BTC is consolidating and should begin to target the weekly FVG at 28000$

Anticipating 👀 pic.twitter.com/9V3AvhViuS

— Mikybull 🐂Crypto 🔬 (@MikybullCrypto) January 19, 2023

The perspective that Bitcoin will rise further has been shared by Blockchain analyst Milky Bull Crypto, who posted the tweet below, who predicts that BTC will soon climb to $28,000.

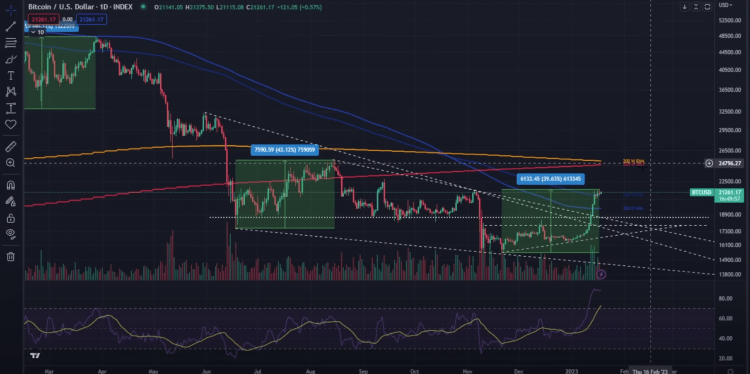

Caleb Franzen, senior market analyst at Cubic Analytics, provided insight on what levels to look out for to confirm the bullish outlook.

There are three lines in the sand for #Bitcoin right now:

1. The 200 day moving average cloud.

2. The short-term holder realized price.

3. Horizontal support/resistance range.Right now, #BTC is trading above each of these levels. Until we break below them, no need to panic.

— Caleb Franzen (@CalebFranzen) January 19, 2023

In a follow-up tweet by Franzen, “These are the 3 most important levels for Bitcoin right now. If we stay above them, keep on partying. If we retest any of them and come back, keep the party going. If we fall under them, the bear situation becomes stronger” scenario is included.

Dave the Wave announces first price target for Bitcoin this year

The analyst who predicted the 2021 Bitcoin crash is now revealing his 2023 price target. Dave the Wave says his target for king crypto this year is over $40,000. cryptocoin.comAs you follow, BTC is now half behind this level.

Citing an analysis he wrote two years ago, Dave the Wave questions whether Bitcoin’s bullish and bearish cycles will become increasingly erratic as the BTC market matures. The analyst also says that Bitcoin is witnessing fewer minor corrections and more real corrections.

Nicholas Merten gave Bitcoin warning

The widely followed crypto analyst is warning investors, saying that Bitcoin’s latest bounce is likely a bull trap ahead of an impending recession. Merten told 511,000 YouTube subscribers that Bitcoin’s price rise in 2023 is similar to the last three rallies.

I want to continue and highlight the percentage increase, and I don’t want to talk about a very similar time frame. From June to August we experienced a relief rally of 46% to 43%, and from November to January we experienced a 40% movement in Bitcoin price. Now, this comes down to the typical percentage increase we get during charity rallies, and again, I just want to point out this caveat.

Merten goes on to say that if global stocks see big takeoffs, it will kick off another crypto winter because of how correlated the markets are.

When it comes to the overall performance of equities and [how] that will have an impact on crypto, don’t doubt whether global equities are on a big break.

If we are entering a recession and stock valuations start to slide lower, this will likely have the same effect on crypto if we continue to experience lower highs and lower lows that indicate a downtrend. Until we see a break in this correlation, we should think in that mindset.

But indicators say $21,000 is good for a rally

Finally, Benjamin Cowen says that Bitcoin has shown that even after a strong rally, it still has a lot to prove. Current analysts said that Bitcoin’s Relative Strength Index (RSI) remains at historic lows:

A very nice move by Bitcoin from $15,000 to $21,000. Note that the monthly RSI in November is lower than it was in June. The monthly RSI is up to 44 to 45 again. What I want to do is draw a line to where it is now…

Note that in 2015, the monthly RSI basically hit lows for three quarters of the year. Until September, the monthly RSI really went nowhere. We were only here for a few months in 2019.

RSI is a momentum indicator that aims to determine whether it is currently overbought or oversold. Cowen goes on to say that investors should keep an eye on BTC’s RSI as Bitcoin needs to break above historic lows to confirm it will turn the current resistance level into support.

The interesting thing this time around is that even though we’re back at $21,000, we’re slightly above the levels we were at in December 2018. So I think the thing to watch out for is that the monthly RSI can really go above these. The levels it’s here [in 2015] and then here [in 2019]?