The recent revival in the price of Bitcoin (BTC) has proven to be a spark of life for the entire cryptocurrency market. This made its market capitalization more valuable than industry giants such as Walmart, Alibaba Group Holding and Meta. While the leading crypto’s retracement of $20,000 seems to have rekindled investor interest, the recent surge in prices may be just the beginning. The conviction comes from three metrics that have historically proven reliable in marking Bitcoin’s next leg.

Understanding indicators: Relative strength index (RIS)

The relative strength index (RSI) is an indicator used to measure the speed and magnitude of recent price changes to assess whether an asset is over or undervalued. RSI values range from 0 to 100. Traditional usage of the RSI indicates that above 70 indicates it is overbought. Values below 30 usually mean it is oversold and therefore undervalued.

Investors can look at Bitcoin’s RSI on various time scales, but the weekly one is the most interesting. After trading below 40 for months and at one point dropping to 26 in June 2022, Bitcoin’s latest move sent its RSI around 50. Based on historical RSI data, once Bitcoin reaches an RSI of 50, it can serve as fuel for sustained momentum.

Periods when the RSI was below 50 and then back above it typically resulted in movements in Bitcoin price skyrocketing, but there were also instances where it fell below the level about a month later. If Bitcoin can hold this line for more than a month, the steady uptrend should serve as a reason for cautious optimism that the worst of this bear market may be behind us.

Measuring the health of the leading cryptocurrency: 200-week moving average

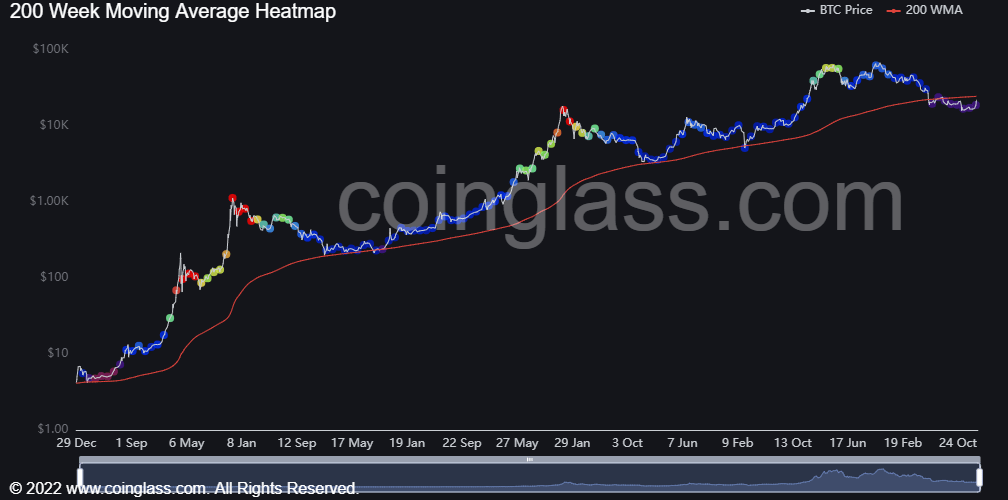

Before calling for an end to any bear market, one thing must happen: Bitcoin must retrace the 200-week moving average (WMA). Historically, there are few other metrics that have proven to be as useful an indicator of Bitcoin’s health as 200 WMA.

This indicator takes the average price of Bitcoin over the last 200 weeks and turns the seemingly volatile and choppy price action into a straight line. This line has proven its resilience as one of Bitcoin’s strongest support levels, as it has dropped below 200 WMA only five times in its history.

The leading coin still finds itself below the 200 WMA line, but is getting closer and closer to reclaiming that level. If so, it could be its last fall for quite some time. Typically, Bitcoin bounces off the 200 WMA, but has been under it for most of the past year. In the past, when Bitcoin fell to the 200 WMA, it was often followed by renewed price momentum signaling the end of a bear market.

The difference between 200 WMA and its current price is just a few thousand dollars, which may be just what Bitcoin needs to get past this crypto winter.

Analysis of bear trends of the cryptocurrency market

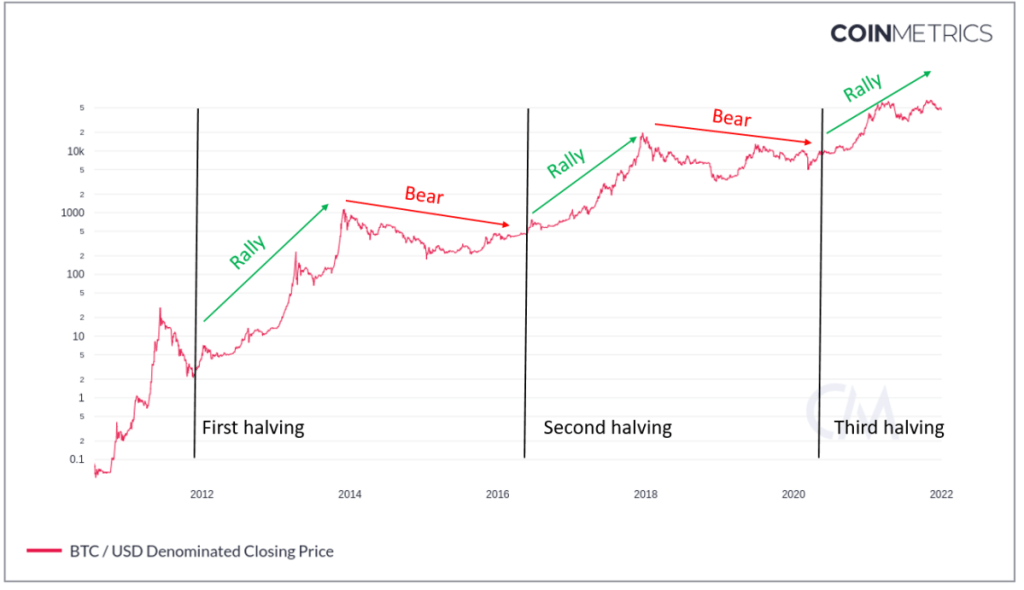

The last indicator is also the most basic, no fancy lines needed. When comparing the duration of past bear markets measured from top to bottom, investors are now in the longest bear market in history. Historically, Bitcoin bear markets have lasted about 311 days.

Bitcoin’s previous ATH level was the $70,000 region, which it reached on October 20, 2021. Assuming the bottom for Bitcoin is as low as $15,700 on November 21, 2022, the time between these two dates is 397 days, well above the average bear market.

Investing is all about taking a long-term perspective, but it doesn’t hurt to look at short-term metrics to draw solid conclusions and develop strategies. This idea is not designed to time the market. Rather, the goal is to maximize returns. With all these, cryptocoin.comTechnical analyst RJ Fulton, whose analysis we share with you, suggests that the leading crypto can make up for its 2022 losses and start a bullish period:

The combination of Bitcoin’s bullish RSI levels, nearing the 200 WMA, and the duration of past bear markets suggest that there could be a significant buying opportunity to grab some Bitcoin before the price rises again.