Cryptocurrencies continue to rise based on speculation of a monetary policy reversal. cryptocoin.comWe have compiled the analyst’s predictions for cryptocurrencies for you.

Values crossed the reverse barrier

After several weeks of trading below the all-important $1 trillion level, the market cap of all cryptocurrencies has finally broken through the upside barrier, albeit barely. Still, with blockchain advocates eager for a comeback in the Federal Reserve’s monetary policy, it’s a mini landmark event. Over the past year, the central bank has significantly shrunk the money supply, scaring particularly risky asset classes. But with inflation falling, fans are hoping for a strategic turning point.

Such a pivot that would bode well for cryptos is out of the question. “Fed tightening appears to be milder and inflation less risky,” Charles Hayter, CEO of crypto data site CryptoCompare, told CNBC by email. Also, ‘There is hope that there will be more prudence towards rate increases globally.’ it was added.

But investors should be careful. During the last big bull cycle cryptocoin.com As we mentioned, cryptocurrencies reached a peak value of $545 billion in early 2018. Shortly after, the total market capitalization of the industry fell to about $140.5 billion at the end of March. In early May, the industry hit a valuation of roughly $302 billion and more than doubled before booming once again.

7 cryptocurrencies that the analyst focuses on

Bitcoin (BTC)

What is even more striking about Bitcoin and other cryptos is their durability. Despite the bankruptcy of digital asset lender Genesis Global Capital, BTC didn’t care about the negative effects. Instead, the main catalyst that supports virtual currencies is likely focused on Fed policy. If it reverses its monetary tightening strategy, BTC could enter the race.

Still, it’s important to keep things in perspective. In February 2018, after the initial drop in Bitcoin price, BTC managed to gain roughly 32% before gradually sliding down. So investors need this rally to last more than a month. Otherwise, the bears may take a bite out of the resurrection.

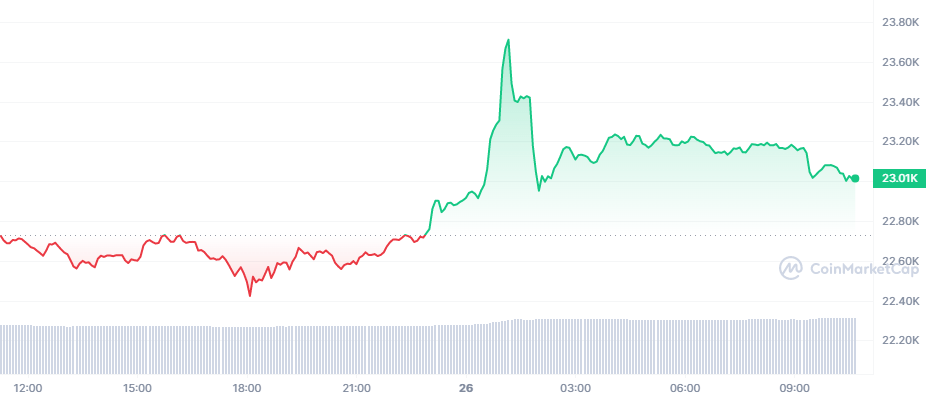

Continuing its remarkable rise, Bitcoin (BTC-USD) stands at around $23,000 at the time of writing. At the beginning of the year, BTC was trading below $17,000. Within a few weeks, traders had a return of about 35%.

Ethereum (ETH)

Basically, Ethereum managed to clear the Genesis Global Capital bankruptcy, among other major cryptos. But for now, all eyes are focused on the upcoming Shanghai hard fork. Targeting the March 2023 release, this protocol update will allow the withdrawal of Beacon Chain stake Ether (ETH). Ethereum developers have also created a ‘shadow fork’ to provide a testing environment prior to the Shanghai upgrade.

While conditions bode well for ETH, investors should note that between April and May of 2018, Ethereum doubled in value before falling into blockchain purgatory. Therefore, investors should be careful about betting too much on this and other cryptocurrencies.

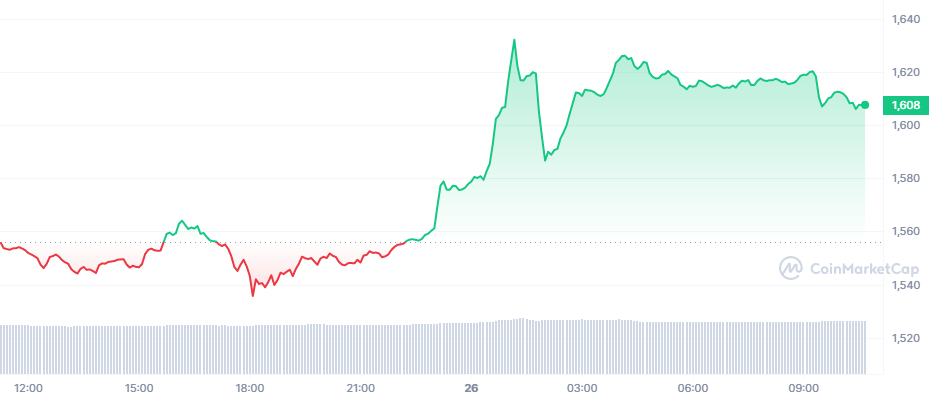

Ethereum (ETH-USD), another name among the cryptocurrencies that continues to impress the audience, started the year at about $ 1,200. Currently, ETH is trading at $1,635, which represents a 36% return in less than a month. Even better in terms of technical analysis, ETH is now hovering significantly above its 50 and 200-day moving averages.

Tether (USDT)

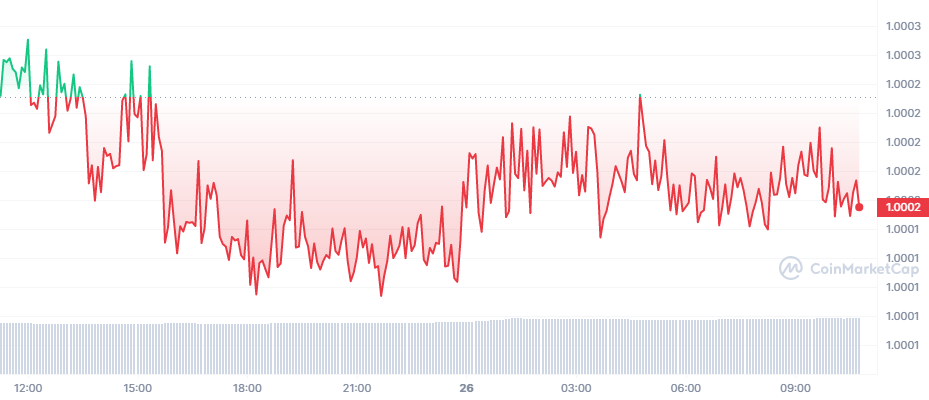

As a stablecoin, Tether (USDT-USD) does not change the value appreciably as it is pegged one-to-one with the US dollar. In previous years, Tether’s long-term ownership lawsuit made some sense. With the dollar constantly melting away its purchasing power, investors were encouraged to try their hand at risky assets like crypto. However, due to the aforementioned change in Fed policy, crypto traders should think carefully ahead.

For example, at the time of this writing, year to date, Tether has gained 0.048% of market capitalization. On the other hand, the purchasing power of the dollar increased by 0.30% between November and December last year. Therefore, by holding the regular old dollar, ordinary people can get a larger return just by sitting on the cash.

To be fair, holding Tether allows stakeholders to acquire cryptocurrencies at lightning speed. However, virtual currencies remain a risky proposition, as the Fed has not definitively stated that it will cut benchmark interest rates. Combined with the boom of other stablecoins, investors should be wary of overexposure to USDT.

BNB (BNB)

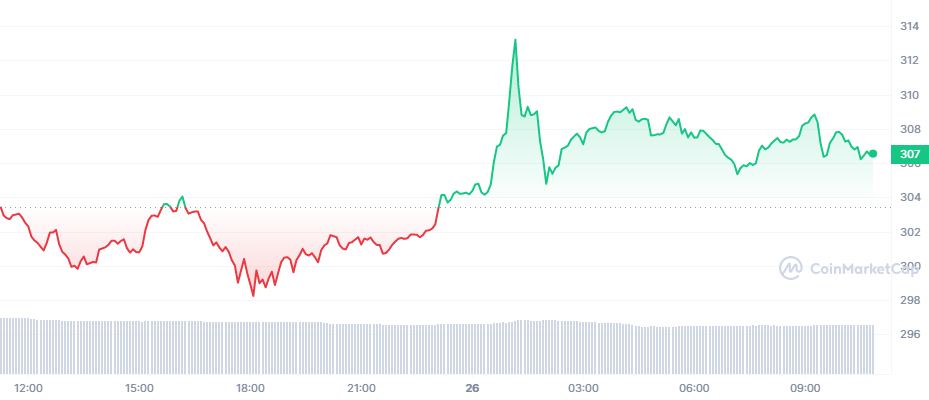

BNB (BNB-USD), which supports the Binance virtual currency exchange, draws attention with the bankruptcy of rival platforms. Fortunately, BNB has similarly taken the recent debates step-by-step and bounced higher alongside other cryptocurrencies. In the week that followed, the coin gained more than 7% of its market cap. And it has gained over 5% in the last 24 hours from the time of writing.

From a technical analysis perspective, BNB, with its current price hovering above the 50 and 200 DMA, undoubtedly looks encouraging. At the beginning of the year, BNB was trading at around $244. As I type these words, it’s close to $322, representing a 32% return.

Although impressive, between March and June 2018, BNB had a rebound rally after the correction in January of that year. From a low of roughly $8 to a high of around $17.27, BNB gained about 116% of market cap. Again, as impressive as this year’s 32% return is, investors should keep everything in perspective.

Cardano (ADA)

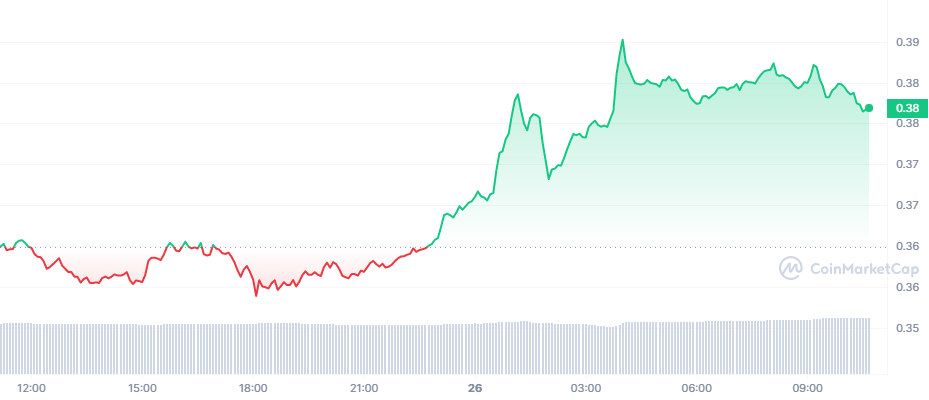

While other cryptocurrencies are posting steadfastly encouraging chart patterns, the recovery rally in Cardano (ADA-USD) leaves some room for mild concern. At its January opening, ADA changed hands for about a U.S. quarter. But right now, ADA has managed to get closer to 38 cents. As a result, we’re talking about a 52% return and January isn’t even over yet.

However, what may bother some prospective investors is that at the moment Cardano has not surpassed its 200 DMA. Close to be sure. The 200 DMA stands at 40 cents, while ADA is trading at 38 cents, leaving a 5% gap and some change. In the crypto world, this is nothing. However, it stands out as many other non-stablecoin digital assets have passed their 200 DMA.

What’s more, despite Cardano’s stratospheric run, it outperformed the dead cat bounce in 2018. Between April and May of that year, the ADA reported a return of 149%. So yeah, it’s great to get excited about cryptos right now. However, it is necessary to keep everything in perspective.

Left (LEFT)

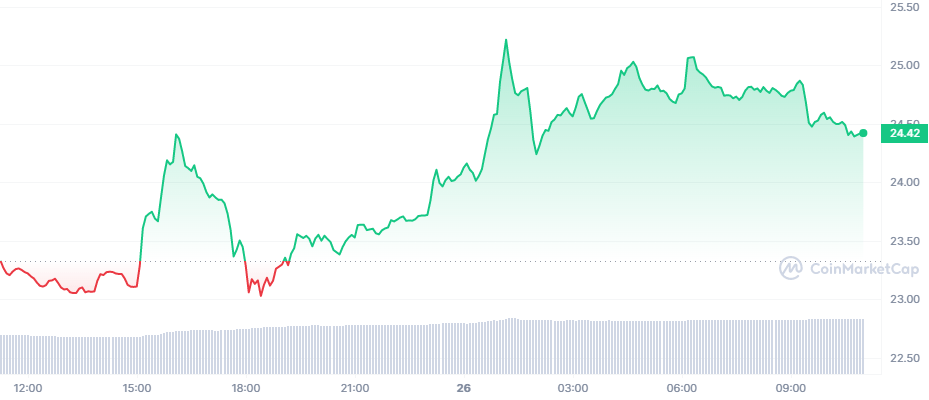

Stigmatized as an Ethereum killer for its ability to incentivize high-speed transactions at well below the costs associated with the ETH network, Solana (SOL-USD) has gained a lot of attention among blockchain developers. Soon after, investors who were definitely looking for the capital gain potential of cryptos jumped on board and sent SOL to the moon.

Unfortunately, Solana was caught in the notorious FTX bankruptcy. While Reuters reported that Solana and FTX had little to do with each other, outspoken support for SOL by FTX founder Sam Bankman-Fried saw the coin fall. Still, this year has had one of the most remarkable rallies in cryptocurrencies. Starting at around $10 per coin, the price jumped to around $25.

While it will undoubtedly please SOL newcomers, the digital asset still has a mountain to climb. Long-term support is around $30. So Solana needs another 20% rally from here. Considering we’re talking about crypto, a 20% move makes sense. However, it is useful to walk carefully.

Dogecoin (DOGE)

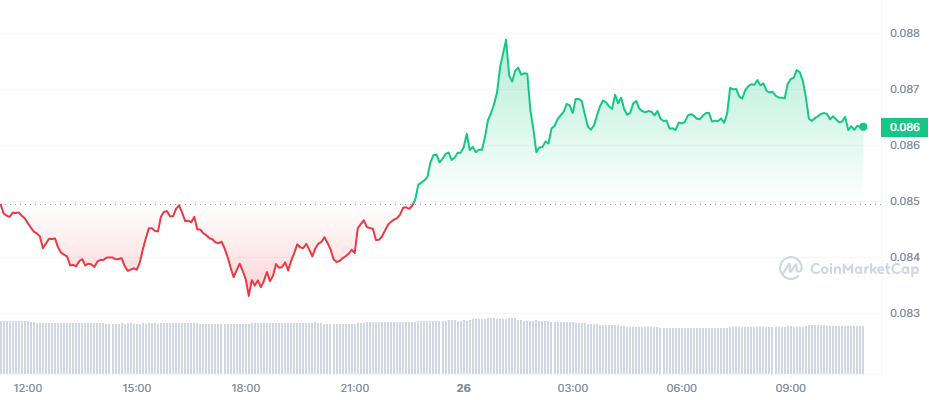

Although Dogecoin (DOGE-USD) carries a somewhat controversial profile due to its disrespectful stance, this renegade stance also attracts viewers. If you consider some of the most popular cryptocurrencies, their fundamental whitepaper is aimed at a better economy, a better world, or at least a better blockchain. With Dogecoin, the emphasis seems to be on community and fun.

It’s not a particularly serious undertaking, but so it’s very refreshing. You are gambling with Dogecoin. Therefore, every time you buy DOGE, you know what you’re getting yourself into. There is no cover in the sense of framing your speculation as a way to address world hunger.

Certainly, DOGE has performed well so far in the year. DOGE, which started January from approximately 7 cents, increased to 9 cents, providing a return of 28%. Still, in April 2018, Dogecoin finally fell and went sideways after gaining 119%. So it’s okay to be a little skeptical about the current rally.