The cryptocurrency market has had a good start to 2023 and is generally holding its gains for now. However, it is very important to follow the latest developments in the market. Therefore, traders have selected 5 altcoin projects worth watching based on their recovery potential, progress in underlying network development, and the persuasive narratives they support.

In the first place is the leading altcoin Ethereum (ETH)

As the community shifts gears for the withdrawal of staked ETH, Ethereum is back in the limelight. Accordingly, Ethereum witnessed increased network activity ahead of the Shanghai hard fork, which will give investors access to their staked ETH following the Merge. Currently, investors are simulating the withdrawal process after the Zhejiang test-net goes live. Prior to the pullback, Ethereum has the largest staking market capitalization among crypto projects supporting smart contracts.

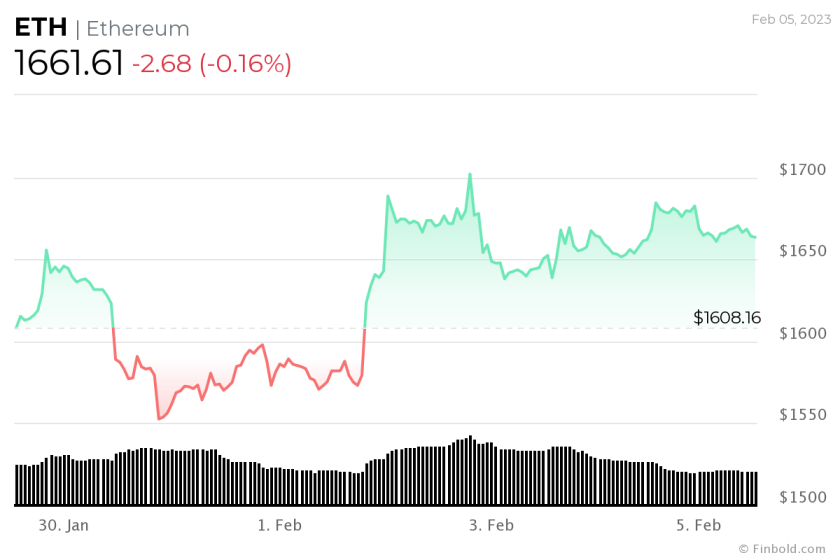

Meanwhile, the Ethereum network is steadily gaining adoption, adding 130,000 unique addresses daily in 2023. In particular, several factors come into play as we focus on the price of Ethereum next week. First, it will be interesting to watch whether the Zhejiang test-net affects the value of the token. At the same time, technical analysis shows that Ethereum may be ready for a price breakout. According to analysts, ETH has successfully emerged from the symmetrical triangle, a factor that will push the price of the asset to around $3,500. At press time, ETH was trading at $1,638, down 2.65% daily.

ETH seven-day price chart

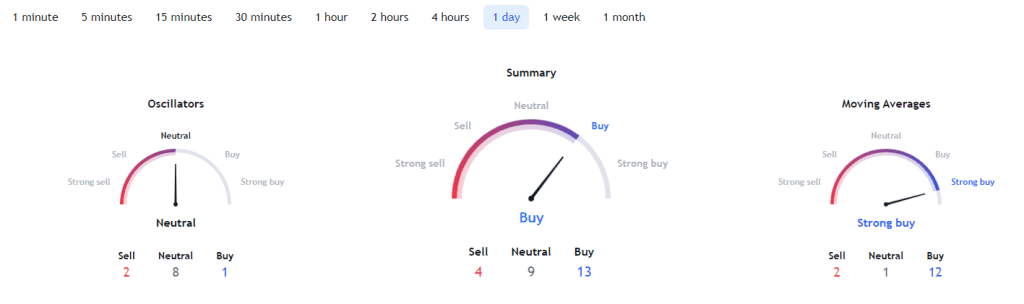

ETH seven-day price chartAdditionally, the machine learning algorithm at PricePrediction predicts that Ethereum will trade at $1,555 on February 28, 2023. Elsewhere, Ethereum’s technical analysis on TradingView remains bullish. The summary of the daily indicators suggests ‘buy’ at 13, while the moving averages point to a ‘strong buy’ sentiment at 12.

ETH technical analysis /Source: TradingView

ETH technical analysis /Source: TradingViewEthereum rival Cardano (ADA) is second on the list.

Cardano has benefited from increased network activity. This helps the altcoin project to become an ‘Ethereum killer’. Indeed, Cardano Blockchain adoption continues to increase. Accordingly, it added 50,000 addresses in January alone. Also, with adoption, ADA is witnessing an increase in capital inflows. Additionally, smart contracts, one of the key metrics in Cardano, continued to increase, reaching the 5,000 milestone. Among crypto projects with smart contracts, Cradano ranks second in the market value of staked assets at $10.4 billion. In addition, Cardano became the second altcoin project with the most development activity on GitHub.

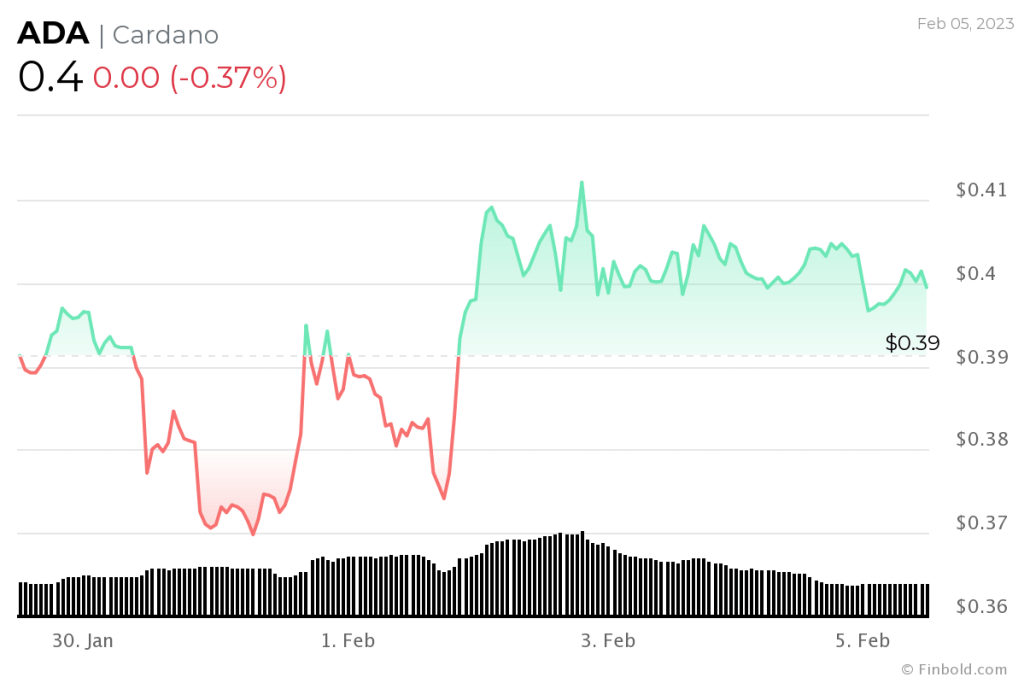

As we enter the new week, ADA is worth watching, especially how the increased interest in the platform can affect the price. According to analysts, ADA has established a basis for a possible rally based on its recent token accumulation. At press time, ADA is changing hands at $0.3898, down 3.42% on a daily basis.

ADA seven-day price chart

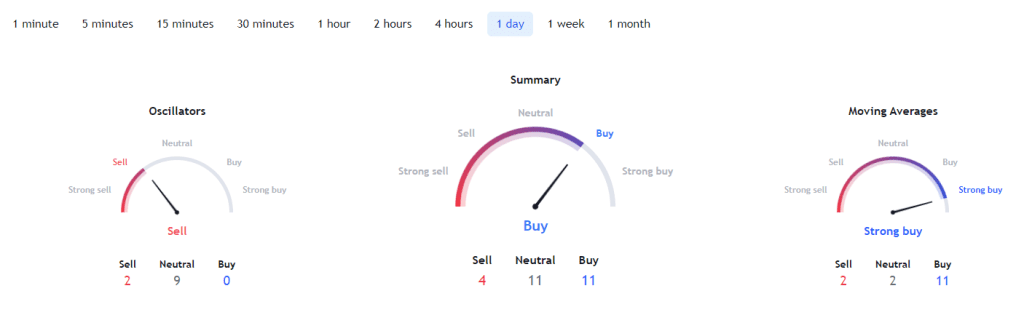

ADA seven-day price chartMeanwhile, within the scope of technical analysis, the ADA daily indicators on TradingView are bullish. The summary recommends a ‘buy’ sentiment at 11, while the ‘moving averages’ suggest a ‘strong buy’ at 11.

Cardano technical analysis / Source: TradingView

Cardano technical analysis / Source: TradingViewLido DAO (LDO) is the third altcoin on the list

Lido DAO (LDO) stood out as one of the most profitable altcoin projects in the new year. Specifically, the altcoin’s gains reflect the evolution around the Ethereum network. In this line, Lido DAO is among the best Ethereum liquid staking solutions. Hence, the upcoming Ethereum Shanghai upgrade inspired the first gains. Therefore, LDO is in a position to benefit as it accounts for a significant share of staked ETH.

LDO is an altcoin worth watching considering it’s the Zhejiang test-net’s latest development to access staked ETH. Additionally, with Ethereum controlling a massive value of staked ETH relative to market cap, this item will likely impact LDO once the staking withdrawal goes live. At the same time, Lido is making significant gains in the DeFi ecosystem, maintaining a significant share of the total value locked (TVL). At press time, LDO is changing hands at $2.03, correcting over 10% in the last 24 hours.

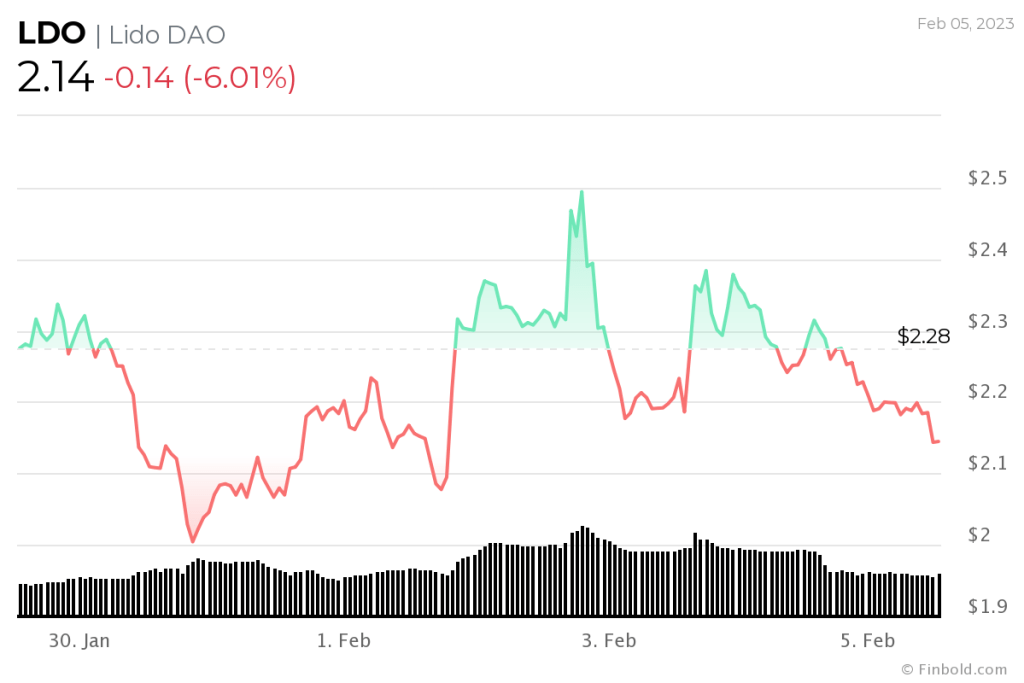

LDO seven-day price chart

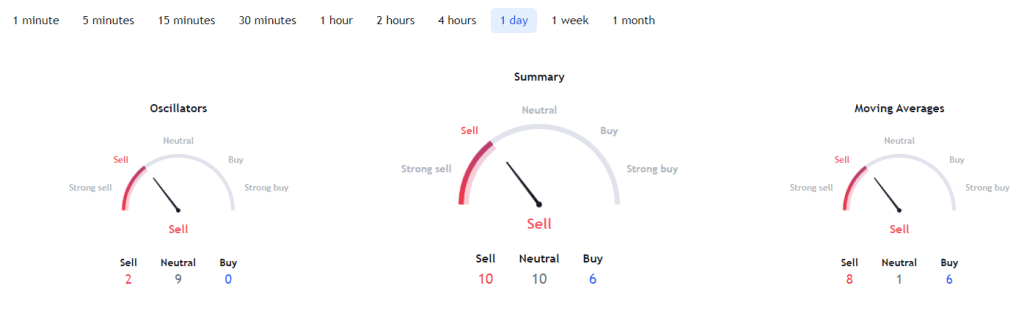

LDO seven-day price chartMeanwhile, the summary of LDO technical analysis suggests ‘sell’ at 10. The same sentiment is exhibited in the moving averages and oscillators at 8 and 9 respectively.

Lido DAO technical analysis / Source: TradingView

Lido DAO technical analysis / Source: TradingViewAnother Ethereum competitor, Avalanche (AVAX), is also on the list.

Avalanche saw an increase in value due to widespread adoption across multiple platforms and benefiting from the overall market’s bullish sentiment. Recently, transfer services SafeTransfer and Delta Prime DeFi have integrated into their token services. At the same time, an increase in the value of AVAX is possible due to the partnership between Avalanche and Amazon Web Services, which fully supports Avalanche’s infrastructure and decentralized application ecosystem.

Apart from adoption, the Avalanche network is seeking continued relevance in the crypto space through increased network development. In particular, the network will receive support from a new update version that will make the work of validators easier. According to Ava Labs developers, the new update, called Banff 8, can improve peer-to-peer (P2P) network interaction by directly affecting the optimization of support for previous version clients. At press time, AVAX is trading at $20.15, down about 3% over the past seven days.

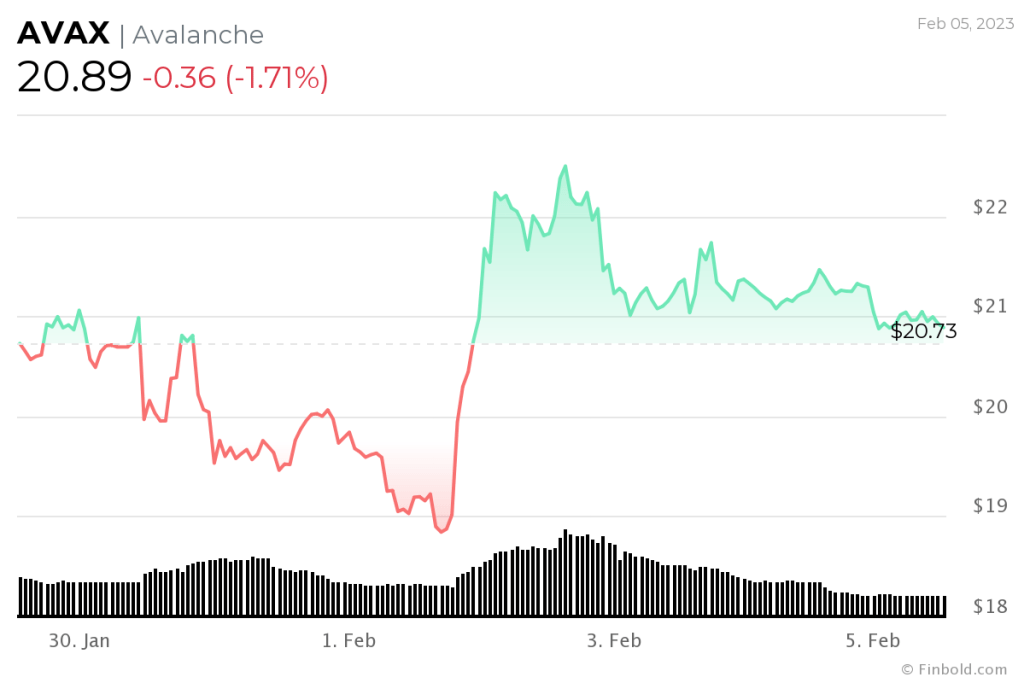

AVAX seven-day price chart

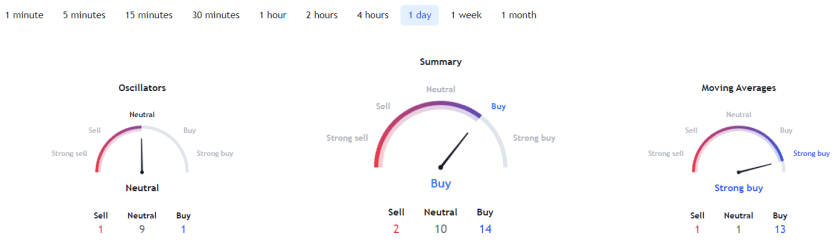

AVAX seven-day price chartAlso, AVAX technical analysis is mostly positive with a summary consistent with the ‘buy’ sentiment at 14. The moving averages, on the other hand, suggest a ‘strong buy’ at 13.

Avalanche technical analysis / Source: TradingView

Avalanche technical analysis / Source: TradingViewLast ranked altcoin Polygon (MATIC)

Polygon (MATIC) is among the altcoin projects with significant activity that takes the asset to new heights. For example, the total value (TVL) locked in the protocol has exceeded $800 million. Thus, the recent surge in Polygon’s activity has seen an increase in DeFi activity as well as elevating it to surpass Ethereum in terms of daily active users. cryptocoin.comAs you follow, Polygon has done impressively with network upgrades to improve staking and gas rates.

Another area that elevates Polygon to the highs of the crypto market is Non-Fungible Tokens (NFT). Polygon’s NFT growth resulted in the network registering more sales than Ethereum. Therefore, these activities are likely to affect the price of MATIC in the coming days. At press time, MATIC is trading at $1.20, down about 4.76% daily.

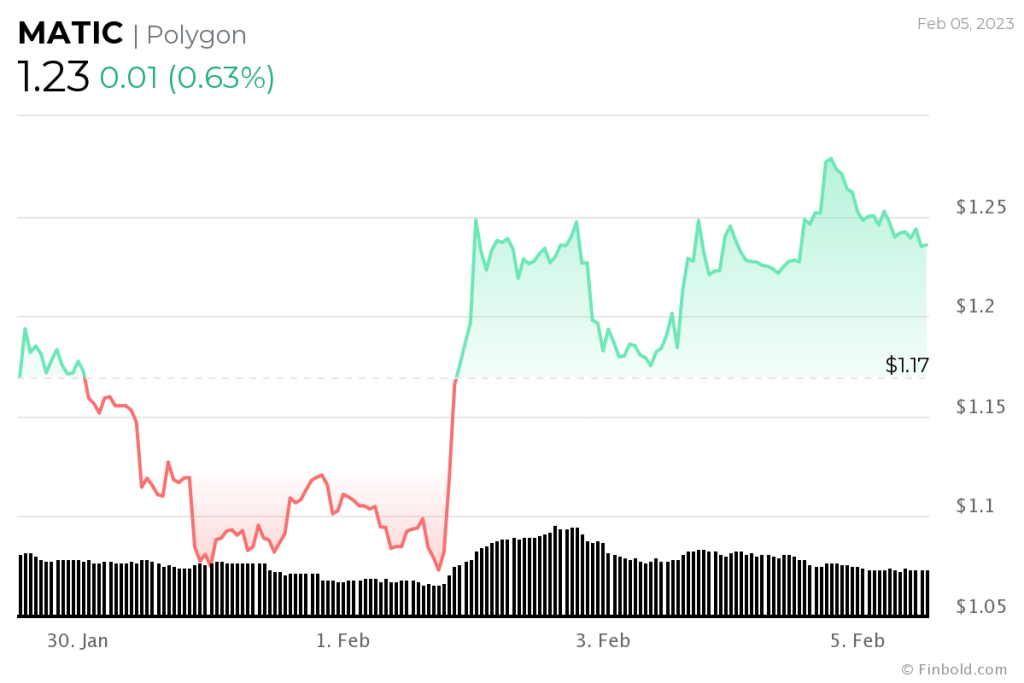

MATIC seven-day price chart

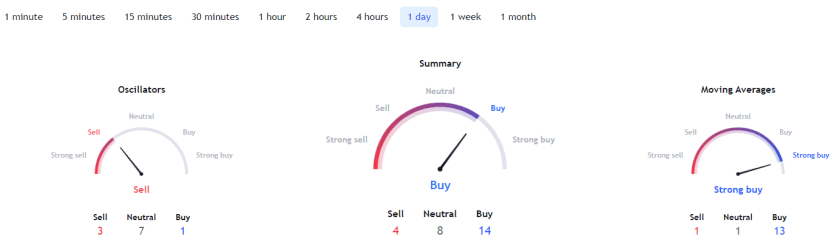

MATIC seven-day price chartA review of technical indicators points to a bullish outlook for MATIC. The summary of the token is in the ‘buy’ position with 14 points. Also, the moving averages point to strong buying sentiment at 13.

Polygon technical analysis / Source: TradingView

Polygon technical analysis / Source: TradingView