The price of the popular altcoin Phantom is at risk of a February pullback due to a growing divergence between its price and momentum in recent weeks. At least one analyst thinks so. Here are the analyzes for Phantom…

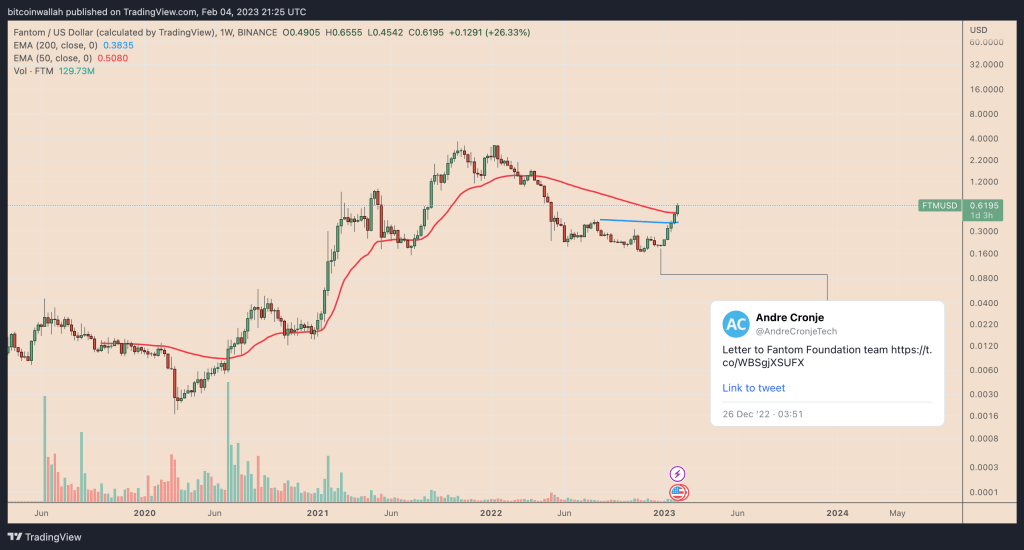

Altcoin price jumps 230 percent after Cronje’s 2023 roadmap

The price of FTM has increased 230 percent in the last five weeks. It is currently trading at $0.55. The rally came as part of a broader crypto market recovery, but outperformed top crypto assets due to the hype created by Andre Cronje. cryptocoin.comAs we reported, Cronje is the co-founder and architect of the Fantom Blockchain.

On December 26, 2022, the developer published a letter discussing the Phantom ecosystem’s goals and priorities for 2023, including its intention to allow decentralized app developers to earn 15 percent of network revenue. The FTM price has increased for five consecutive weeks since Cronje wrote to the Phantom Foundation team. The FTM/USD pair closed the week ended February 5 with close to 20 percent profit, aided by Cronje’s latest Twitter thread, which offered 13 reasons why Fantom should be one of the top layer-1 blockchains in 2023.

Next fix for the phantom price?

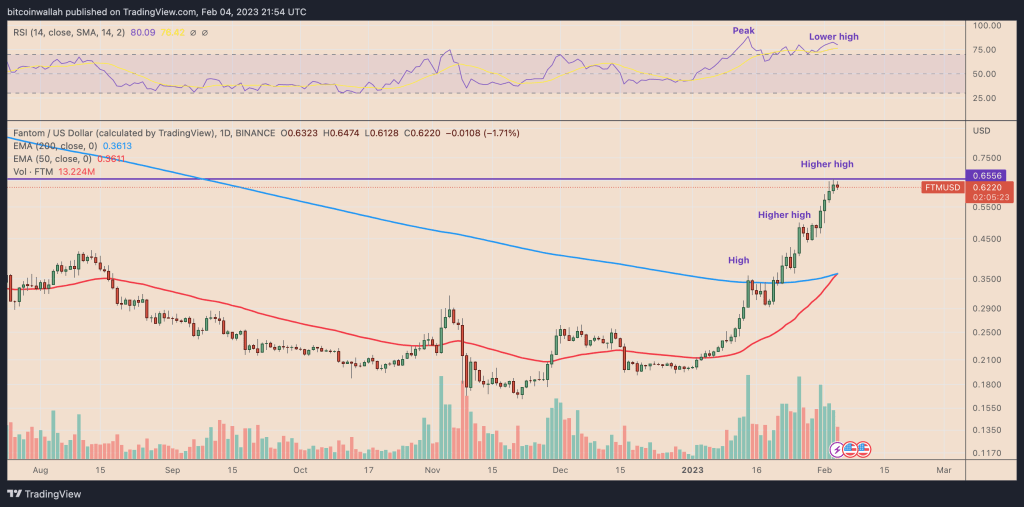

However, according to analyst Yashu Gola, FTM’s continued rally risks being exhausted due to the increasing bearish bias between its rising price and falling momentum. On the daily chart, FTM/USD has made higher highs since mid-January, while the relative strength index (RSI) has made lower highs. According to technical analysis rules, such a discrepancy means that the upside momentum has slowed.

Additionally, the RSI remains above 70, indicating that FTM is “overbought.” It also gives hints of short-term uptrend and possible sideways or downside price movements in the coming days. FTM risks falling towards $0.42, or 35 percent of current price levels, given the level’s recent history as resistance.

Also, a close below $0.42 could mark FTM’s 200-day exponential moving average (200-day EMA) at $0.38 as the next downside target. Overall, the Phantom remains bullish as long as it stays above the 200-day EMA and the 50-day EMA. Currently, FTM is trading as much as 84 percent below its all-time high of $3.46 recorded on October 28, 2021.