Ethereum (ETH) whales have become active again in recent weeks. Interestingly, all of their recent purchases are centered around 4 altcoin projects. Here are the reasons…

Ethereum’s Shanghai upgrade wakes altcoin whales

Before we move on to projects that whales are buying, let’s take a look at Ethereum’s Shanghai upgrade. This is because whales are currently particularly interested in liquid staking tokens. This upgrade, which will take place in March, is very important for Ethereum.

Liquid staking platforms have been collecting massive amounts of ETH for staking as they await the transition to Proof of Stake since late 2020. The Shanghai upgrade will allow these locked ETHs to be withdrawn. cryptocoin.comWe have included the details in this article.

ANALYSIS: According to data from Blockworks Research, the #Ethereum Shanghai upgrade has boosted the growth of liquid staking tokens, outperforming other digital assets. pic.twitter.com/IcYIVDtx4d

— Coingraph | News (@CoingraphNews) February 7, 2023

Whales are after these 4 altcoins

Centralized Exchanges and Liquid Staking platforms are two options available to investors looking to stake Ethereum. Centralized exchanges such as Coinbase and Binance are profiting greatly from this development. All exchanges have ETH staking pools. As for Liquid Staking Platforms, here investors can earn income on funds coming in and out of their platform. Therefore, we can say that large investors prefer decentralized platforms more.

Lido DAO (LDO)

Lido is one of the most popular liquid staking options for the leading altcoin. About $8 billion worth of ETH is staked here. This amount is ⅓ of all ETH deposited.

By the way, the token that whales buy is not Lido Staked Ether (symbol stETH), but Lido DAO token as Lido works as a DAO. So this is not a stake on how the liquid staking derivative will be. A staking mechanism for the platform itself. In terms of price, LDO rose more than 100% to $2.53 after falling to $0.90 in November.

Today Lido contributors are proud to present Lido V2 – Lido’s largest upgrade to date and an important step towards further decentralization. https://t.co/SDxlxCgMNq pic.twitter.com/KJewhEp8rV

— Lido (@LidoFinance) February 7, 2023

Rocket Pool (RPL)

Like Lido, Rocket Pool is a liquid staking platform. They are smaller than Lido but have around $1 billion stake ETH on their platform. Also like Lido, it provides the infrastructure to stake 32 ETH and run a node there.

The liquid staking token purchased here is rETH. While not as widely available as stETH from Lido, you can use rETH in many places, including the Farming Protocol, and in many pools to gain even more attention.

Rocket Pool's mission from day one has been to encourage small & independent home stakers in alignment with Ethereum's core values

We're stoked to reach the milestone of 2000 permissionless node operators spread all across the world! pic.twitter.com/OrYQuvyZWr

— Rocket Pool (@Rocket_Pool) January 26, 2023

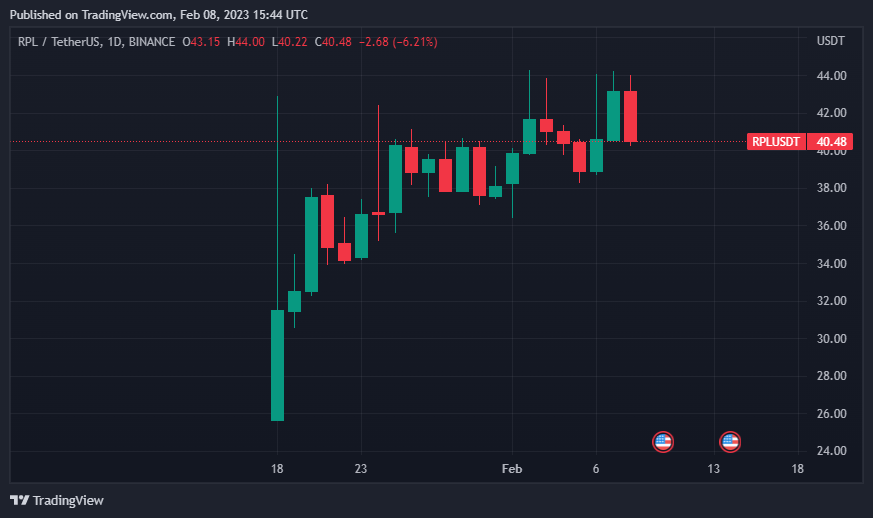

But as with Lido, whales do not buy rETH, they prefer platform cryptos with RPL tokens. Rocket, which reached the low of the bear market at $13.32 in early November, more than doubled to $41.1. A ~50% return from here will push Rocket above the all-time high of the last bull market at $59 and the trend here is clear.

Frax Share (FXS)

frax , Ethereum’s 3rd best liquid staking platform. At Frax, you get frxETH for your ETH. Frax also has one of the most ambitious stablecoin projects in crypto. Its goal is to take the best of algorithmic stablecoins and use them with the security of collateral-backed coins. Its stablecoin is called FRAX. It is also the only cryptocurrency on this list that is not related to liquid staking.

Autocompounding $frxETH – $ETH LP on @beefyfinance is a great success, TVL rose by 300% in 12 hrs! 🤯@samkazemian pic.twitter.com/I7CkSdukLL

— CryptoThatDoesntSuck (@CryptoThat) February 5, 2023

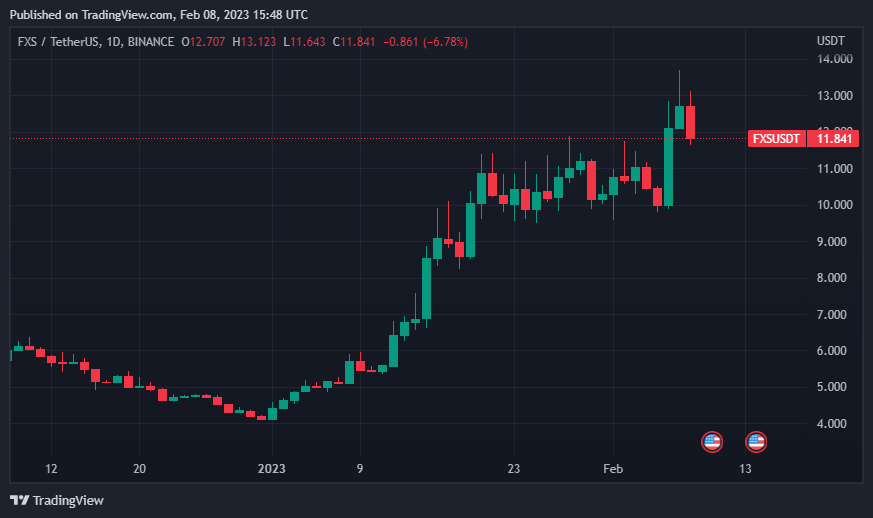

You print or burn FXS to produce the FRAX stablecoin, as UST did with LUNA. This altcoin that the whales bought is the FXS altcoin. This is a sign that they are on the rise in stablecoin. Because you need to burn FXS to produce more FRAX stablecoins. This means you are running low on FXS supply. These whales think that the nose will add value to the token by reducing the supply, so they buy it.

StakeWise (SWISE)

Stakewise, just like the other platforms mentioned in the list, is a platform where ETH is staked and a liquid token is earned. In this case, the liquid token is sETH2. Among the 3 liquid tokens, this one has the least investment options, but there are still some good tokens, including the 2 pools that Stakewise offers.

One presents virtually no risk of temporary loss as there is an ETH-sETH2 pool on Uniswap that pays a healthy 12.71%. Another includes rETH2, another ETH derivative token, and the pool is rETH2-sETH2. This is on Uniswap and it pays 12.68%. These are excellent returns for the risk you take. Risk is low here as both derive their value from the underlying Ethereum.

Who are the big DeFi movers to start off the year?

Liquid staking derivatives like @stakewise_io and @LidoFinance are off to a hot start, seeing market cap increases of 65.4% and 47.7%, respectively. pic.twitter.com/oJd73lMQ1z

— Messari (@MessariCrypto) January 21, 2023

Like Lido and Rocket, whales here are buying Stakewise’s SWISE platform crypto, not the sETH2 liquid token. This platform is the smallest of the liquid staking platforms with a market cap of only $32 million, but there is a lot of room for growth if you think liquid staking and authorized ETH staking will continue to grow as I did here.