There have been allegations that the US Securities and Exchange Commission (SEC) will take steps towards staking. This has caused the price of altcoin projects of platforms focused on liquid staking to jump. Here are the details…

The value of these altcoin projects has skyrocketed

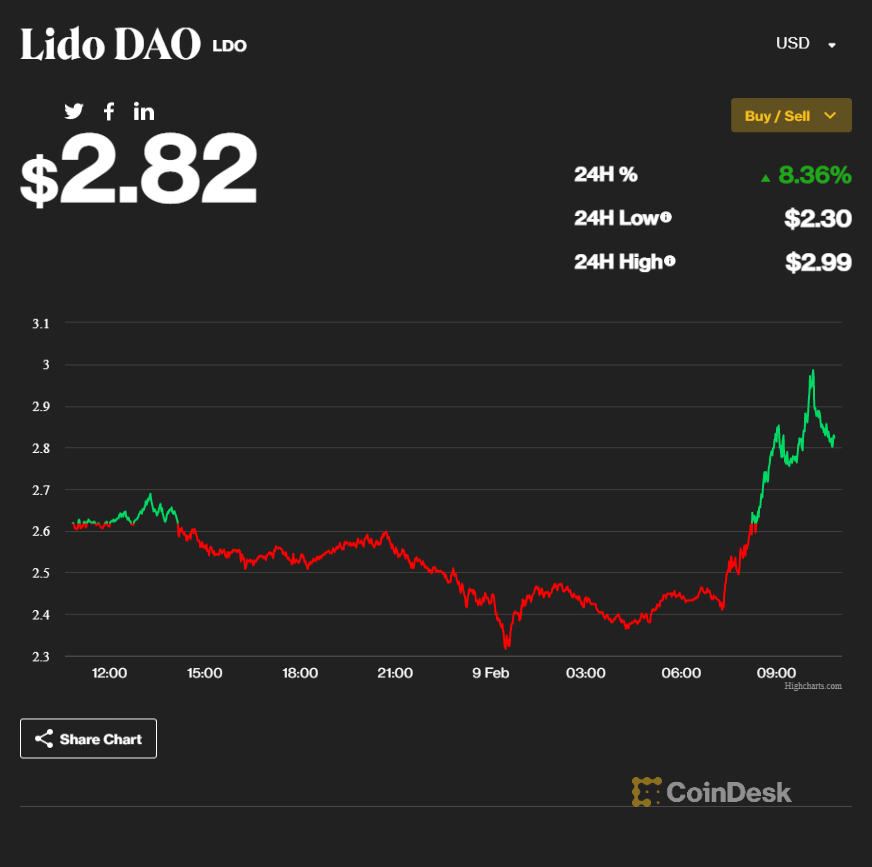

Liquid staking tokens jumped overnight as investors bet on growth in decentralized staking products amid rumors that their centralized counterparts will face a possible ban in the US. The data shows that the liquid staking sector rose 5.4 percent on average, while the broader crypto market cap fell 3.4 percent. Market leader Lido’s tokens rose 9 percent before pulling back on Thursday. LDO, the governance token of the decentralized autonomous organization behind Lido, is up about 11 percent in the wake of the comments and is up about 8.4 percent in the last 24 hours. Rocket Pool’s RPL and Stader’s SD tokens are up 10 percent in the last 24 hours.

Liquid staking refers to ETH staked for tokenized versions of Ethereum that can be used in decentralized finance (DeFi) applications. That is, these staked tokens can be used in many ways as collateral for loans or margin trading, or to generate returns. Normally, these coins attract a lot of attention as the staked token cannot be touched. For example, the Lido protocol managed by the LDO token allows staking. Users are awarded a token called stETH, which represents their staked position in ETH. As a decentralized protocol, it is unlikely to follow the same securities rules as a US-resident centralized entity such as Coinbase.

What were the SEC allegations?

cryptocoin.com As we reported, Coinbase CEO Brian Armstrong tweeted that he had heard rumors that the U.S. Securities and Exchange Commission wants to ban retail investors from staking cryptocurrencies. Despite this, Verasity (VRA), which is popular in terms of staking, gained 10 percent, TosDis (DIS) 65 percent, and Tranchess (CHESS) 19 percent. According to a report from Staked, a staking service provider, the value of staked assets was approximately $42 billion in the fourth quarter of 2022, with annual staking rewards of $3 billion. This figure wasn’t just limited to retail investors.

Leading traders in the crypto space on Twitter; they assumed that these funds flowed into DeFi alternatives such as Lido and Stader. This could explain the sudden price increase for the respective tokens. A ban on central staking providers in the US would be a boon for Lido. The rumors precede the highly anticipated Shanghai upgrade in Ethereum next month, which will allow investors to withdraw their ETH staked on the Ethereum Blockchain. Because, as we mentioned above, staked ETH cannot be withdrawn or freely traded at this time.