Avalanche (AVAX), which is one of the permanent names in the top 20 according to its market value, is also a pioneer in the field of NFT and DeFi, in addition to its features such as high speed and low cost. In this post, let’s take a look at 3 AVAX-based DeFi projects from analyst Camille Lemmens’ list.

3 Avalanche (AVAX)-based DeFi projects you should follow this year

Avalanche is one of the PoS Blockchain platforms that supports smart contracts. It’s fast and cost-effective, so it attracts developers and users alike. The protocol is in the top 20 in the market capitalization ranking. It also has a vibrant DeFi ecosystem. AVAX is the native cryptocurrency of these platforms and powers the platform. With all that said, let’s take a quick look at what Avalanche has to offer in DeFi protocols.

Sub-second transaction finality is paramount to the success of DeFi dApps.

Slow transaction finality means that value is at risk.

This is why DeFi innovation is happening on Avalanche. #AvalancheStandsApart pic.twitter.com/LqO5fskV0z

— Avalanche 🔺 (@avalancheavax) December 1, 2022

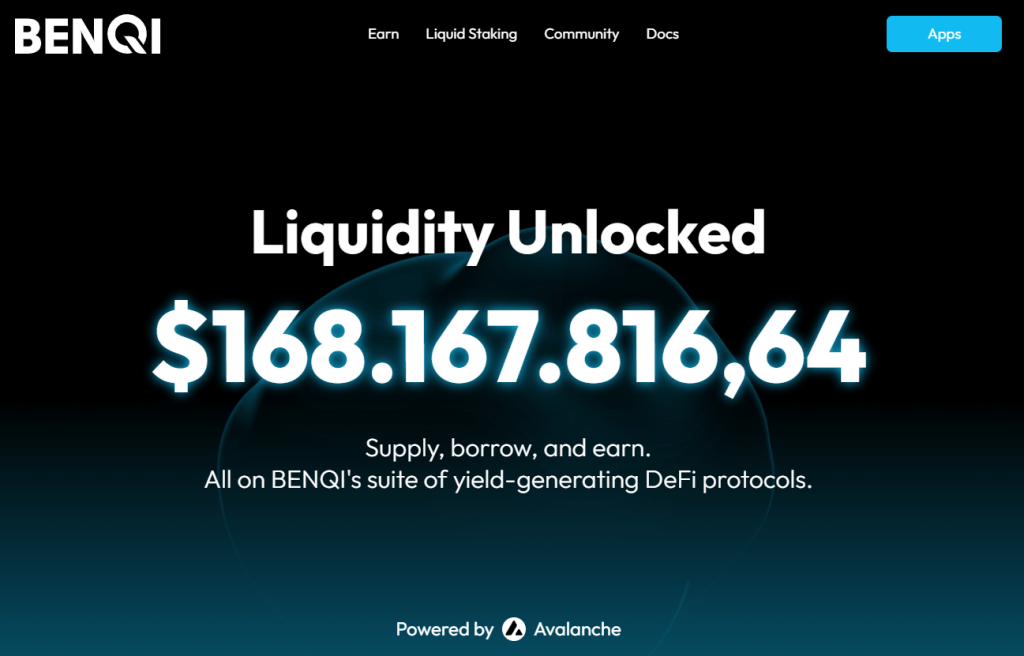

BENQI (QI)

Benqi focuses on two aspects of DeFi. These are liquid staking and lending and borrowing. They also claim to have broken the Blockchain trilogy. This feature means they can offer a decentralized, secure and scalable platform.

In terms of TVL, Avalanche ranks second behind Aave. According to DeFiLlama, his TVL is $232 million. However, like all DeFi protocols, it is currently quite far from its ATH. The platform reached this with $1.81 billion in early December 2021. Around May 2022, most protocols lost their TVL. Key features of the two main protocols in Benqi:

- Benqi Liquid Staking (BLS) tokenizes your staked AVAX. You can use this liquid staking coin, sAVAX, by trading or using it as collateral. You can also sell and buy liquid again. However, the owner of the Liquid Staking token is the owner of the staked AVAX.

- BENQI Liquidity Market (BLM) allows you to lend and borrow cryptocurrencies. You can also earn interest with it. You either provide liquidity and generate returns, or borrow and over-collateralize.

DEX platform where you can use AVAX-based leverage: GMX (GMX)

GMX is a decentralized exchange that offers leverage. A leveraged DEX means you can open larger positions with your available money as it gets a centralized platform. GMX provides leverage of up to 50x. But be careful when trading with leverage. Profit may seem tempting. However, your losses can be just as big as your potential profits.

That said, GMX has been rallying for a while. DeFiLlama cites its TVL as $78.2 million on Avalanche. The Avalanche launch of the platform took place in January 2022. There is also another $451 million TVL in Arbitrum. Let’s say that the price has increased by 50% since the beginning of the year.

Unlike other leveraged platforms, GMX offers reduced liquidation risk. This feature is when the exchange forcibly closes your leveraged position. Get more trading experience before you start trading with leverage. The risks are high when trading with leverage.

Weekly Rewards Info 🔹

$3,156,367.41 collected in the past 7 days

$2,619,296.49 (ARB), $451,156.59 (AVAX), $85,914.33 (GMX-ETH)

To buy and stake $GMX / $GLP: https://t.co/HnDqM1Kd37 pic.twitter.com/MrL6x4B2b7

— GMX 🫐 (@GMX_IO) February 8, 2023

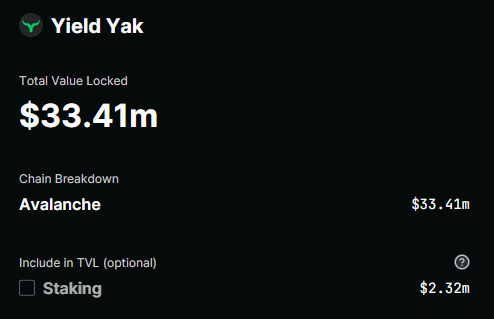

Yield Yak (YAK)

Yield Yak is an automated merge platform. It is also a yield aggregator. It helps you optimize your profit. The platform offers automated merge repositories. This option is the opposite of many other farming, where you have to assemble yourself. Each time you combine your rewards, it will cost you gas fees. It is also time consuming. Yield Yak does this automatically.

In a nutshell, Yield Yak does all this automatically. They do this by pooling coins and sharing the cost of combining them. In other words, your rewards are combined with lower gas fee costs more often. DeFiLlama tells us their TVL is $33 million. Yield Yak currently offers 99 different farming ponds. Also, users have staked 80% of their native YAK tokens.

Yield Yak currently, with 22.1% APY