The United States Securities and Exchange Commission is increasing the pressure on the crypto industry. On February 9, the SEC reached a $30 million settlement with Kraken for its centralized staking program to its users. This development led to a rise in a certain altcoin group. Here are the details…

Some altcoin projects rise after SEC ban

News of the SEC’s crackdown on crypto staking sent Bitcoin’s price to a three-week low as investors began to fear regulatory sanctions. The price of the leading altcoin Ethereum was also corrected on the news, reinforcing the token’s worst-performing day of 2023. But there have also been positive developments: while the overall crypto market was on the decline following the SEC announcement, decentralized liquid staking tokens LDO, RPL, and FXS ended their sharp corrections.

2/ Staking is a really important innovation in crypto. It allows users to participate directly in running open crypto networks. Staking brings many positive improvements to the space, including scalability, increased security, and reduced carbon footprints.

— Brian Armstrong (@brian_armstrong) February 8, 2023

According to analyst Korpi, Kraken and Coinbase represent 33 percent of all staked Ether, and if US-based centralized exchanges struggle to offer staking programs as a service, liquid staking derivatives providers could absorb this market share. Based on recent tweets, crypto traders are well aware of this potential outcome and it may be part of the reason for the short-term recovery seen in Lido’s LDO, Rocket Pool’s RPL and Frax’s FXS.

Central staking may be banned for US-based investors

cryptocoin.com As we reported, after Kraken surrenders to the SEC, it may spread to other centralized exchanges that offer staking as a service. While not all SEC commissioners agree on the crackdown on Kraken, the deal also brings other companies like Coinbase and the Earn program under scrutiny. On February 8, Coinbase CEO Brian Armstrong revealed how disastrous he believes the SEC’s crackdown on staking will be for US investors.

The SEC’s decision to regulate cryptocurrencies through enforcement actions rather than explicit regulations caught the ire of the crypto community for its “anti-crypto” actions. Decentralized staking as a service could solve securities problems If broader pressure starts on centralized staking services, this market share of stakers could be absorbed by decentralized providers such as Lido, Rocket Pool, and others. Following the SEC’s decision, Rocket Pool briefly reached $1 billion in total locked value (TVL).

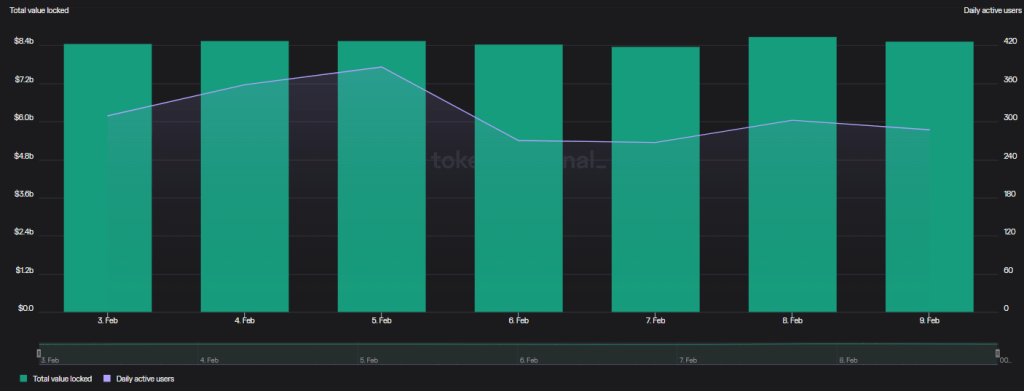

Locked value of liquid staking projects jumps

Lido, the largest liquid staking provider, has over $8.5 billion TVL. While the platform did not see an increase in initial usage after the SEC’s decision, massive inflows of funds could begin as users seek new places to stake their ETH. The crypto market may be on the decline since the SEC decision, but RPL and LDO prices have risen.

2.

Address "0xcd93" bought 40,834 $RPL from Jan 21 to Feb 9, the buying cost was $1,674,153, and the average buying price was $41.

And the address staked all 40,834 $RPL to @Rocket_Pool 4 hrs ago.https://t.co/pesj8QxoJe pic.twitter.com/AIx3ECUwzv

— Lookonchain (@lookonchain) February 10, 2023

Within 24 hours of the February 9 SEC announcement, the price of RPL rose 14.5 percent. Also, LDO was up 13.2 percent and corrected to $2.39. According to experts, the increase in prices may be due to large whales accumulating large amounts of tokens. The growth may indicate that investors are betting on increased platform usage even when the market is down.