Gold prices reversed their direction after falling below $1,800 earlier in the week, ending a four-week losing streak. Market analyst Eren Sengezer says technical indicators suggest that gold may struggle to continue rising next week, but the response of US Treasury yields to the FOMC’s May meeting minutes should drive gold’s action later in the week.

What happened in the markets last week?

The risk-averse market environment at the start of the week helped the dollar continue to gain strength, putting gold at $1,786, its lowest level since late January. Data from China revealed that Retail Sales and Industrial Production contracted by 11.1% and 2.9% year-on-year, respectively, in April, reminding investors of the negative impact of the country’s zero-Covid policy on the economy. Reflecting the impressive performance of the dollar, the US Dollar Index (DXY) reached its highest level since late 2002.

On Tuesday, the city of Shanghai announced that it had reached zero coronavirus infections in all districts, and that they will begin to gradually ease restrictions from May 21, with the aim of lifting restrictions completely by June 1. According to the analyst, although this development helped gold recover, rising US Treasury bond yields limited gold to the upside. As Kriptokoin.com also reported, gold prices remained relatively quiet on Wednesday and closed the day flat on Thursday before picking up bullish momentum.

Disappointing earnings numbers and depressing sales outlooks from major US retailers including Walmart, Target and Kohl’s triggered a heavy safety flight on Thursday. Despite risk aversion, the dollar struggled to find demand amid falling US interest rates, and gold prices rose nearly 1.5%, posting their biggest one-day gain since early March. He also notes that gold has broken above the key 200-day SMA during Thursday’s rally, further attracting technical buyers.

In the absence of top macroeconomic data releases and key headlines, gold consolidated its weekly gains on Friday and posted modest daily losses. Regardless, gold posted weekly gains for the first time since mid-April.

What is on the agenda of the next week for gold prices?

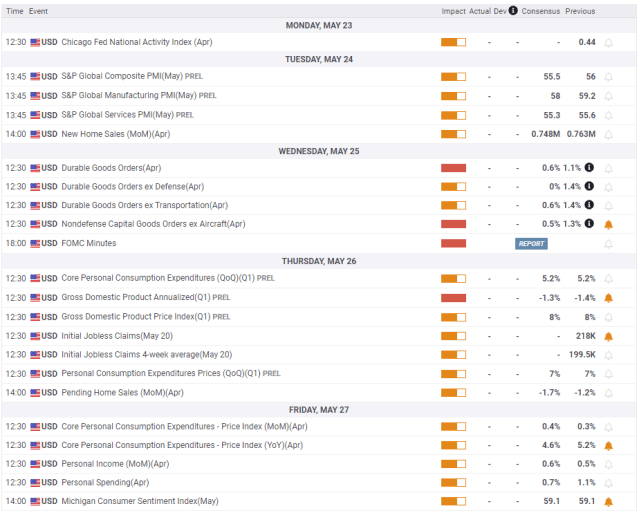

S&P Global will release their flash PMI report for the US on Tuesday. These publications are expected to show that business activity continues to grow at a strong pace in both the services and manufacturing sectors in early May. However, the analyst reminds that if he points to rising input prices and the difficulties companies are facing in filling vacancies, the dollar may hold its ground and put pressure on gold prices.

On Wednesday, the FOMC will release the minutes of the May meeting at which the Fed decided to raise the policy rate by 50 basis points. “An increase of 75 basis points is not something the committee is actively considering,” FOMC Chairman Powell said at the press conference. The analyst evaluates it as follows:

If the minutes reveal that some policy makers are open to the idea of an interest rate hike above 50 basis points, it can be seen as a hawkish development and may cause gold to turn south by increasing interest rates.

On the other hand, Fed officials expressed their willingness to increase the policy rate by 50 basis points in the next two meetings. The publication may suggest that policymakers may then try to take a cautious stance to see the impact of higher rates on inflation and consumer activity. In such a scenario, the analyst notes that dollar sales may gain momentum and pave the way for a long-term recovery in gold.

US economy to include first-quarter GDP growth and Personal Consumption Expenditures (PCE) Price Index data for the second half of the week. According to the analyst, the GDP data is unlikely to trigger a noticeable market reaction as it will be a revision to the US Bureau of Economic Analysis’s initial forecast, which showed the economy contracting by 1.4% annually.

Core PCE inflation is expected to decline to 4.6% yoy in April from 5.2% in March. If this data is in line with market forecasts or even lower, the analyst says gold is likely to gain momentum before the weekend and vice versa.

In the meantime, investors will continue to closely follow the developments regarding the coronavirus in China. Positive headlines on this front could help gold strengthen as they point to an improving demand outlook.

Gold prices technical outlook and gold sentiment survey

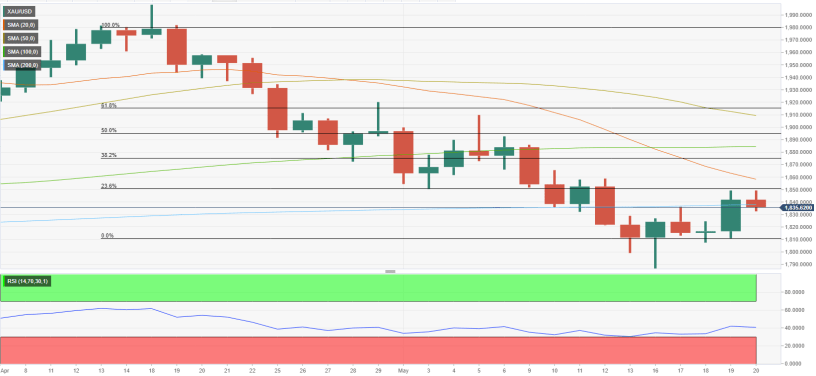

He states that it still remains below 50, noting that it shows that the recent rise of gold is part of a technical correction. Additionally, the analyst states that gold has yet to confirm the 200-day SMA, which is currently around $1,840. The analyst points out the following technical levels:

If gold starts using $1,840 as support, the next key resistance is aligned at $1,850, where the 23.6% Fibonacci retracement of the latest downtrend. A daily close above this level can be seen as a bullish development and could open the door for additional gains towards $1,870. On the other hand, if gold fails to break past the 200-day SMA, sellers may step in again. In this scenario, $1,810 is aligned as the next bearish target before $1,800.

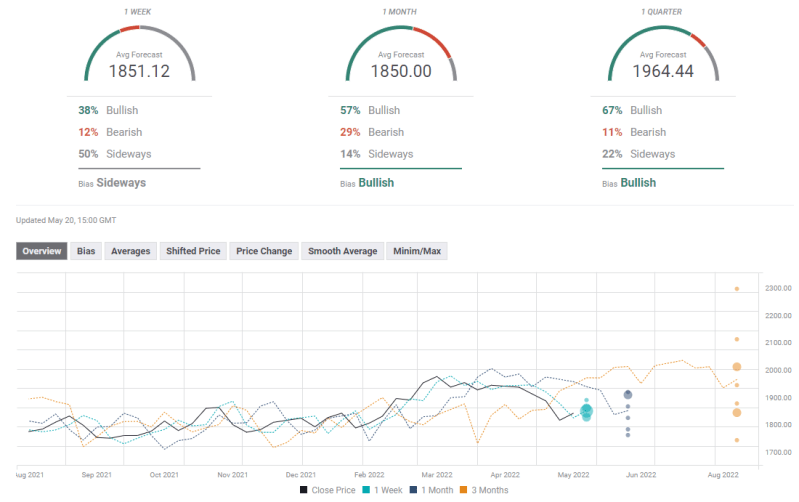

FXStreet Forecast Survey shows that the majority of experts predict that gold will move sideways next week. The average target of $1,850 means there is room for additional gains in the near term. The analyst states that there is a bullish trend in both the one-month and quarterly views.