Coinbase stands up to the SEC and says these altcoins are not securities. Then guidance is important, not threats of lawsuits, they add.

An explanation has been made for these altcoins

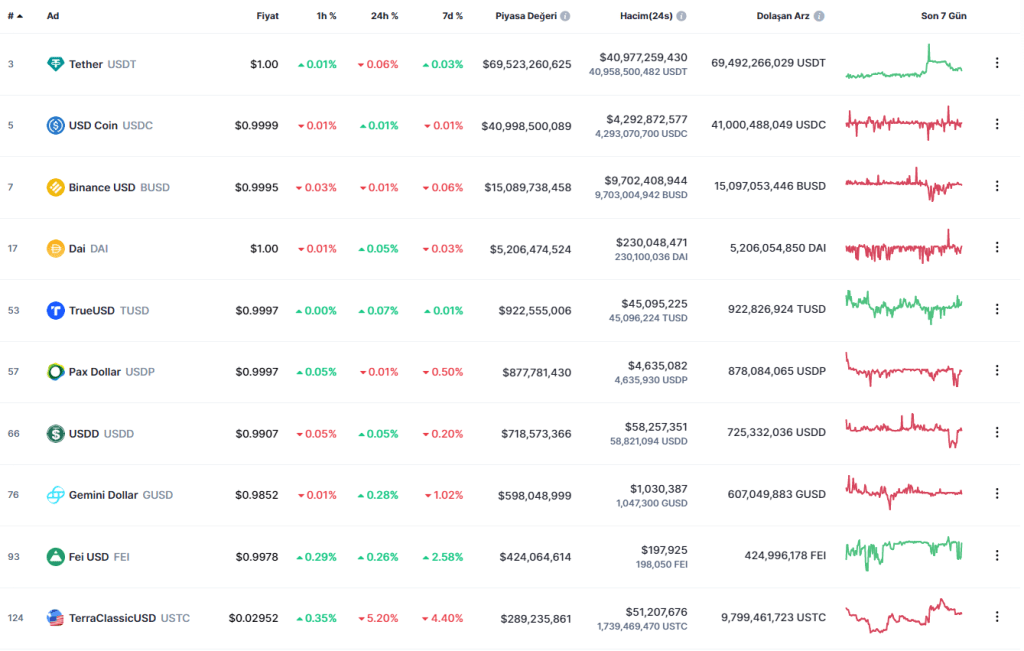

Coinbase has been the go-to crypto exchange in the United States, which guarantees not going out of bounds. However, a recent lawsuit from the US Securities and Exchange Commission (SEC) has pushed the trading giant to make a statement in support of stablecoins. cryptocoin.comAccording to the data, the top 10 stablecoins are indicated in the image below.

Coinbase supported Paxos and stablecoins

In its latest statement, Coinbase mentioned that stablecoins are not securities. This stance is extremely important not only for the crypto space, but also for the traditional financial sector. However, some examples of stablecoins include Tether (USDT), Circle USD (USDC), and Binance USD (BUSD). Stablecoins are cryptocurrencies pegged 1:1 to the US Dollar.

The US-based exchange mentioned that the stablecoin ‘makes payments like USDC instant and affordable. Also, the exchange takes time to make payments in traditional finance, ‘They (stablecoins) allow you to receive payments in seconds without the long transaction time and high fees that can be associated with intermediaries such as banks and credit card companies.’ he made statements.

The crypto platform said in a thread of tweets that if the SEC continues to enforce securities laws on a regulated product like stablecoins, it will ‘push innovation to the high seas’ and end the US ‘global rule’.

Coinbase’s bold statement clearly demonstrates that it stands up to the SEC’s tyranny and indirectly supports stablecoins and Paxos in doing so. But the exchange makes a wise distinction, saying, “We don’t know what aspects of BUSD might be of interest to the SEC.”

Is the SEC bullying?

It’s true to some extent that Coinbase has taken over platforms that are subject to the SEC’s strong arming regulations. The SEC attacked the entire staking ecosystem with Ether and the platforms that offer it, before sending a Wells Notice to the Paxos Trust for allegedly offering unregistered securities.

Kraken, another US-based exchange, agreed to cease its staking services and pay a $30 million fine. However, when news of the SEC’s move broke out, Coinbase founder Brian Armstrong opposed law enforcement and said, “Coinbase’s staking services are not securities. We will be happy to defend it in court if necessary.” He finished his speech by making a statement.