Bitcoin price action appears to be on the cutting edge as analysis hopes the monthly close could reflect a positive end of the week. cryptocoin.comWe have compiled for you the developments that will affect cryptocurrencies this week.

Bitcoin continues to press

Bitcoin continues to press for a bullish end to February as the monthly close kicks off another week’s price action. The biggest cryptocurrency seems determined to hold its gains as it closes the second month of 2023, keeping bulls’ hopes alive in the process.

The coming week could mean decision time for a key area of BTC price action around $25,000. Analysts are looking for a break towards $30,000 if support becomes more persistent, though concerns remain that a reversal towards the resistance regained in January is still likely.

In the midst of a quiet week for macroeconomic data, any catalyst that determines whether the BTC/USD pair rises or not could come from within Bitcoin. One thing is for sure, on-chain data shows that long-term Bitcoin holders are not in the mood to sell yet and continue to increase their BTC exposure en masse at current prices.

Bitcoin monthly close blocks March trend showdown

The weekend seemed to be touch and go, but Bitcoin managed to avoid a major pullback and is back in the new week. The weekly close of around $23,500 sounded like music to the ears of those who want to see a bullish recovery sooner or later.

“BTC has managed to break above the ~$23,400 level, which is the Macro Monthly Range High Range,” said popular trader and analyst Rekt Capital. For Rekt Capital, March marks a real bullish or breakout month for BTC/USD, as it approaches a long-term trendline, a breakout of which would signal a complete trend reversal.

Another post reiterated $25,000 as the level to break to ‘confirm’ a macro uptrend. Trader’s friend Crypto Chase is more categorical about short-term price movements. He also marked $25,000 as the line in the sand in a tweet.

Meanwhile, trading source Stockmoney Lizards described a ‘short-term bullish reversal’ for both price and the relative strength index (RSI) on the 4-hour chart as the weekend comes to a close.

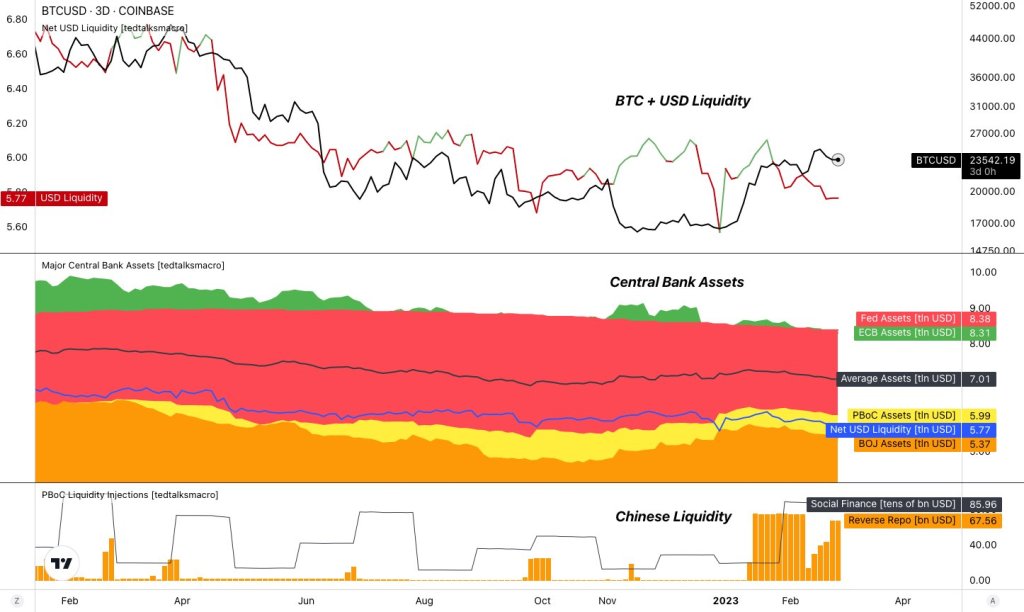

Macro focus returns to central bank liquidity

In a refreshing change from the previous two weeks, US macroeconomic data will be calmer in early March. However, analysts are increasingly watching equivalent publications in Asia as a potential BTC price influencer. Popular commentator Tedtalksmacro tweeted that day, “Global liquidity is expected to increase in 2023, but has recently been pulled back.” is in the form.

Tedtalksmacro nevertheless highlighted a potential counter-trend in the form of Japan’s central bank, the Bank of Japan (BoJ), and warned it could resort to financial tightening to rein in inflation. While comparing US macro-asset performance to crypto following the January Consumer Price Index (CPI) data pressure, he added that cryptoassets remain ‘stubborn’ despite others starting to rise.

Analysis platform Mosaic Asset focused on the potential to raise benchmark interest rates more than expected at the Fed’s March meeting. According to CME Group’s FedWatch Tool, the probability of a 0.5% hike instead of the 0.25% seen in February currently stands at 27.7%.

Sellers suffer net losses in first week of 2023

While Bitcoin is up over 40% year-to-date, the path to recovery remains fragile for the average hodler. This is the conclusion of the latest data from research firm Santiment, which shows that last week’s mixed BTC price action still manages to generate net losses among sellers.

Bitcoin saw the same phenomenon that sellers lost in the first week of 2023. “Bitcoin and Ethereum this week, the first week so far in 2023, both Bitcoin and Ethereum are having more investors selling at a loss than a profit,” Santiment commented.

The bad luck of the sellers contrasts with the strategy that is still firmly in place for long-term holders who continue to increase their BTC positions. According to on-chain analytics firm Glassnode, the net position change of hodlers hit a four-month high this weekend, reflecting the rate at which accumulation occurs.

Also, the percentage of BTC supply that has been idle for at least five years now is higher than ever at 28.24%.

Bitcoin revenue hits 8-month high

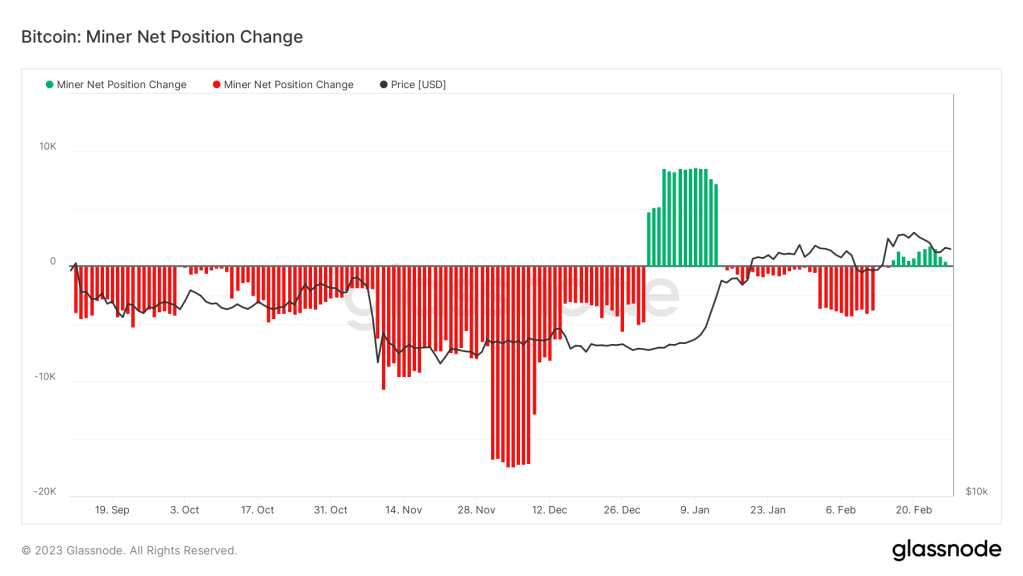

A broadly similar situation is currently being witnessed among Bitcoin miners. The Glassnode data here shows that on a 30-day basis, miners are holding more BTC than they are selling, but current prices keep this trend unstable. While it doesn’t take much of a price drop to return to net sales, current conditions remain much healthier than those seen in previous months.

There is a glimmer of hope in the form of miner revenue, which, though modest, is still at an eight-month high. Revenue was helped by ranking fees, which exceeded $1 million in February.

According to Glassnode, despite the ordinal numbers resulting in a ‘full mempool’ for Bitcoin, miners still managed to clear it, according to research done last week.

Early 2020 for Bitcoin whales

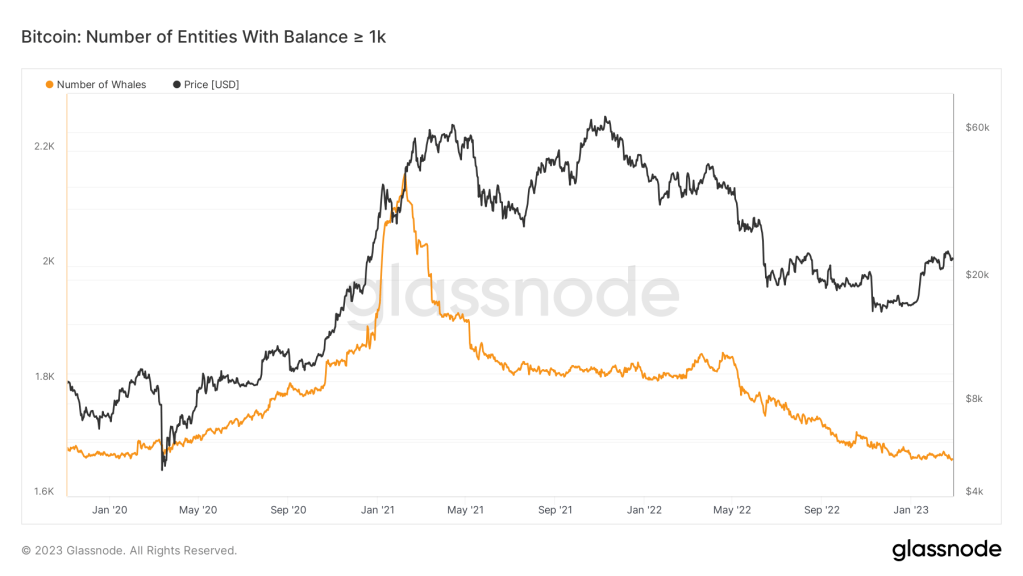

They may be responsible for some interesting events on the exchange order books, but Bitcoin whale numbers are actually dwindling. With price action still 65% below all-time highs, the biggest Bitcoin investors have yet to decide it’s time to return to the market.

According to Glassnode, the whale count is currently at a three-year low. Three years ago, in February 2020, Bitcoin was trading below $10,000. Glassnode defines a unique entity as ‘a set of addresses controlled by the same network entity’. At its peak in February 2021, there were 2,161 whales of this species.

The ‘clusters’ of whale trading activity can still provide an idea of support and resistance, even if there are depleted whale numbers. As tracking resource Whalemap points out, $23,000 remains a key price focus this month thanks to the whale factor.

Important developments of the week

- Monday, February 27 (18.30)

- Speech by the US Federal Reserve Bank (FED) Jefferson

- Synthetix Network (SNX) third version network update

- Tuesday, February 28 (18:00)

- US Conference Board (CB) Consumer Confidence Ratio (Exp. 108.5 Previous:107.1)

- Wednesday, March 1 (17:45)

- US Manufacturing PMI (Exp. 47.8 Previous: 47.8)

- Hedera (HBAR) $235M key opening

- Thursday, March 2 (15.30 and 16.30)

- Publication of the European Central Bank monetary policy meeting minutes

- Announcement of US unemployment benefits applications (Expected: 197 thousand Previous: 192 thousand)