He reportedly made a quick profit of over $50,000 in less than 20 minutes by buying and selling altcoins right after it was listed. cryptocoin.comWe have compiled these altcoins that make a profit on Binance for you.

Altcoin quickly brought profit

Timing is everything in the world of cryptocurrencies and this is exactly what a trader going by the name ‘SmartMoney’ demonstrated in a recent tweet from Lookonchain. SmartMoney reportedly made a quick profit of over $50,000 in less than 20 minutes by buying and selling the token right after it was listed on Binance’s Innovation Zone.

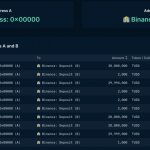

According to Lookonchain’s tweet, SmartMoney bought 105,384 LQTYs with 180,000 USDC just seconds after Binance’s announcement. LQTY was recently listed on Binance’s Innovation Zone. SmartMoney sold LQTY for 199,485 USDC after the price went up, making a profit of 19,485 USDC.

2/ The SmartMoney bought 105,384 $LQTY with 180,000 $USDC within seconds of #Binance's announcement today.

And sold 105,384 $LQTY for 199,485 $USDC after the price rises.

This guy made a profit of 19,485 $USDC in less than 20 minutes! pic.twitter.com/rInjMCx5aH— Lookonchain (@lookonchain) February 28, 2023

But SmartMoney did not stop there. The tweet says that SmartMoney also bought 110,482 SYN with 150,000 USDC just seconds after Binance’s announcement on February 22. SYN is a synthetic asset that tracks the price of popular cryptocurrencies like Bitcoin and Ethereum. SmartMoney sold SYN for 185,610 USDC after the price went up, making a profit of 35,610 USDC.

This impressive feat highlights the potential profits that can be made by trading cryptocurrencies, but it also raises some concerns about the fairness of the system. Some might argue that traders like SmartMoney have an unfair advantage over regular traders who don’t have the same level of access or knowledge. However, it is important to note that cryptocurrency trading is inherently risky and profits are not guaranteed. SmartMoney’s success can be attributed to some luck as well as skill and experience.

USDC transfer done

On-chain data shows Voyager’s assets were in motion during the company’s bankruptcy filing. According to the transaction records, approximately $154.4 million in USDC was transferred from Coinbase this month to the ‘Voyager 1’ Ethereum wallet of the shut down exchange.

The sale was noted by web3 analytics firm Arkham Intelligence, confirming in a tweet that Voyager is selling assets at a rate of ‘approximately $100 million per week’. He added that the company has “$700 million in two very large wallets.” According to Arkham, Voyager wallets contain $268 million in ETH, $236 million in USDC and another $77 million in SHIB.

Transfers may be in accordance with court rulings, as regulators contested a renewed bid by Binance.US to buy Voyager and said last week that Voyager’s plans to sell the cryptocurrency may violate securities laws.

Voyager was previously allowed to liquidate cryptocurrency from customer accounts with negative USD balances and sweep cash held on third-party exchanges by a court order dated August 5, 2022.