Wall Street research firm Bernstein warns in its research report published today that we may see a decline in this altcoin project despite major updates scheduled for the end of March.

Bernstein says altcoin investors are concerned about “oversupply”

The research firm said in its report on Wednesday that the Ethereum (ETH) price may act “with caution” until the Shanghai rise, as the market worries about an oversupply. Bernstein’s analysis shows that supply increases will likely spread over several weeks or even months, creating little selling pressure on a daily basis. The firm sees limited impact on ETH supply, but noted that weak sentiment from “stake unlocking” could put pressure on ETH price before raising.

On the positive side, many analysts expect the release of staked ETHs to incentivize more people to stake pools. This can give investors confidence in staking. The Shanghai upgrade is expected to go live in March and the ETH price managed to hold above $1,600 ahead of time.

“The availability and wide adoption of stable existing pooled staking tokens invalidates the claim that there was a significant increase in staking immediately after the Shanghai upgrade,” Bernstein analysts Gautam Chhugani and Manas Agrawal wrote. “The Shanghai upgrade may attract some additional staking from institutional investors (who do not want to stake through liquid staking platforms),” they added.

Bernstein said that “steady-state staking penetration” for Ethereum will gradually increase, and the Shanghai upgrade is a step in that direction. With the Shanghai upgrade, stakers and validators (validators) will be able to withdraw staked ETH from the Beacon Chain. Many of these investors started staking ETH at $600. By the end of March, around 16 million staked ETH will be available for withdrawal.

Liquid staking TVL becomes second largest among DeFi services

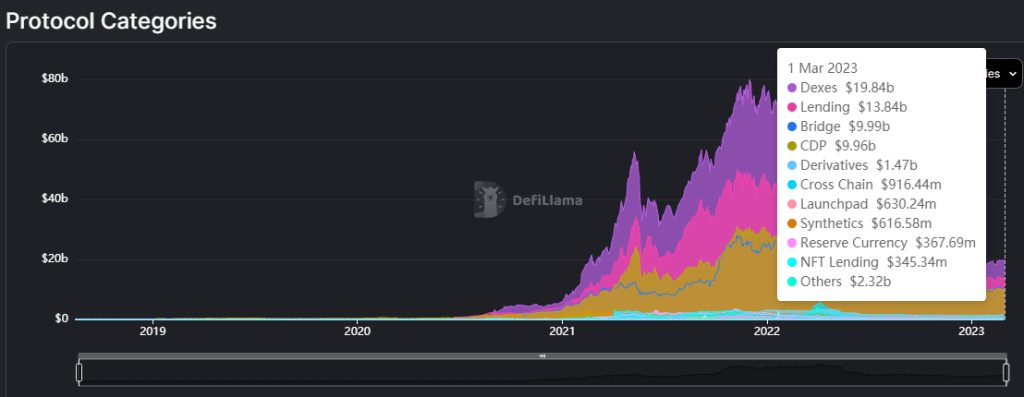

According to DefiLlama data, the surge in February makes liquid staking the second largest service among DeFi protocols. DEX protocols are at the top of the list with $19.7 billion. Liquid staking protocols allow users to receive derivative tokens such as staked ETH (sETH) on a 1:1 basis. These tokens allow users to lock their funds to earn returns.

cryptocoin.com In this article, we have included what you need to know about the Ethereum Shanghai upgrade planned for the end of March. Prior to the upgrade, Ethereum staking pools Lido Finance (LFO) and Rocket Pool (RPL) saw some recovery. The biggest concern with the Shanghai upgrade is that ETHs locked in the Beacon Chain will lead to selling pressure as withdrawals will become active.