The cryptocurrency market showed some signs of recovery in early 2023, but is now in trouble again. cryptocoin.comWe have compiled the consulting giant’s crypto recommendations for you.

Cryptocurrency market is in a difficult period

The cryptocurrency market showed some signs of recovery in early 2023, but is now in trouble again. Just as we think the FTX crash may be over, another crisis is shaking the crypto world. Silvergate Capital delayed submitting its annual report and warned it could face financial difficulties. This can start another long-running regression, or you can see it as another chapter of the FTX saga.

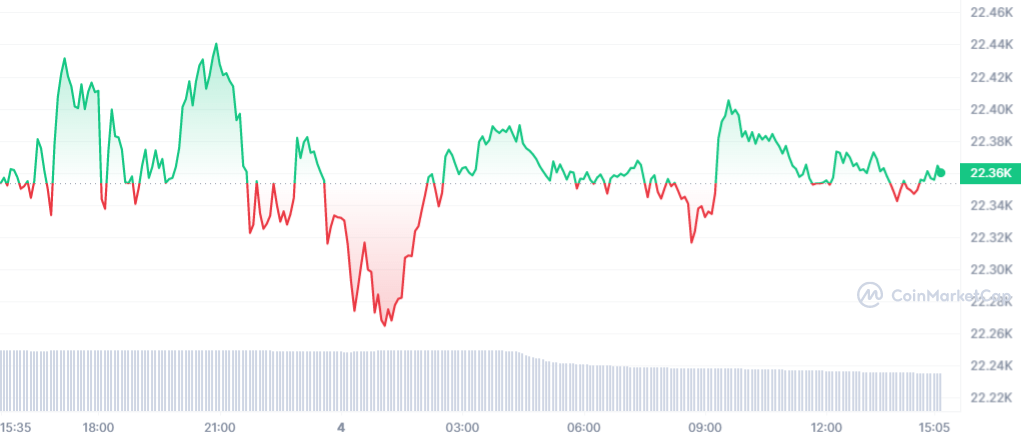

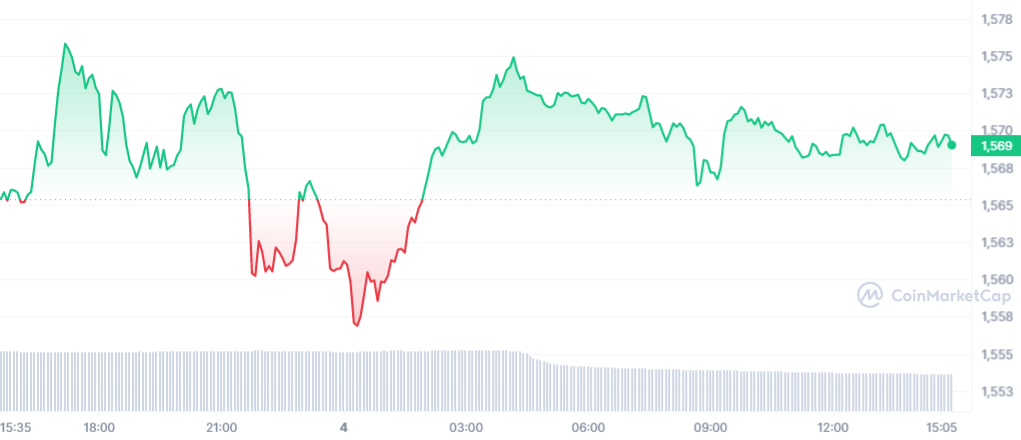

So the crypto rally that started in January is taking a break again. Bitcoin (BTC) prices are down 10% in two weeks and Ethereum (ETH) has lost 8% in the same period. Moreover, floating meme coins are making even bigger cuts. Dogecoin is down 14% and Shiba Inu is down 17% in the same two-week period.

In this unpredictable market, many investors are wondering if crypto will return to solid long-term growth.

Reshaping financial systems

The core premise of investing in crypto, according to the company, is simple: Cryptocurrencies are poised to reshape and disrupt the way money is earned, stored and transferred. Many financial functions that require banks and other intermediaries today will be migrated to decentralized systems in the relatively near future.

A lot will change when automated blockchain networks and smart contracts replace brokers and intermediaries who want a stake in every transaction. Transactions will be faster and cheaper. Risk assessments will be based on artificial intelligence and machine learning. From banking and insurance to online gaming and gambling, many trillion-dollar industries stand on the threshold of a new era.

Forward steps

The promise of tremendous improvement also signals radical change, and change can be frightening. It’s not surprising to see the old guard of financial institutions go after them to protect the world they know today and the business they run. In other words, sea change will take years and every step forward is a war.

Some of the world’s largest and most powerful companies and governments are struggling. But even they cannot stop the relentless march of progress. Better financial systems are coming, whether people like it or not.

Even the biggest cryptocurrency bulls should agree that the painful challenges along the way also have a serious positive side. Every emerging technical flaw, fraudulent business practice, and unstable financial platform could trigger a crypto industry crisis, but it also draws attention to the problem and a long-term solution.

The final policy is stronger thanks to these challenges. The same will be true of the regulatory system for owning, trading and creating cryptocurrencies.

Falls of cryptos

Bitcoin and Ethereum have been around for over a decade, but their histories as serious financial instruments are much shorter. These are still the early days of the blockchain-based business era, and there are likely to be many more scandals and crises ahead.

It should be noted that the latest crisis is not the end of the crypto world and the next one will be no different. For every permanent winner, there are dozens of instant flashes, bad ideas, and maybe even outright scams in the pan. Instead, the consulting giant think it’s time to double down on the tried-and-true giants of the field.

Bitcoin is the closest asset to digital gold, with an inflation-proof mining mechanism and a grizzled security model. Ethereum, on the other hand, has a solid platform for developing next-generation financial instruments and applications, defined as Bitcoin’s gold versus silver. Also, according to the company, Polkadot (DOT), the official blockchain network of the Web3 project, seems to be another key component of this big shift.

According to the company’s statement, these are the three cryptocurrencies it wants to buy when the crypto market experiences another sudden drop. While talking about Bitcoin, Ethereum and Polkadot, the company finally states that it did not skip Shiba Inu and Dogecoin.