Bitcoin, Ethereum, and USDT are some of the first coins that come to mind, but investor interest has shifted to this altcoin.

Investors are interested in these altcoins instead of Bitcoin, ETH

Bitcoin, Ethereum and USDT are some of the first coins that come to mind. This is because they are highly valued in terms of market value. However, cryptocurrencies can be ranked by other parameters such as earned value, lost value, most visited coins, and other factors.

Among the altcoins that investors are interested in, BLUR ranks first on the list, while Optimism (OP) ranks second after BLUR. GMX took third place, while Stacks and ssv network took fourth and fifth places on the list, respectively.

These 5 altcoins that investors are interested in

Blur

Blur is an Ethereum-based NFT marketplace for professional traders, launched in October 2022. BLUR, a management token, was introduced in an attempt to decentralize and give control to its community. Also, its user-friendly interface and features such as ‘floor-sweeping’ across multiple markets, quick ‘revealing’ and portfolio analytics tools have won the hearts of the masses.

Since February 3 (before BLUR was launched), Blur has provided more royalties to creators than any other marketplace. However, net royalty income is the highest in 3 months.

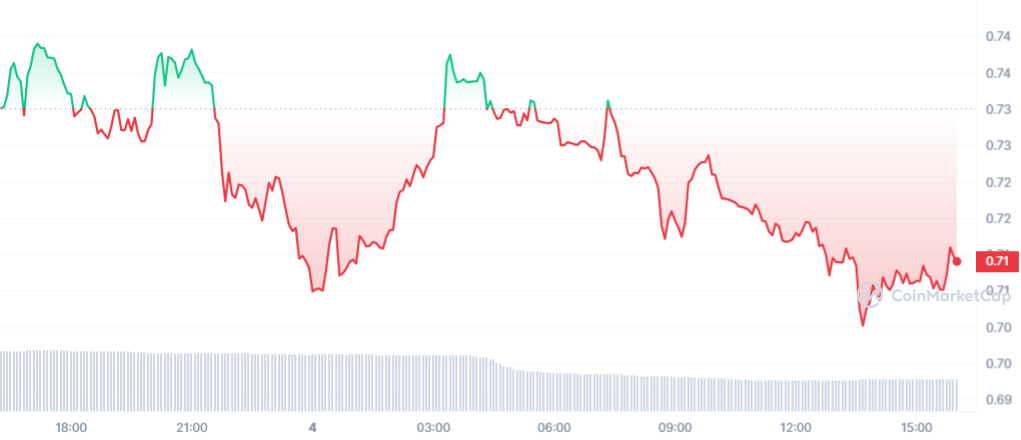

The BLUR token is trading at $0.70 and is down 3% in the last 24 hours. Also, the token ranks 127th with a live market cap of $282,035,825. The highest price paid for Blur (BLUR) was $5.02 recorded on Feb. 14 and hit an all-time low of $0.489540 on the same day. Blur expects to distribute over 300 million BLURs to the community in Season 2.

Optimism

Optimism (OP) is a second layer blockchain above Ethereum. It ranks 63rd with a live market capitalization of $773,200,344. These aggregations are so named because they aggregate all transactions and package them into a single transaction for execution at Layer 1.

Therefore, Optimism’s Layer 2 blockchain inherits all the security features of Ethereum. The company said it estimates that over the past two years, Optimism Mainnet has saved users a cumulative $2.69 billion in fees. In terms of time, it saved 15.8 years of waiting for transaction confirmations and now secures $2.8 billion in on-chain value.

Also, Optimism has an optimistic future in which they hope to promote Superchain. Superchain needs to have the scalability of parallel chains and the buildability of a single blockchain on an open-source stack that prioritizes decentralization, governance and security.

GMX

GMX is a decentralized, permanent exchange that trades top cryptocurrencies. Also, the exchange has two tokens: GMX and GLP. GMX is the utility and governance token and accrues 30% of the fees generated by the platform, while GLP, a liquidity provider token, accrues 70% of the fees generated by the platform.

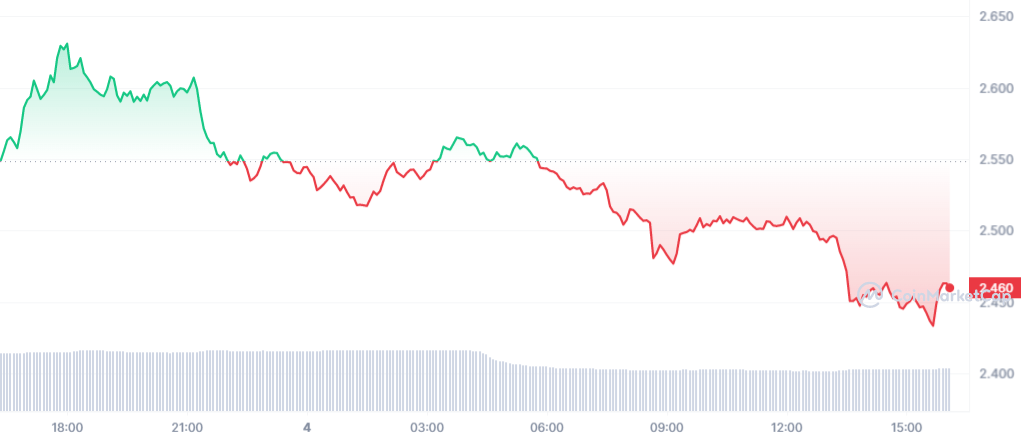

cryptocoin.com According to data, the price of GMX is trading at $68.32. Considering the token’s performance over the past week, GMX has struggled with losses. Despite the valiant efforts of the bulls to reach the opening market price, GMX has not been able to move up. Currently, GMX is down 0.59% in the last 24 hours and is ranked 78th with a market capitalization of $581,187,895.

Interestingly, Santiments’ on-chain data showed that wallets with 100K to 1M GMX have purchased 10 million tokens worth around $20 million since the collapse of FTX.

stacks

Stacks is a BTC layer for smart contracts that enables decentralized applications to safely use BTC as an asset. Moreover, the platform can be used to settle transactions on the Bitcoin blockchain and also allows building powerful applications secured by Bitcoin. Additionally, the “Clarity” language used in the development of smart contracts is designed to prevent exploits and bugs.

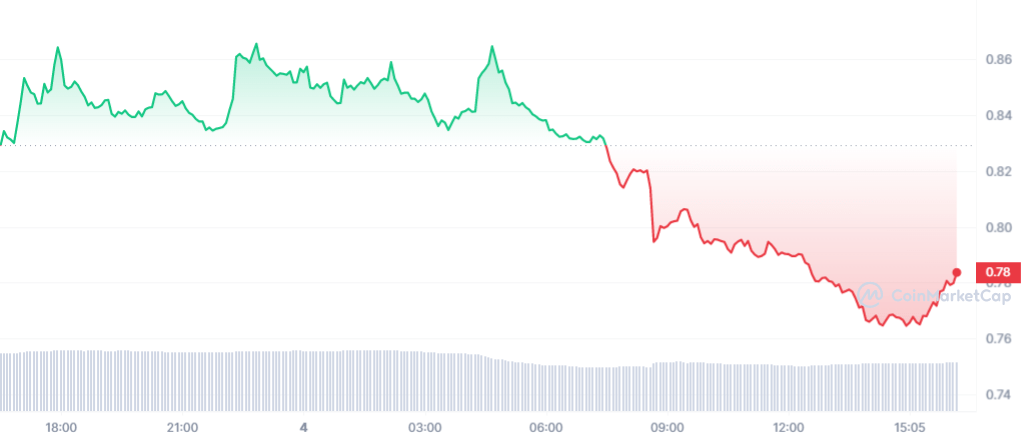

Looking at the price, STX has been corrected after a false start to the week. The token is valued at the opening market price of $0.77. For the first two days of the week, the token was in the red zone but recovered well towards the end of the week. As of now, STX is trading at $0.77 and is down 5.52% in the last 24 hours. The token ranks 46th with a market cap of $1,063,556,533.

SSV Network

SSV is defined as a decentralized staking infrastructure for building high-performance, secure and decentralized Ethereum. In addition to being one of the top performing cryptocurrencies this week with its rise, SSV has managed to become one of the top trending crypto winners.

As SSV continues to build and leave its mark on the crypto world, it recently shared its updates for the new year on Wednesday. One of the updates mentioned that the ssv network Grants ecosystem has expanded with six new grants approved for execution. SSV is trading at $38.98, down 11% in the last 24 hours.

Additionally, the ssv network has launched a $50M ecosystem fund to support Ethereum PoS decentralization. The network also promised to continue to expand and focus more on being community-driven. They focus on improving the structure and flow of decision making within the DAO.