According to crypto analyst Filip L, a comeback for LUNA seems unlikely, with its shattered image and loss of investor confidence. The analyst states that the BTC price could slide further down as the bearish elements outweigh the bulls. According to the analyst, Solana price has bears in the driver’s seat of SOL as the downtrend has not bottomed yet. We have prepared Filip L’s analysis of LUNA, BTC and SOL with his own narration for our readers.

“LUNA will be forgotten soon”

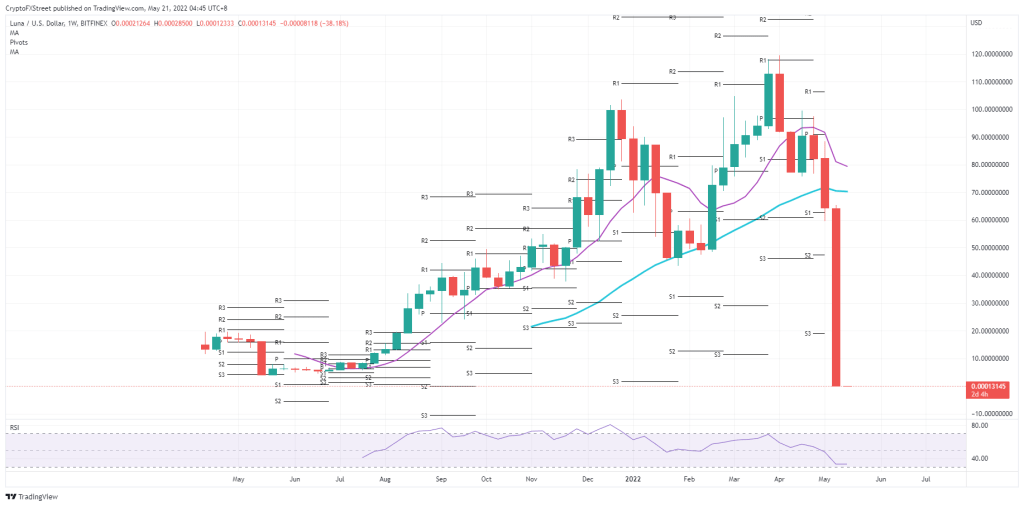

Terra (LUNA) price has turned into a cryptocurrency zombie, as you can see from the news of Cryptokoin.com . The price action shows no heartbeat or vital signs after the sharp drop in the spread from its subsidiary and stablecoin UST.

After the peg between Terra and the US dollar broke, the LUNA price fell below even a penny stock’s value. In several conversations, no comments or details were given about what assets the company holds and buys to reach real value. This puts the entire $180 billion altcoin industry at risk as they are not regulated and therefore not backed by any central bank.

With its short presence in the sub-space, LUNA will likely contribute to the fact that a number of regulations have been implemented to help cryptocurrencies survive the woes and movements in global markets.

“BTC price at top of downside slide before reversal”

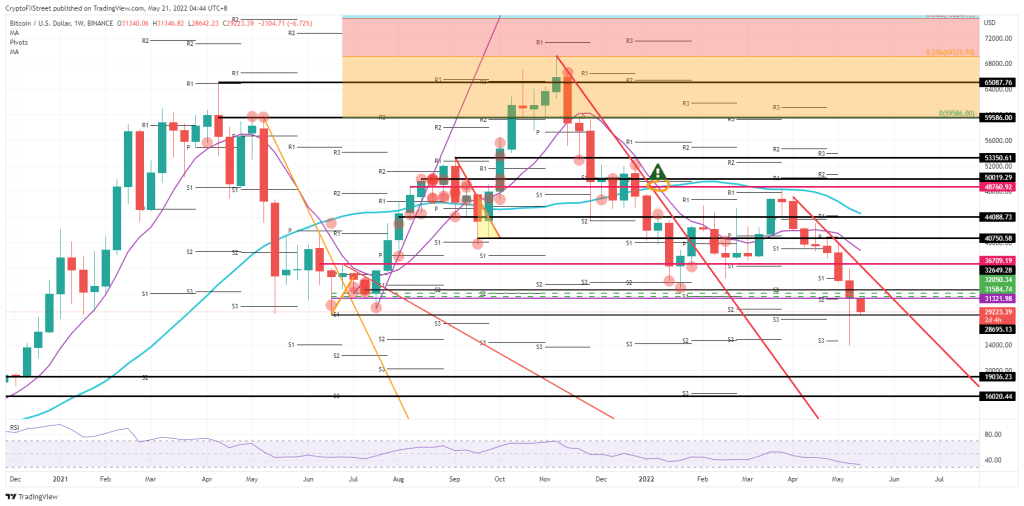

Bitcoin (BTC) price is down as a definitive rejection emerged at $31,321.98 at the opening of the trading week at the apex of the directional shift. With the distribution zone just above it and the breakout below, Bitcoin price is set to lose more value as bears are in the driver’s seat. But a comeback is always possible and certainly at lower levels. BTC price could slide into a defined zone between $19,036 and $16,020 as a fresh distribution area for the bulls.

Bitcoin price is under various pressures as the price drops every week. As in the global markets, it is not only important macroeconomic and geopolitical problems that affect the price movement, but there is also the image problem as well as the pressure for the ESG. The large carbon footprint from the energy consumption of mining creates a systemic issue for the price of Bitcoin in the long run as to when mining will be sustainable and used as the main cryptocurrency.

Therefore, the BTC price has many elements against itself, which only means more downside is coming. At some point the price will have reached the fair value point where the bulls will want to join. Looking at the charts, a region between $16,020 and $19,036 can be identified from the end of 2020. This is an ideal distribution level for the bulls to take over from the bears. By then, Bitcoin investors may have come up with a greener solution for me to remove the negative image that has plagued investor sentiment in cryptocurrency.

An earlier return is of course always possible, as investors can choose over a variety of geopolitical themes where a single cap could easily trigger a steep rise that breaks these downward pressures. A reversal means a weekly close above $30,000, preferably above $32,650, which could open the way for a retracement to $36,709. From then on, $40,000 comes into play again as the silver lining to the upside at $40,750.58, which means a 40% reversal.

“Solana may lose 2/3 of its value”

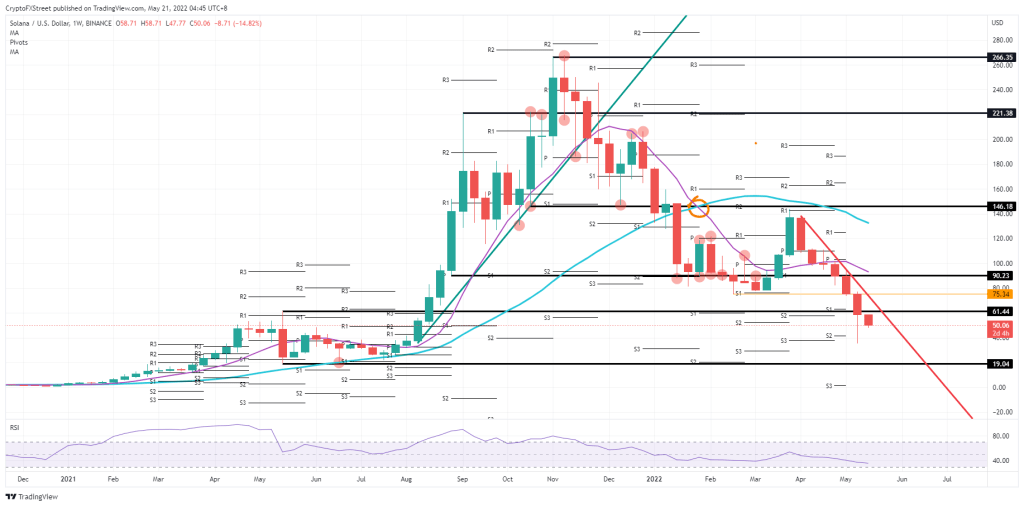

There is no news that a bull run is underway for Solana (SOL). Each rally throughout the week has been just a dip on a hot plate as the bears quickly paired and broke below the previous trading day’s low. With such a bearish sentiment, the bulls will edge further and wait to enter a better level with $19 marked as a reversal signal.

Solana price is holding below a critical level of $61.44 on the weekly chart that extends to May 2021. The overall tone is still very bearish, with the 55-day Simple Moving Average (SMA) trading below 200 (death cross). So there won’t be any comeback anytime soon. Although this downtrend has entered its seventh bearish week, the Relative Strength Index is still not oversold, but is starting to level out a bit.

SOL price may therefore witness a rebound in the coming weeks. But as indicated by the RSI, further declines are still possible. It could still lose 70% of its value as the price drops from $61.44 to $19.04. This last level could be the long-awaited bottom that could set Solana price for a recovery and climb above $61.44 before surging to $90.23 and facing a double top just above a historically important level with the 55-day SMA.

The US dollar may not make it to that point and may find a bullish spot next week as the DXY index is set to close the week weaker than before as the DXY index drops. If the Eurodollar slumps further above $1.06, we can probably expect SOL price to squeeze and move higher against this $61.44. A break above the red descending trendline could trigger a faster rally and move from $90 to $100.