The cryptocurrency market is making headlines due to several financial crises and the SEC’s scrutiny from space with unpredictable fluctuations. It looks like next week will not be an exception as the market will continue to be volatile ahead of major macro events. Meanwhile, BTC price is keeping traders and analysts in the dark as the fundamentals of the Bitcoin (BTC) network are heading towards all-time highs.

Bitcoin (BTC) and altcoin investors will follow these events

All eyes on Jerome Powell as macro signals return

The macroeconomic scene is starting to heat up in the coming days, after a cold week, with two rounds of testimony from Federal Reserve chief Jerome Powell. A classic source of market volatility, Powell’s remarks to the US Congressional Financial Services Committee could change the general mood (at least for a short time), depending on his language about future economic policy.

It’s still two weeks away from the next decision on interest rates and the next benchmark Fed rate hike. “In Powell’s statement, I expect Bitcoin volatility to increase towards the middle of next week,” trader and analyst Crypto Santa wrote in part of his Twitter posts over the weekend. Popular analytics account Tedtalksmacro also cites nonfarm payroll data and a statement and press conference from the Bank of Japan towards the end of the week as critical points.

Key events for the week ahead 👇

Tuesday – RBA statement/presser + Powell testifies to the Senate Banking Committee.

Wednesday – ECB's Lagarde + Fed's Powell speak

Friday – Bank of Japan statement/presser

Friday – US NFP employment data— tedtalksmacro (@tedtalksmacro) March 5, 2023

Liquidity decisions by central banks outside the US are increasingly seen as a significant influence on the BTC and altcoin markets. “US dollar liquidity is increasing so far in March (~+100 billion inflows),” adds Tedtalksmacro.

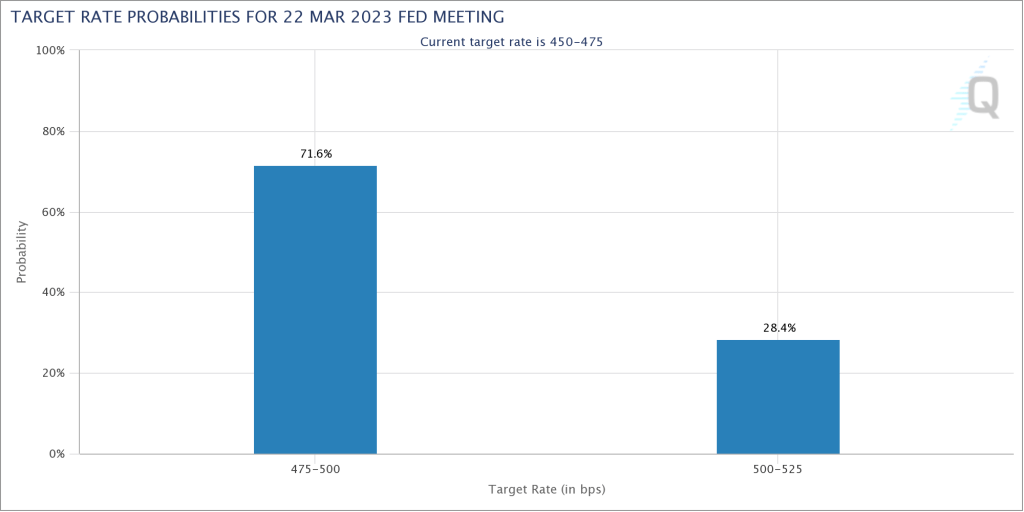

According to CME Group’s FedWatch Tool, the probability of the Fed’s rate hike in March to reach 50 basis points compared to the previous 25 basis points was 28.6% as of March 6.

Fed target rate probability chart / Source: CME Group

Fed target rate probability chart / Source: CME GroupFoundations set for more all-time highs

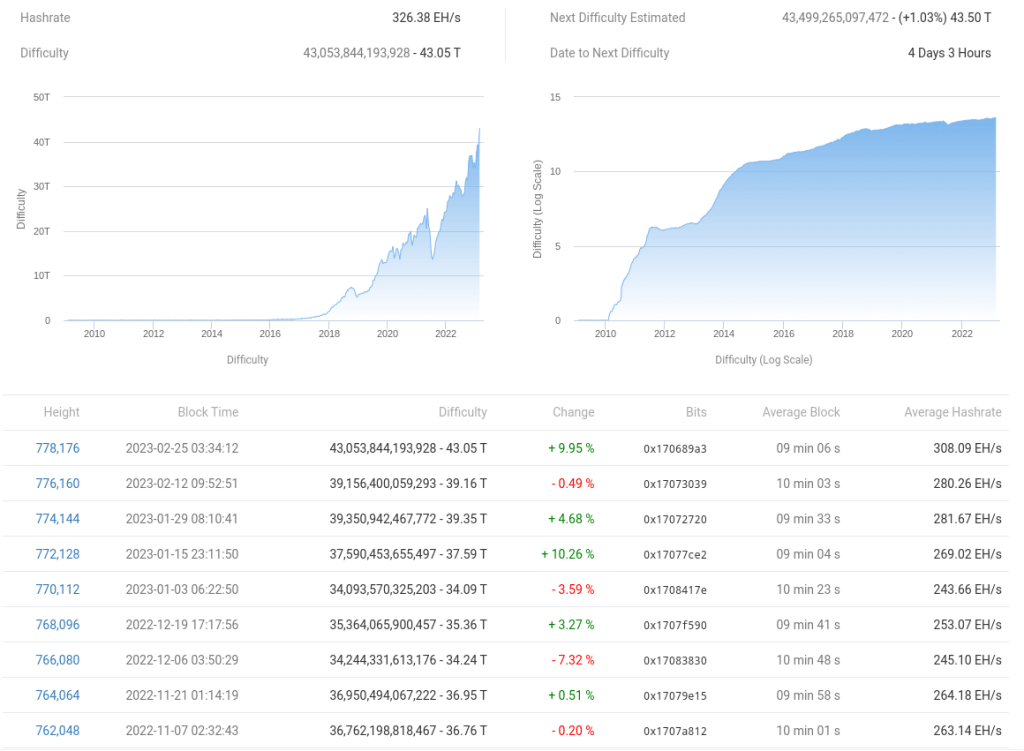

Another adjustment comes in Bitcoin difficulty and will hit an all-time high. The latest data from BTC.com confirms that later this week, difficulty will increase by 1% to hit new record levels of 43.5 trillion.

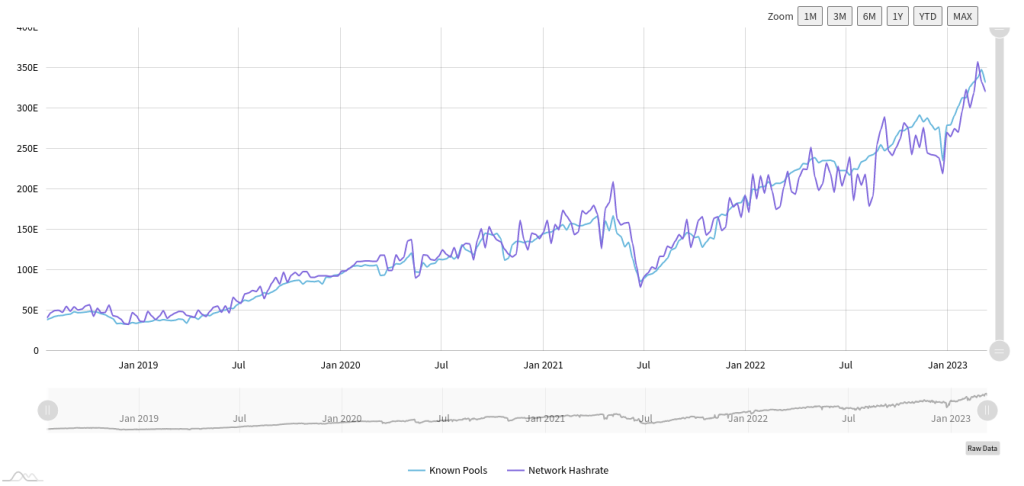

This is not a feat that comes at a time when the BTC price has been consolidating for several weeks and miner profit margins continue to be weak. However, the hash rate shows that the commitment of mining participants is also in a solid uptrend. Raw data estimates from MiningPoolStats show the hash rate at 320 exahash per second as of March 6.

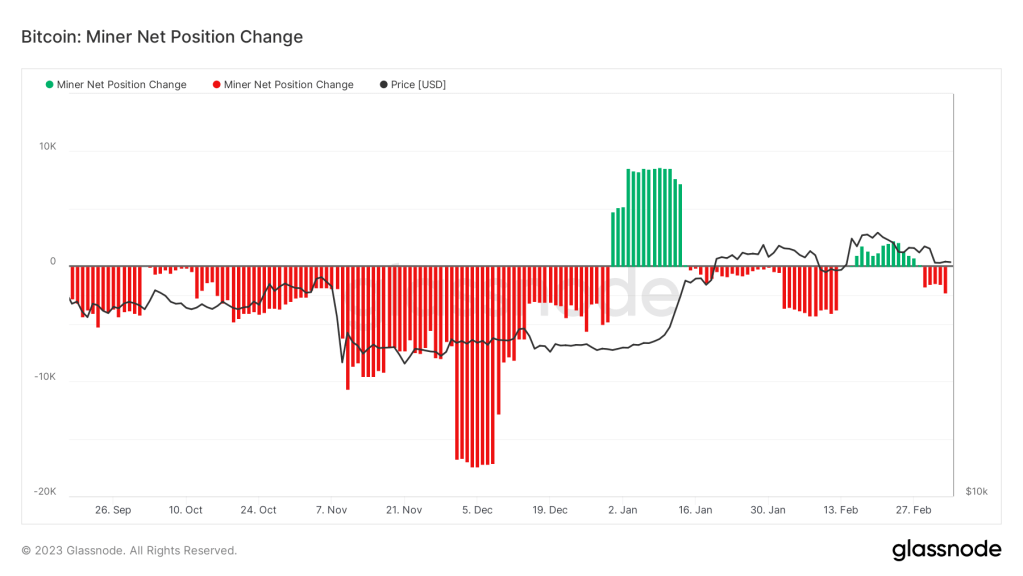

Meanwhile, on-chain analytics firm Glassnode has shared profitability statistics for BTC miners, which has improved markedly compared to the second half of 2022.

As #Bitcoin hashrate pushes to new ATHs, we can estimate the number of operational ASIC rigs required to generate that hashpower.

Using three latest generation Antminer rigs, we estimate a fleet of

– 🟢5.5M S17s

– 🟡2.8M S19 Pros

– 🔴1.2M S19 XP Hydhttps://t.co/O2EU4gZTCe pic.twitter.com/EQabTeA7mS— glassnode (@glassnode) March 5, 2023

Additional data show that miners have yet to start a solid accumulation trend at current prices, despite an increase of 40% compared to the beginning of the year. On a 30-day basis, miners’ BTC balances were lower in March.

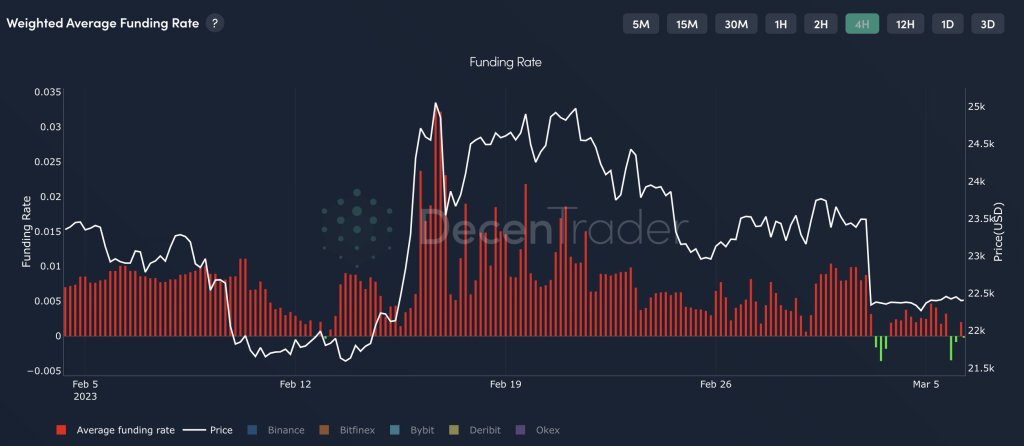

Funding rates cause optimism

In the derivatives markets, analysts are observing a possible recurrence of the conditions that drove BTC to February highs above $25,000. This is mainly thanks to funding rates that have dropped negatively twice since last week’s 5% BTC price drop. Trading package DecenTrader announced on March 6 that “BTC Financing Rate is currently performing similar to Ethereum. It turned negative several times after the nuclear bomb a few days ago. Prior to that, Funding Rates were last negative before rising to $25,000 on Feb. 12,” he says.

Bitcoin weighted average funding rate chart / Source: DecenTrader / Twitter

Bitcoin weighted average funding rate chart / Source: DecenTrader / TwitterMeanwhile, DecenTrader adds that the ratio of longs to shorts remains ‘stubborn’, with two longs per short ‘typically higher than normal for Bitcoin’.

Bitcoin long/short rate chart / Source: DecenTrader / Twitter

Bitcoin long/short rate chart / Source: DecenTrader / TwitterSentiment index hits 6-week low

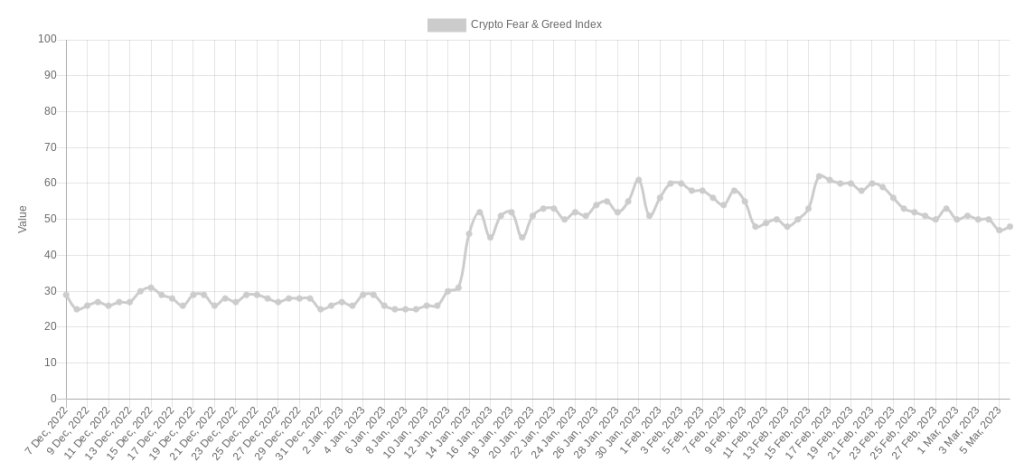

With a more pronounced reversal than price action indicates, the crypto market sentiment is more and more beating any bullish trail this month. According to the Crypto Fear and Greed Index, the mood on the ground is now ‘neutral’, while the return of ‘fear’ is getting closer and closer. The index hit 47/100, its lowest level since mid-January over the weekend.

Studies even question the extent of the cryptocurrency’s newly discovered cold feet, arguing that the market’s reaction to the Silvergate event was disproportionate. “Traders are more confused when it comes to shorting or missing markets right now,” says research firm Santiment, which published the findings. Santiment adds that, given the funding rates outlined above, sentiment may not necessarily be an accurate reflection of market strength. “While perpetual contract funding rates on exchanges don’t have to match that sentiment, something weird can happen with an exaggerated amount of negative reviews,” the report states.

Crypto Fear and Greed Index / Source: Alternative.me

Crypto Fear and Greed Index / Source: Alternative.meSilvergate being shored

Short sellers are lining up to buy a piece from crypto bank Silvergate, and notable Marc Cohodes predicts the bank will be destroyed within a week. Therefore, it could be another messy week for crypto banking. cryptocoin.com As you follow, Silvergate has recently been hit by its ties to FTX and Alameda Research. The institution shut down one of its top money transfer platforms, the Silvergate Exchange Network, on Friday, shortly after Moody’s downgraded its long-term issuer rating. What’s more, shares are down nearly 95% in the last six months. According to Bloomberg, crypto companies are considering where to go with Swiss banks looking like potentially good options for some.

Binance.US, Voyager and SEC

Securities and Exchange Commission staff said at the Voyager Digital bankruptcy hearing on Friday evening, as reported by Stephanie Murray, an attorney believed Binance.US operates an unregistered securities exchange in the United States. The comments come as the SEC ramps up crypto enforcement activity, including agreeing with crypto exchange Kraken on its staking service and proposing stricter rules for crypto custodians. It could be another week of narrative debate by heavyweight crypto businesses trying to navigate these choppy regulatory waters. Voyager’s trial will also continue Monday in the US Bankruptcy Court for the Southern District of New York, extending to a third day.

PMI data

The Purchasing Managers Index (PMI) data is an important economic indicator that can provide valuable insight into the health of various industries, including the cryptocurrency market. S&P Global Asia Sector PMI and S&P Global Dubai PMI will be released on March 6 and 9, respectively. PMI data can provide a graph of the health of the cryptocurrency market, including institutional adoption, level of innovation and development, and regulatory uncertainty. All in all, positive data will significantly increase the market’s bullish potential next week.

US Federal Reserve meeting

Although the Fed meeting will be held on March 22, the recent release of the US Federal Reserve’s meeting minutes on February 1 may put bearish pressure on the market as more rate hikes are on the horizon. This could pose a significant challenge for the cryptocurrency market in the medium term. A further increase in interest rate in March will create a pullback for the crypto market and BTC could drop below the $19,000 level, forcing several assets to drop significantly.