Switzerland-based investment firm Republic has decided to switch to an altcoin project it sees as ‘more reliable’ after concerns caused by the FTX bankruptcy. The investment firm plans to buy altcoins worth $3 million.

His firm, Republic, has entered into a new deal involving the purchase of million-dollar altcoins.

Related altcoin project Astra Protocol announced today that it has signed an agreement with investment platform Republic, which includes the acquisition of 10 million ASTRA. With ASTRA trading at $0.3164 at the time of writing, Republic’s acquisition equates to an average of $3 million. The Swiss-based investment firm includes detailed explanations including the concerns caused by FTX as the reason for the investment.

🤯Investment Firm Republic Purchases 10M $ASTRA in New Deal. The tokens will be locked for compliance usage.

💪 @CoinDesk writes, this development will remarkably strengthen & advance the growth of #Astra’s compliance capabilities by Republic.

Read more: https://t.co/vqWBTv3De3 pic.twitter.com/HvTCHqfdoo

— Astra Protocol (@AstraProtocol) March 7, 2023

How ASTRA Protocol (ASTRA) price reacted to the news

Meanwhile, ASTRA Protocol (ASTRA), a low-volume altcoin, is up around 3% after the announcement. Ranked 2,638 by market cap, the altcoin has been keeping its gains over 10% since March 6th. ASTRA is trading between $0.2865 and $0.3189 levels today. Accompanied by the recent gains, it has brought the price gap with the ATH level to 35%.

10 million altcoin purchase deal builds on FTX concerns

Regulatory scrutiny on cryptocurrency has increased since the collapse of FTX, which allegedly suffered a liquidity crisis due to bad actors rather than the failure of technology. The scandal has increased the need to focus on decentralized finance (DeFi) projects, as well as avoid potential regulation that might resemble traditional finance (TradFi).

“The events of the past year made it clear that legitimate crypto and DeFi projects with a long-term strategy can no longer operate outside the confines of TradFi regulatory frameworks,” said Andrew Durgee, president of Republic Crypto. “Astra Protocol brings together the best of both worlds for individual users and allows everyone to continue enjoying the benefits of Web3 without compromising their privacy, security or anonymity.”

Press Release pic.twitter.com/rgxq3QSBqm

— FTX (@FTX_Official) November 11, 2022

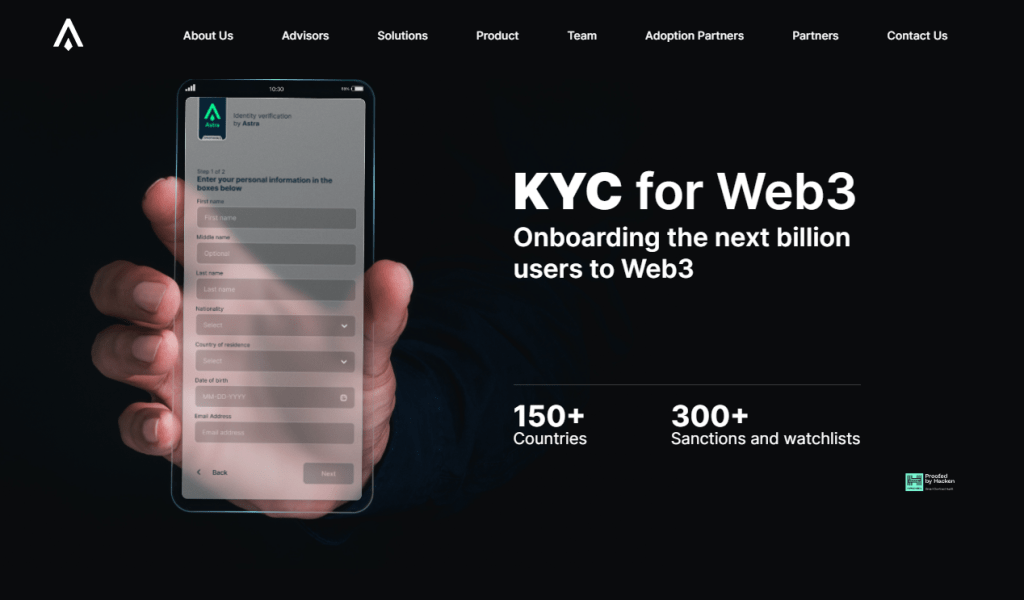

Astra Chief Technology Officer Sakhib Waseem detailed the deal, explaining that “Republic will use approximately $3 million worth of ASTRA tokens as “credit” for Astra’s compliance platform for KYC and Know Your Business (KYB) services. The protocol uses tokenization to sort incoming transactions for faster throughput, even with high volume requests.

About Astra Protocol

Astra’s platform, which also offers anti-money laundering services (AML), enforces financial regulatory standards and more than 300 sanctions and watchlists from more than 160 countries, without compromising user anonymity.

The altcoin project made headlines with its stacked advisory board that included former Samsung Corporate President and Chief Strategy Officer Young Sohn, former White House acting Chief of Staff Mick Mulvaney, former Homeland Security Secretary Kirstjen Nielsen, and former European Trade Commissioner Phil Hogan.

“Because of the lack of regulatory compliance and its open-source nature, people have looked at [crypto] as a kind of shady financial tool,” said Waseem, Chief Technology Officer. Astra brings more legitimacy to many platforms because it shows that builders don’t work on shady mechanisms. They take advantage of incredibly fast and incredibly innovative technology, but they do it right.” cryptocoin.comreaders We have featured Astra’s February Sandbox partnership in this article.