Now that finance has gone global, the debate over which investment generates the most significant return continues to rage. Investors around the world grapple with the question: Bitcoin or Gold, Real Estate or Stocks? Finance expert Jay Speakman explores the historical performance and future potential of each investment type, starting with Bitcoin.

Let’s look at Bitcoin (BTC) first

Many investors see Bitcoin as a revolutionary investment, some even calling it ‘digital gold’. While it has been volatile over the years, Bitcoin has seen tremendous growth since its inception in 2009. cryptocoin.com As you follow, BTC value rose to an all-time high of around $65,000 in April 2021. However, it has since dropped more than 70% from its ATH. This raises questions about its future potential.

Despite the recent decline, investors such as MicroStrategy’s Michael Saylor continue to be extremely bullish on Bitcoin. Saylor argues that BTC is the best investment because of its scarcity and utility. Not everyone was convinced, however, and Saylor came under criticism for investing most of his company’s money in Bitcoin.

Let’s take a look at the real gold

For centuries, gold has been a reliable investment rewarded for its value and stability. It has stood the test of time and remains a popular investment option for those seeking a safe haven in uncertain times. Gold has grown significantly over the years, with its value increasing nearly fivefold over the past two decades.

However, not everyone was convinced. Gold bugs like Peter Schiff ignore Bitcoin as a speculative asset, arguing that gold is the only real safe-haven investment. Meanwhile, others like Michael Saylor and Max Keizer believe that Bitcoin will eventually replace gold as a safe-haven investment due to its limited supply and superior technological capabilities.

Another investment instrument: Real Estate

Real estate has long been a popular investment option. Many investors see it as a way to generate passive income and build wealth over time. While it has had its ups and downs over the years, real estate has been a reliable investment. Historically, the value of real estate has been increasing steadily over time. However, real estate can be risky as it depends on economic conditions and local market comparisons. The recent pandemic has highlighted the risks of investing in real estate as many commercial properties face significant challenges due to the transition to remote working.

Finally, we look at stocks

Stocks have been a viable investment for many, with the potential for significant growth and returns over time. With the rise of technology, investing in stocks has become more accessible to individual investors, with many platforms offering commission-free trading. Although stocks have shown significant growth over the years, they can be quite volatile with sudden market crashes causing significant losses for investors. Also, not all stocks are created equal, as some companies experience significant growth while others struggle to stay afloat.

Over the years, there has been a growing interest in the relationship between Bitcoin and traditional investments such as the stock market. Some investors see Bitcoin as an alternative asset, while others see it as a complement to their existing investment portfolios. Let’s take a closer look at how Bitcoin performs on average against the stock market, specifically the S&P 500 and NASDAQ.

Bitcoin and Stocks

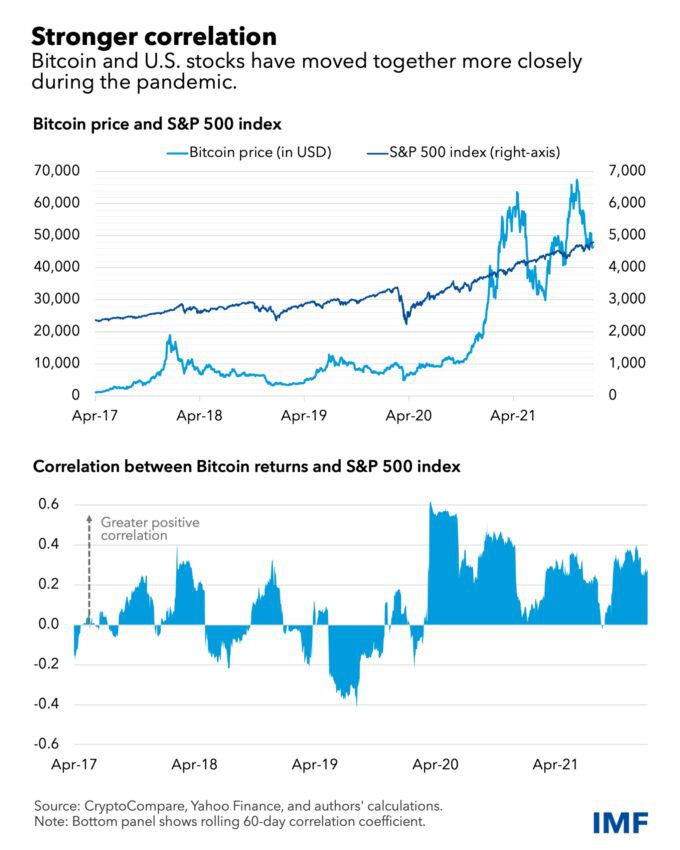

Historically, Bitcoin has nothing to do with the stock market. However, in recent years, there has been an increasing correlation between Bitcoin and the stock market, especially during times of economic uncertainty. And yes, we are now in uncertain times. When the stock market suffers significant losses, investors may turn to alternative assets like Bitcoin to hedge against inflation and market volatility. This was evident during the Covid-19 pandemic, where Bitcoin saw significant growth while the stock market experienced significant drops.

Bitcoin and the S&P 500

Representing the top 500 publicly traded companies in the US, the S&P 500 is considered one of the most accurate measures of stock market performance. Historically, Bitcoin and the S&P 500 have not been correlated, but in recent years there has been an increasing correlation between the two.

Bitcoin and S&P 500 / Source: IMF (International Monetary Fund)

Bitcoin and S&P 500 / Source: IMF (International Monetary Fund)Bitcoin and NASDAQ

NASDAQ is an index that tracks the performance of more than 3,000 technology companies, including the world’s most important technology giants such as Apple, Amazon and Google. Historically, Bitcoin is more associated with the NASDAQ than the S&P 500. In a similar study, Bloomberg showed that the tie between Bitcoin and the NASDAQ was 0.51 last year, with a moderately positive correlation between the two. This is likely due to Bitcoin’s status as a largely technology-based digital asset and its growing adoption by tech companies.

What is the best investment?

— Michael Saylor⚡️ (@saylor) March 8, 2023

Diversify the portfolio

While traditional investments such as Bitcoin and the stock market have historically been unrelated, there has been an increasing correlation between the two in recent years. While still relatively low, it highlights the importance of diversifying your investment portfolio to include alternative assets like Bitcoin. Investors considering investing in Bitcoin should consider the risks and potential rewards of this young asset class. And of course they shouldn’t forget the growing correlation with the stock market.

Ultimately, the best investment is the one that fits your financial goals and investment strategy. Whether you choose Bitcoin, Gold, Real Estate or Stocks, the keys to success are staying informed, being patient and investing for the long term.