Crypto traders endured some $307 million of liquidations in the past 24 hours, data from Coinglass shows, as crypto markets tanked Thursday on news about crypto-friendly bank Silvergate Capital (SI) winding down operations.

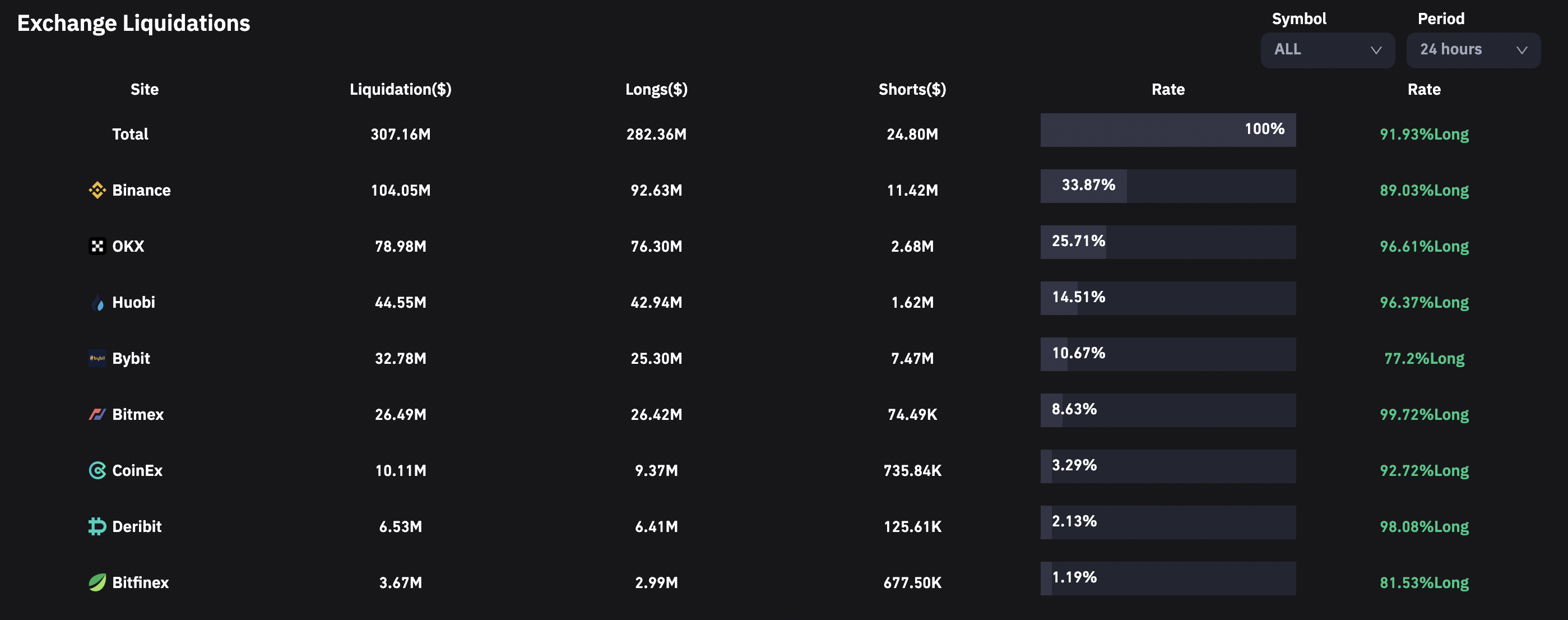

Traders on Binance, the world’s largest crypto exchange by trading volume, saw $104 million of losses, the most among exchanges, followed by $79 million of losses on OKX and $45 million on Huobi, per Coinglass.

Bitcoin (BTC) traders suffered the most losses, some $112 million, while ether (ETH) liquidations surpassed $73 million.

Of the liquidated trading positions in the past 24 hours, some $282 million were longs, betting on higher prices. This is larger than the highest daily long liquidation of this year, recording $254 million on Feb. 8, according to Coinglass.

Binance and OKX saw the most liquidations, as the recent nosedive in crypto prices caught traders off-guard. (Coinglass)

Soaring long liquidations suggest that cryptocurrency prices’ sudden nosedive caught investors off-guard. BTC, the largest cryptocurrency by market capitalization, has plummeted more than 6% in the past 24 hours, and earlier in the day, reached its lowest level in seven weeks at around $20,050. Popular altcoins dogecoin (DOGE) and tron (TRX) have led the price decline.

Crypto markets enjoyed one their strongest starts year in their 14-year history, recovering some losses from the collapse of crypto exchange FTX. BTC rallied above $25,000 in February at one point after starting the year at about $16,600.

The recent decline has come as concerns mounted about the stability of Silvergate Bank, a key banking partner for digital asset companies. After suffering huge losses and dwindling deposits, the bank announced Wednesday evening that it will “voluntarily liquidate” its assets and shut down operations.