According to crypto analyst Filip L, Dogecoin (DOGE) price is under pressure due to both tail risks and bearish technical factors such as headwinds. While Cardano price closes the week with another loss, the analyst states that the ADA price slips into more disadvantageous positions as investors move away from cryptocurrencies. We have prepared Filip L’s DOGE and ADA analysis for our readers.

“Dogecoin (DOGE) may become 50% off”

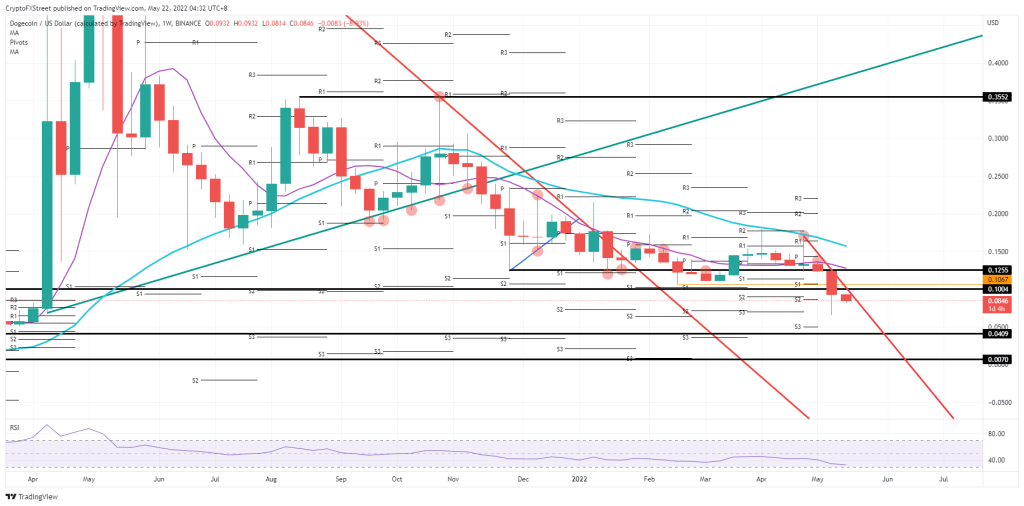

Dogecoin (DOGE) price will get another leg next week after consolidating below $0.10 It is on the cusp of saying goodbye to $0.10 as it is set to fall further. As there is not even a test for the upside on the cards, it indicates that there are no bulls and capital inflows to squeeze the price action higher. The lack of nearby supportive arms is a risk indicator as the first nearby support level is at $0.040. This means a 50% depreciation is required before there are enough bulls to push the price up.

Dogecoin price risks losing more than 50% if new capital is not transferred quickly. As the bear trend continues, the most important risk comes from the sideways Relative Strength Index (RSI). As this RSI is not falling, a long stretch could occur and pull DOGE price down further and longer term. By doing this, the interest of investors will decrease even more. Therefore, Dogecoin price will never see the light of day above $0.10 again.

Besides the DOGE price, there is an issue with a few tight arches at the top. At first, the historical baseline is $0.1004, while the simple 55-day Moving Average is $0.1255 and is falling parallel to a historical axis. As seen three and four weeks ago respectively, both are showing their strength and rejection to the upside.

The last element for Dogecoin price is that price action has turned into a big bag of tail risks and geopolitical tensions with regulatory pressures in hindsight. This scares traders and capital flows, drying up buyer-side demand, and giving sellers room to lose 50% of value, pushing price action further down towards $0.0409.

While plenty of highs have been spotted above, all this could easily topple if markets can get into calm water. Suppose the equity markets could start to rally on economic data for several days in a row and support in other asset classes. In this case, cryptocurrencies could see a recapitalization as investors deposit money to raise prices. Many of the previously mentioned caps can break, undermine or slice, potentially hitting $0.18 upwards.

“ADA price is at risk of turning into a penny trade”

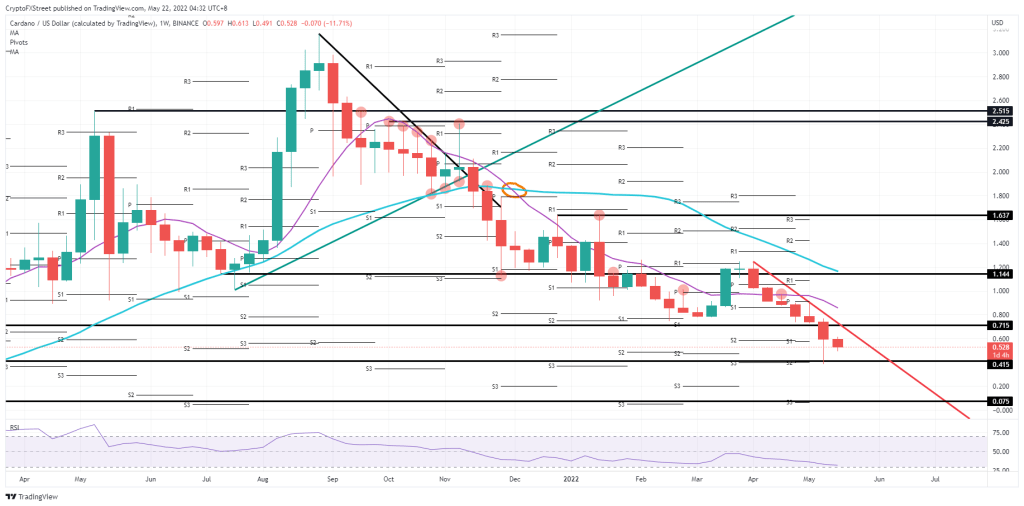

As you can follow from cryptokoin.com news, Cardano price is drifting into the turmoil of cryptocurrencies that have lost their status. It began to be seen as unreliable and overexposed to the volatility of financial markets. In the aftermath of the Terra LUNA massacre, the image of cryptocurrencies was severely damaged, and individual investors and traders realized that there could be significant losses if things got really bad. Cardano price is poised to enter a new round of bitter trading, with the risk of falling to $0.415 last week’s low in the back of their minds and then an 85% drop to $0.075 after that level.

ADA price is at critical risk of closing the week with another loss on their trade books. With the seventh consecutive week of losses, it looks like there’s no comeback anytime soon. There are no key support levels or elements that the bulls can rely on for an entry and a reversal. It would be foolish to enter here as the stop and stop losses within the trade management would be too obvious for a compression.

Instead, ADA price seems set for at least a downside test towards $0.415, which caught the falling blade the previous week. It coincides with last month’s S3 and May’s S2, making it a fascinating area for a possible power transfer from bears to bulls as the Relative Strength Index approaches this low before it goes oversold. However, it could be that a technical breakout triggers a fire sell in ADA price, reducing the price action to $0.075, battering the cryptocurrency with losses of over 85%.

The spark of the reversal could come from some broad and robust risks in the markets as these heavy tail risks fade. For example, the Ukrainian situation died out a bit in the background as China managed to achieve a soft landing for the economy. These elements could create a slight but longer-term tailwind for Cardano price and other cryptocurrencies once faith and trust are restored. After that, we can expect ADA price to bounce back to $0.715, break above the red descending trendline and rally to $0.900 against the 55-day Simple Moving Average border.