The Bitcoin and altcoin crisis kicked up gear early on Saturday as the failure of Silicon Valley Bank (SVB) caused some of the industry’s core plumbing to spiral out of control. Here are the details…

SVB crisis hit altcoin investors

Hours after regulators shut down the SVB during its cryptocurrency-linked “bank run,” stablecoin prices fluctuated wildly and transaction fees soared as investors struggled to keep the money moving. cryptocoin.com As we reported, SVB became the second crypto-linked bank to go bankrupt this week. Afterwards, Treasury Secretary Janet Yellen brought together top financial regulators to discuss the collapse of the SVB. Shortly after, the crypto markets fell into turmoil, which may indicate that the bear market, which has been going on for over a year, has entered an even darker phase.

There are echoes of the 2008 global financial crisis, with bad news followed by worse news. When it comes to crypto, which doesn’t have a central bank like the US Federal Reserve (FED) that can save the industry, some investors are voicing their concerns. Circle Internet Financial’s USDC stablecoin has drastically deviated from its $1 price, which should have remained stable.

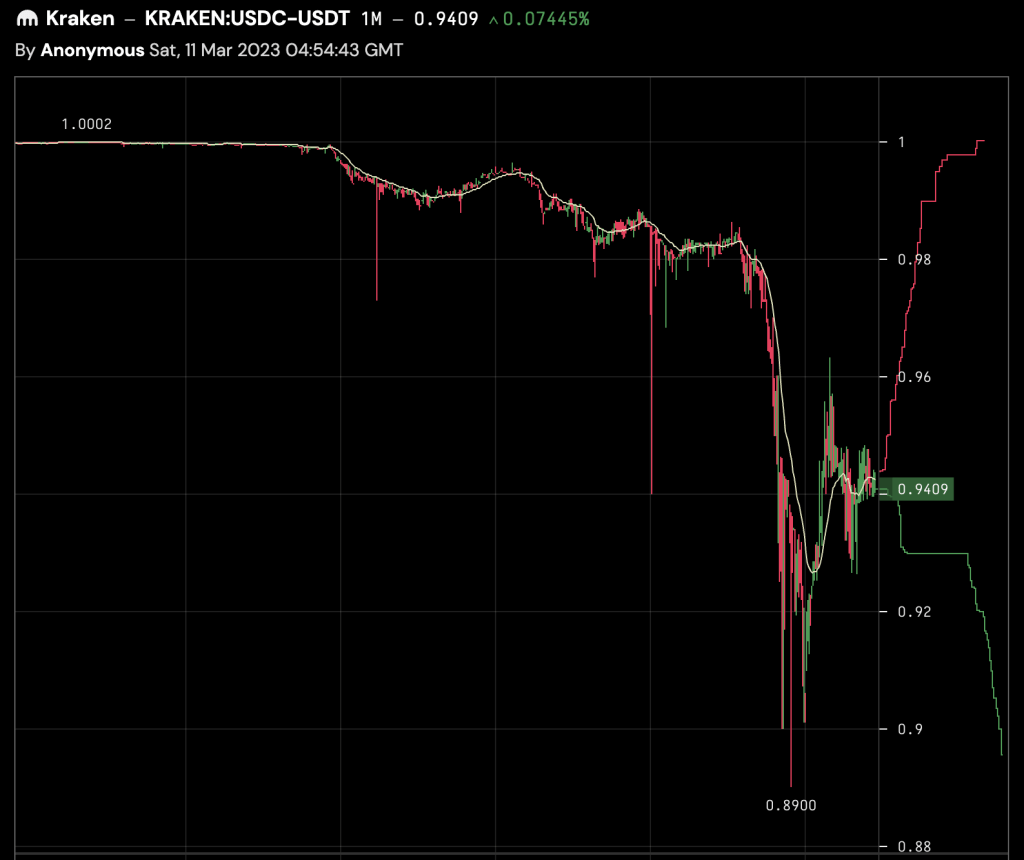

This is a sad development for a product designed for investors to keep money steady. The USDC/USDT pair fell as low as $0.89 on the Kraken exchange on Saturday morning. Thus, in mid-November 2022, Bitcoin and altcoin exchange recorded lower levels than ever since amid the market stress that followed the FTX debacle.

USDC’s market value has dropped

The financial services firm confirmed late Friday that about $3.3 billion in reserves backing the world’s second-largest stablecoin has been tied to the SVB. Stablecoins get their value from these reserves. If this stablecoin is worth more than $43 billion, there must be a $43 billion cash or cash equivalent fixed income instrument held somewhere to support it. USDC’s market cap has now dropped below $40 billion.

$USDT "depegged" to the upside, worth 1.06 $USD and 1.08 $USDC today. $USDC dipped to 0.89 $USD. You have to wonder if the market is losing faith in US-homed financial products.

Board: https://t.co/ndnGPaSwmm pic.twitter.com/Fi6Fh5mSQk

— Jesse Powell (@jespow) March 11, 2023

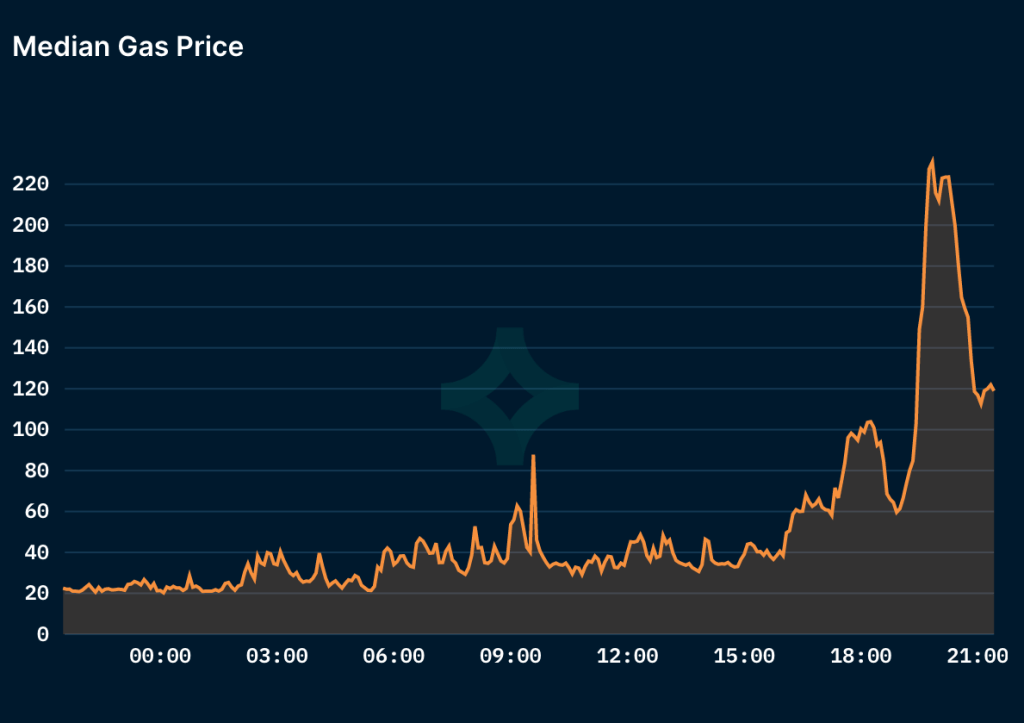

Meanwhile, USDT rose to $1.06 against the US dollar on Kraken at one point. In addition, the price of Bitcoin has also increased. Gas fees, which measure how much it costs to complete a chain transaction, also jumped. According to Nansen.ai, the average gas fee for Ethereum has risen to around 231 gwei, compared to the roughly 20 to 40 range seen earlier Friday.

Crypto was born in the aftermath of the 2008 crisis and, according to some, in response to it. Satoshi Nakamoto’s article on Bitcoin entered a world where governments support the financial system by infusing money. Crypto lacks such a central authority. Meanwhile, Razer CEO Min-Liang Tan tweeted late Friday that Twitter should buy SVB and turn it into a digital bank. In response to this tweet, billionaire Elon Musk said, “I’m open to ideas.”