Crypto analyst Filip L notes that Cronos (CRO) is heading upstream after receiving a definitive rejection on the upside earlier this week. Also, the analyst says that the CRO has received supportive tailwinds from Bitcoin’s rally this Friday. Accordingly, the altcoin is worth watching this week for a breakout move that could yield 90% gains by summer.

It is possible that the altcoin price will see a 90% increase!

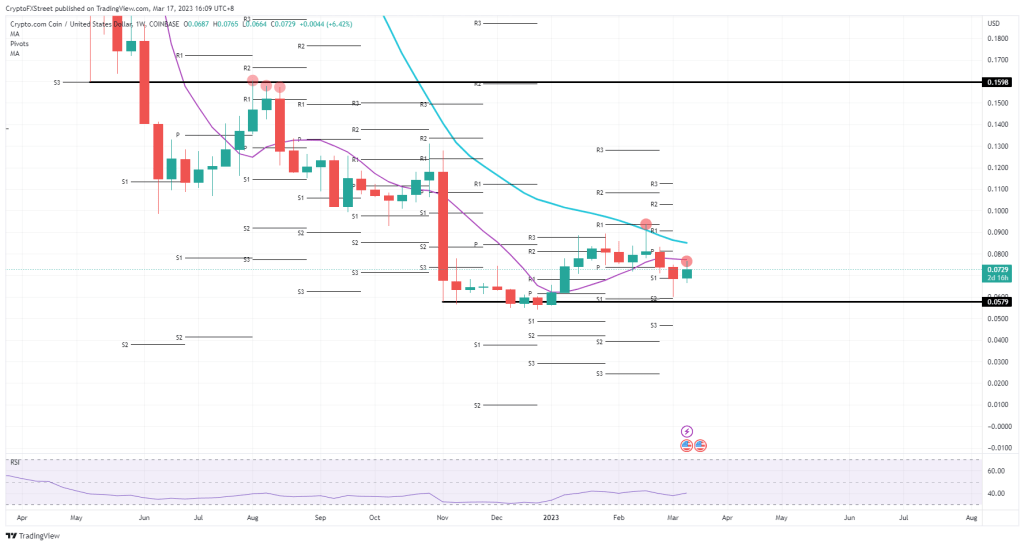

cryptocoin.com As you follow, the Cronos (CRO) price is holding all the cards here this Friday as it pits it against many of its brothers and sisters in the altcoin space. Price action is up over 6% over the week. With the rally in Bitcoin price this Friday, another headwind seems to be moving in favor of the CRO. If the CRO can break the 55-day Simple Moving Average (SMA) upwards, just one more element stands among the bulls and a 90% gain is possible by the summer of this year.

The altcoin price is showing some very bullish signs this Friday before the weekend kicks off as it is up over 6% throughout the week. While it received a definitive rejection earlier in the week, it has become quite clear that the bulls are strongly involved in the price action and tailwinds from Bitcoin price are only adding more fuel to the bullish fever. With market tensions easing over the weekend, it’s possible that the bulls will have a fair opportunity to break the 55-day SMA at $0.0765.

CRO weekly price chart

CRO weekly price chartThere are also headwinds that Cronos will face

The CRO will face the 200-day SMA at $0.0851 next week, which might be a little tricky. Certainly, traders who saw the weekly performance in February, when a false breakout triggered an almost complete drop in all earnings in the same week, are aware of what they are facing. If bitcoin price rises further, this is likely to be enough for the CRO to break above the 200-day SMA and open wide with $0.16 as a profit target in the coming months.

As noted above, there may be a repeat of the events of February. This means that the bulls will face a bearish wave that pushes the 200-day SMA and pushes the price action below the moving average, which could even trigger a full squeeze below the 55-day SMA. This could stop many bulls and lead the price action to drop to $0.0579.