With the rise in the last 24 hours, leading crypto money whales changed their strategies and many of them started selling the leading altcoin project Ethereum (ETH)! So why? Here are the details…

Whales are selling their Ethereum (ETH)! What’s next?

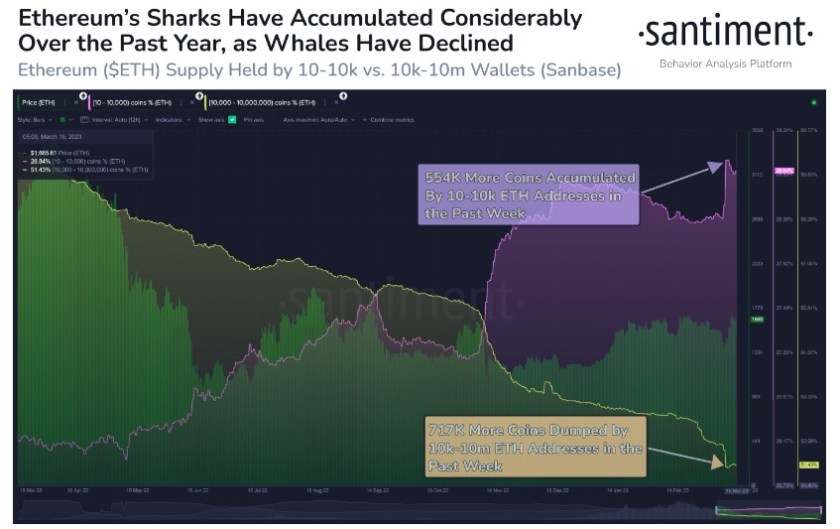

On-Chain analytics firm Santiment recently released data showing that investors in leading altcoin Ethereum (ETH) have behaved differently over the past year depending on the holdings they hold. The data shows that addresses holding 100,000 to 10,000 ETH, known as “sharks”, continue to increase their holdings, while “whales” holding 10,000 to 10 million ETH have experienced significant declines in their holdings after the FTX meltdown in 2022.

Shared data states that sharks bought approximately $6.3 billion of ETH last year, adding 3.61 million ETH to their wallets. On the other hand, whales sold 9.43 million ETH worth $16.4 billion in the same period. According to experts, this indicates a clear divergence in investment strategy between large and small investors in the Ethereum market.

On the other hand, the data indicates that whales are losing their holdings even faster as they actively profit from the rising ETH price since last week. Santiment argues that this change in the distribution of assets has led to a general shift in the distribution of supply in the Ethereum market. Specifically, it is stated that sharks are buying Ethereum from whales, leading to a change in the overall distribution of supply. Despite this change, the report shows that whales still hold more than 51 percent of the total Ethereum supply, while sharks hold less than 29 percent.

Santiment data shows sharks buy whale assets

On the other hand, interestingly, reports state that while Ethereum’s price has been rising since last week, whales’ holdings are declining even faster as they are actively making profits. This trend shows that larger investors are trying to take advantage of the recent rise in Ethereum’s price by selling their holdings.

Santiment, the on-chain analytics firm responsible for providing data for this report, argues that this change in the distribution of assets has led to an overall shift in the distribution of supply in the Ethereum market. Specifically, it is stated that sharks are buying Ethereum from whales, leading to a change in the overall distribution of supply.

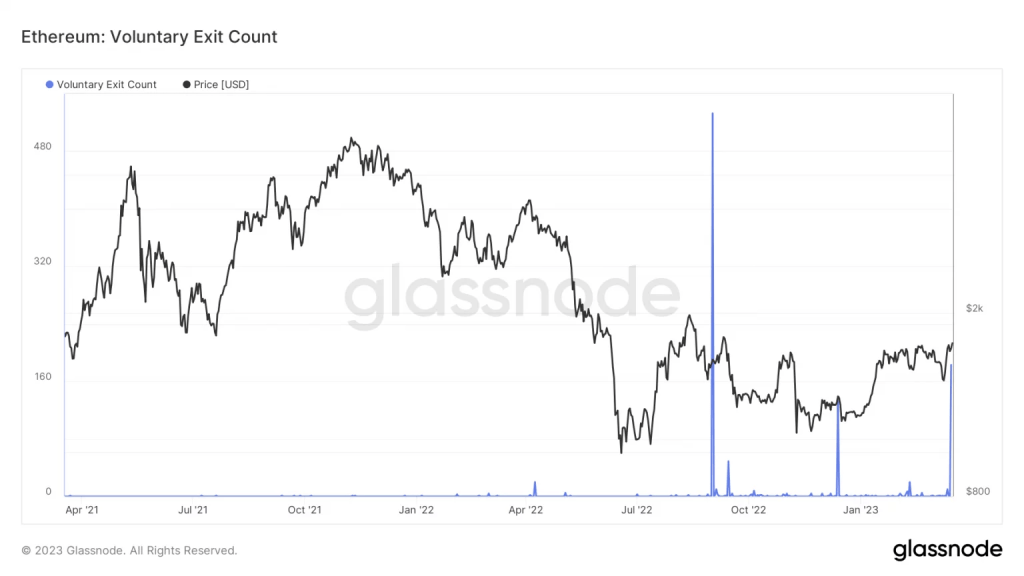

The number of voluntary exits for the leading altcoin Ethereum peaked on March 16

Surprisingly, however, the number of Ethereum voluntary exits exploded on March 16, the second highest since the merger. Voluntary exit count refers to the number of validators who chose to leave the validator pool and stopped participating in the consensus process. While this may seem like a cause for concern, experts say it’s actually a positive sign for the Ethereum network.

When a validator chooses to exit, it goes into the exit queue and no longer recommends or approves blocking. However, ETH shares cannot be repurchased until the Shanghai upgrade is online. Despite this, 183 voluntary exits took place on March 16, the highest number recorded since the merger.

With the increase in voluntary exits, the ETH price also rose, causing it to hit its highest levels this year. As quoted by Kriptokoin.com, ETH is trading at $1,819.75, an increase of 9.2 percent compared to 24 hours ago. This increase in price is believed to be due to increased demand and interest in altcoin Ethereum. Despite the high number of voluntary exits, experts say this is a positive sign for the Ethereum network.

The increase in voluntary exits indicates that the network has become more decentralized and there is more competition among validators. This is a good thing for the network as it makes it more resistant to centralization and ensures that no single entity can control the network. All in all, the increase in voluntary exits on March 16 is a positive sign for the Ethereum network. It indicates that the network has become more decentralized and there is healthy competition among validators. While it may take some time for validators to withdraw ETH shares, the network is poised to become more efficient and secure with upcoming upgrades. Experts say that if the demand for Ethereum increases, we will see more developments and innovations in the world of DeFi.