The cryptocurrency market has witnessed a long-awaited rally. In this rally, the leading crypto Bitcoin attracted attention. Because, with a 35% increase on a weekly basis, Bitcoin’s performance hit the altcoins. In the midst of this rally, analysts are explaining what lies ahead for the Bitcoin price.

Bitcoin price is out of the bull pattern, is the target $35,000?

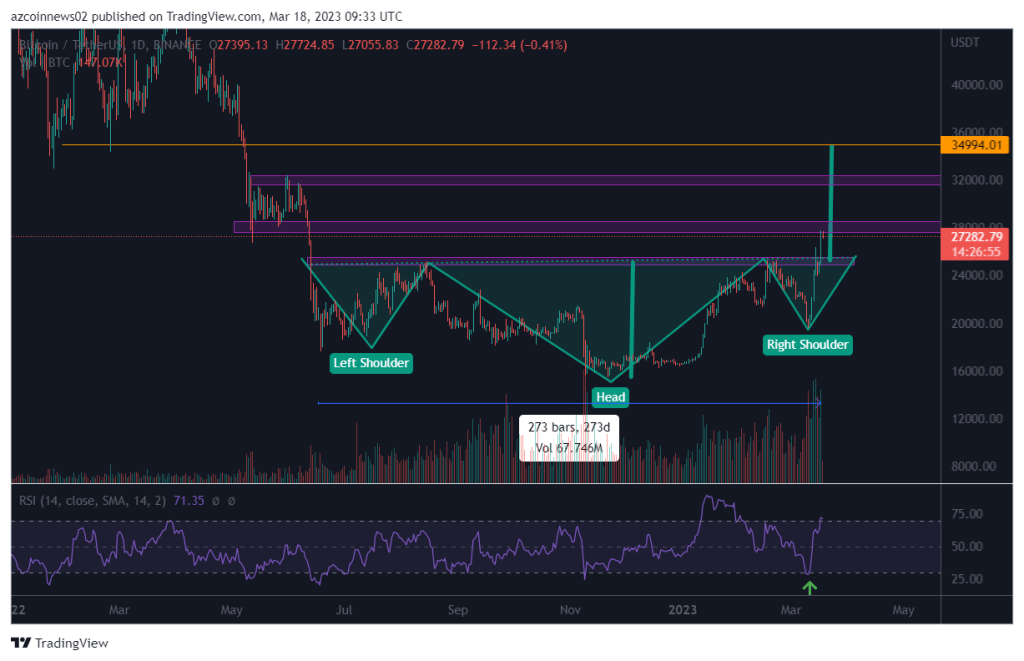

According to crypto analyst David, Bitcoin has confirmed a long-term uptrend and may continue to rise in the near future. The recovery helped the price complete the right shoulder of an inverted head and shoulders pattern. This is a bullish pattern that often leads to an uptrend reversal. Indeed, the price broke out above the pattern with a large bullish candle on March 17, 2023, signaling the continuation of the uptrend. This technical pattern has a target of $35,000 calculated by connecting the height of the pattern to the breakout point.

On the way to this target, there are minor resistance levels at $28,000 and $32,000. However, these levels can be overcome as BTC has just emerged from a more than 9-month pattern. The RSI indicator supports this view as it quickly recovered from oversold to overbought territory, indicating strong buying momentum. Overall, the most likely expectation is for Bitcoin to continue rising to its $35,000 target. However, the price could correct higher in the $25.8K -26.2K range before continuing higher. The uptrend will continue when the price breaks out of $27.7k on March 17.

BTC daily chart / Source: TradingView

BTC daily chart / Source: TradingViewAnalyst warns: Bitcoin volatility explosion may be triggered!

Janitor JJ, an analyst from the Jarvis Lab team, thinks that the $19,700 level that Bitcoin bottomed out last week is a critical indicator for determining the current trend of BTC, as represented by the 200-day MA. “The fact that it has been tested and held can confirm the thesis we shared all year: This is the early stage of a new bull market rally, not the late stages of a bear market rally,” the analyst says.

The analyst believes that in the early stages of a bull market, prices will eventually reach a point where they are overvalued, triggering a chain reaction of ‘long short’ liquidations. This liquidation chain could happen once BTC approaches the $30,000 level. In a future liquidation tier, prices could drop towards key support levels such as the 200-day MA, which will continue to rise as BTC price rises. While bitcoin price is currently above the 200-week MA, for the analyst, this represents a short-term victory. “As if holding this line, there will be no ‘upper’ resistance for BTC for the first time since 2021,” the analyst says.

Bitcoin volatility score explosion / Source: Jarvis Labs

Bitcoin volatility score explosion / Source: Jarvis LabsAs seen in the chart above, Bitcoin’s Volatility Score, represented by the blue line, is breaking out of its 7-month range and recently surpassed the 200-day DMA (red line) at 26.13. This indicates that BTC will likely break out of the $15,000-25,000 range shortly.

Bitcoin historically rallies above 200-day MA / Source: Jarvis Labs

Bitcoin historically rallies above 200-day MA / Source: Jarvis LabsAs the chart above shows, there has been a significant increase in both volatility and price action from late 2020 to early 2021. Bitcoin broke the 200-day MA during this period and rose from $15,500 to $58,000 in just four months. This shows BTC’s potential to unleash significant bullish momentum in the coming months.

Bitcoin price could rise above $50,000 in 2023

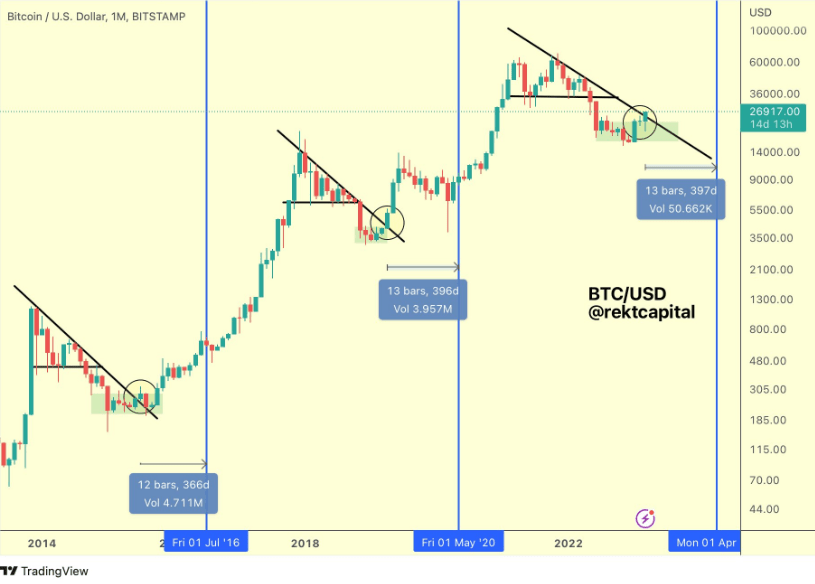

Cryptokoin.com’ As you follow, Bitcoin is approaching the halving that happens every four years. The previous halving took place in 2020, while the next halving is scheduled for 2024. Analysis shows that the coin followed a similar pattern before and after the halving. According to crypto analyst Rekt Capital, the price has reached a critical point where it has experienced a huge spike in previous times.

As the monthly chart below shows, BTC price has been following a similar price action since 2014. After each halving, BTC price loses its uptrend and falls hard to mark the bottom of the cycle. Then, with a notable rebound, the price ignites a massive rally that pushes it higher to form the all-time high (ATH). This pattern occurred after each halving and a similar rise is expected once the price breaks above the trendline.

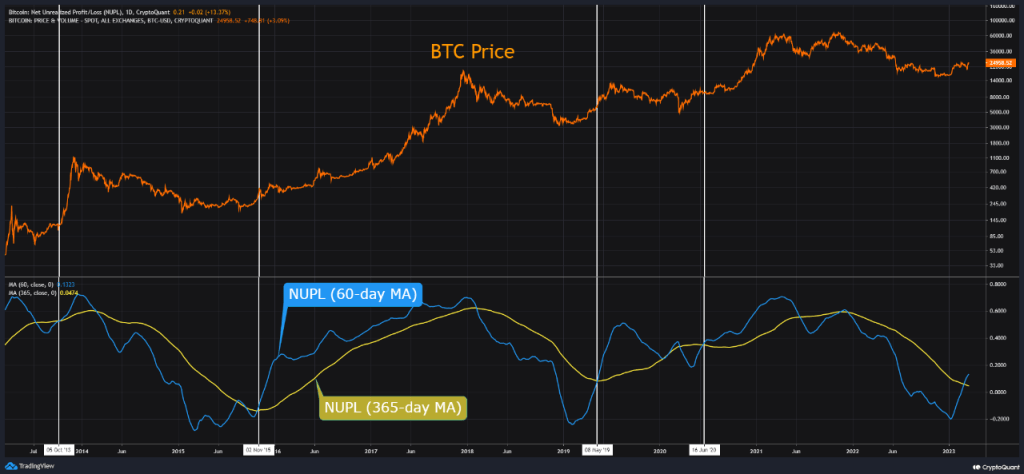

BTC bullish signal: NUPL forms ‘golden cross’

On-chain data shows that Bitcoin Net Unrealized Profit and Loss (NUPL) has formed a bullish ‘golden cross’ for the price. One CryptoQuant analyst points out that this transition pattern has been repeated many times since 2013. Here is a chart showing the trend in the two moving averages (MA) of Bitcoin NUPL: the 60-day and 365-day versions.

It seems these two metrics have been crossing each other lately / Source: CryptoQuant

It seems these two metrics have been crossing each other lately / Source: CryptoQuantBitcoin price could hit $30,000 in a few days

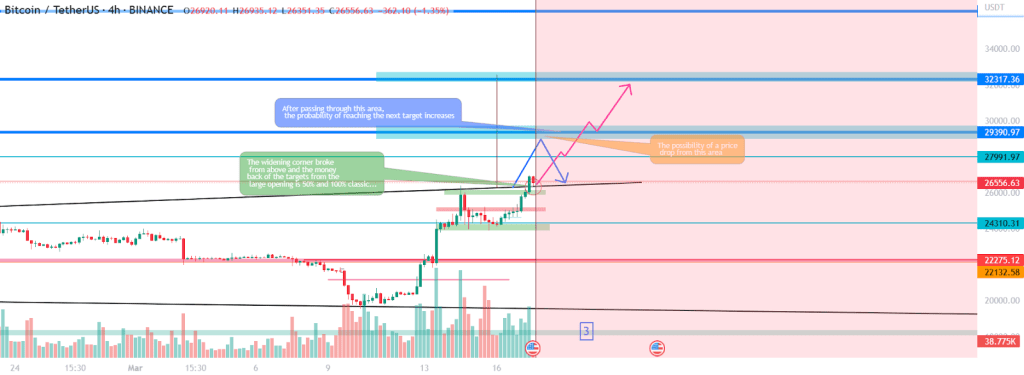

The price of BTC recently broke a nine-month high of $27,000. However, it is currently hovering near $266,000. According to crypto analyst Shayan Chowdhury, in a few days, Bitcoin’s price is on an upward trajectory and could reach the potential resistance level of $30,000. On the 4-hours price chart, Bitcoin is expected to break the $28,000 resistance this weekend and face a slight rejection near $29,000. However, after gaining support around $26,000, BTC price is likely to rise again and form a new high around $32,000.

Will Bitcoin reach $28,000 this weekend?

Retesting $25,000 for the third time since the crypto capitulation in June last year, Bitcoin bulls have had the upper hand in retrieving ATH. According to on-chain analytics firm Glassnode, Bitcoin has now safely surpassed the Adjusted Realized Price of $24.6k. Specifically, the average cost basis variable excludes the enormous profit held by the lost coins. Additionally, Glassnode noted that the Bitcoin market recently found support for the classic Realized Price of $19.8k. As a result, renowned crypto analyst Michael van de Poppe underlines that Bitcoin bulls must continue to move upwards throughout the weekend to avoid a bearish bias.

#Bitcoin continued to hold above $25.9K and is printing a new high, almost.

Needs to continue pushing, and when we do $28-30K is next.

This push needs to happen coming hours, otherwise bearish divergences and potential reversal.

Interesting volatility. pic.twitter.com/uGhHcyBQKq

— Michaël van de Poppe (@CryptoMichNL) March 17, 2023

A similar sentiment is shared by Markus Thielen, head of research and strategy at Matrixport. Thielen states that Bitcoin’s next technical hurdle is $28,000 and makes the following statement:

Bitcoin now has a chance to climb to the next technical level at $28,000. Within larger price swings, BTC rallied, reacted, and retested from the $4,000 gains ($16,000, $20,000, and $24,000). The current breakout is currently targeting $28,000.