BlackRock, the world’s largest asset manager, mentioned several cryptocurrencies in this year’s annual letter to its shareholders.

BlackRock’s annual letter: 3 key takeaways for crypto investors

On March 15, BlackRock CEO Larry Fink released his special annual letter to shareholders. This annual letter from the world’s largest asset manager is particularly worth reading this year, given that it addresses the Silicon Valley Bank crisis and the changing risk landscape for investors worldwide.

Today Larry Fink released his annual Chairman’s Letter to Investors. Read more➡️https://t.co/1Hmo4jvLlO pic.twitter.com/hIAUd5GbNT

— BlackRock (@BlackRock) March 15, 2023

BlackRock, which stood out in the crypto industry with its much-spoken partnership with Coinbase last year, also has something to say about the crypto industry. In a section of the letter titled “Cryptocurrencies,” Larry Fink points to three big takeaways for crypto investors.

Summary of a few key trends in the crypto and blockchain industry

Predictably, Bitcoin (BTC) is currently high on the minds of crypto investors. At a time when the entire banking system was in meltdown, Bitcoin emerged as a potential safe-haven for investors trying to somehow protect their savings.

Therefore, it may come as no surprise that Larry Fink mentions Bitcoin in his annual letter. In fact, if you read between the lines, he seems to think that while there are many exciting developments in the crypto industry, investors are showing a lot of interest in Bitcoin. For example, he draws particular attention to the “media obsession with Bitcoin.”

However, one of the key themes going forward will obviously be the adoption of cryptocurrencies by institutional investors. Bitcoin is a key focus of any new venture for institutional investors as they increase portfolio allocations. Once upon a time, BlackRock was skeptical of Bitcoin, but cryptos seem to have finally proven their worth as an asset class.

Tokenization

Tokenization is an area where Larry Fink and BlackRock mentioned in the letter see a future. Sure, asset tokenization may not be as attractive as Bitcoin to the average crypto investor, but for Wall Street giants, it’s a seismic shift in the way the financial world works.

Asset tokenization refers to the process of converting a real financial asset into a digital asset that can be traded and stored on a Blockchain. For example, you can own tokenized stocks and bonds. According to BlackRock, asset tokenization makes the asset management job much easier.

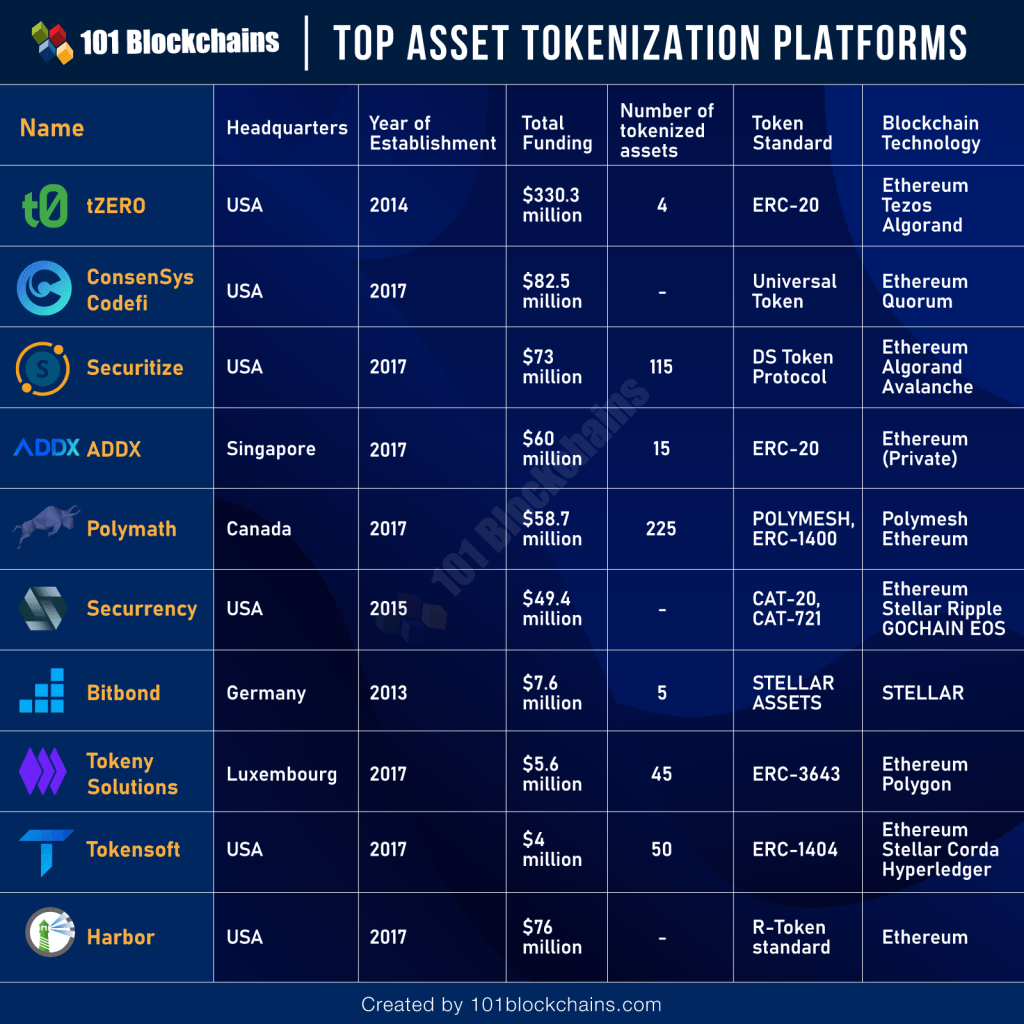

Tokenization can lead to many interesting investment ideas. For example, one of the best asset tokenization platforms in the world right now is tZERO, which is mostly owned by internet retailer Overstock.com. So, investing in Overstock can be an indirect way to access the crypto industry.

Or if you’re looking for direct access to the crypto industry, check out Avalanche, which is at the forefront of tokenizing financial assets. A high-profile success story in 2022 was Avalanche’s tokenization of a $4 billion healthcare fund from private equity giant KKR.

crypto payments

Finally, Fink touches on the issue of crypto payments, which he says is rising worldwide. BlackRock CEO states that the US currently lags behind other nations in adopting crypto as a form of payment for online purchases.

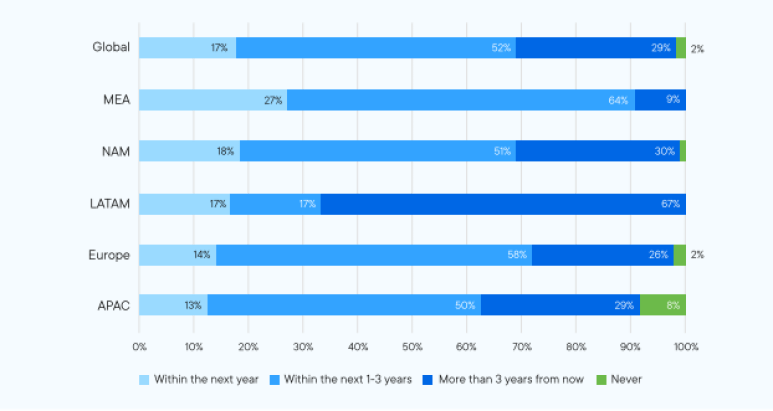

But BlackRock clearly sees a world of opportunity here (especially in India and Brazil). This trend could be big for cryptos like Bitcoin and Litecoin, which can be used for online payments. According to a recent survey, more than 50% of users worldwide will be able to accept crypto payments within the next one to three years, so this is definitely an area to watch if you are pursuing long-term growth opportunities in the market.

Where to invest in 2023?

Fink does not mention any other crypto in his nearly 9,000-word shareholder letter, aside from Bitcoin and FTX. But there are definitely a few exciting ideas for 2023 and a number of interesting investment angles to play with. For example, when it comes to tokenization, projects like Avalanche are at the forefront. The same goes for payments. Companies that provide tools and services for digital payment providers or real cryptos used for these digital payments can be the answer to this question.