Many investors’ eyes are on the FED meeting, which will take place next week. However, leading crypto experts have announced their Bitcoin (BTC) price predictions for the FED interest rate decision, which will be announced on the evening of March 22! So what will the price be? Here are the details…

Investors’ focus turned to the FED interest rate decision: Will the price of Bitcoin be 30 thousand dollars?

The outcome of the March 21-22 FOMC meeting will address the dual issue of controlling and reducing inflation while preventing a larger banking crisis that could harm other sectors in the country. The target rate measurements for the upcoming meeting show that the probability of a 25 basis point increase is 63 percent. However, if interest rates increase, Bitcoin price could rise above the $30,000 level. On the subject, Bitcoin investor @tedtalksmacro tweeted, “If we see a 25 basis points + pigeon Fed next week, I wouldn’t be surprised if Bitcoin trade is over 30,000.” in his words.

If we see 25bps + a dovish Fed next week, I’d not be surprised to see #Bitcoin trade above 30k. pic.twitter.com/X0AHJUsTqq

— tedtalksmacro (@tedtalksmacro) March 18, 2023

However, experts also point out that BTC may see some correction ahead of the meeting, given the BTC price trend at the previous FOMC meetings.

Experts point to metrics for Bitcoin price

As Cryptokoin.com reported, the world of cryptocurrencies is constantly in volatility due to different market trends. Leading crypto experts are turning to metrics because of these volatility and price changes. Finally, the data reveals that Short-Bitcoin investors are poised to sell, as evidenced by the increase in the Exchange Reserve metric. The Currency Reserve is an aggregate measure of potential cryptocurrencies available for sale in the market. It is calculated according to Exchange In/Outflow and Netflow, which naturally follows the indicators of the input/output. If the net flow trend is increasing, this indicates selling pressure, while a decreasing trend indicates buying pressure.

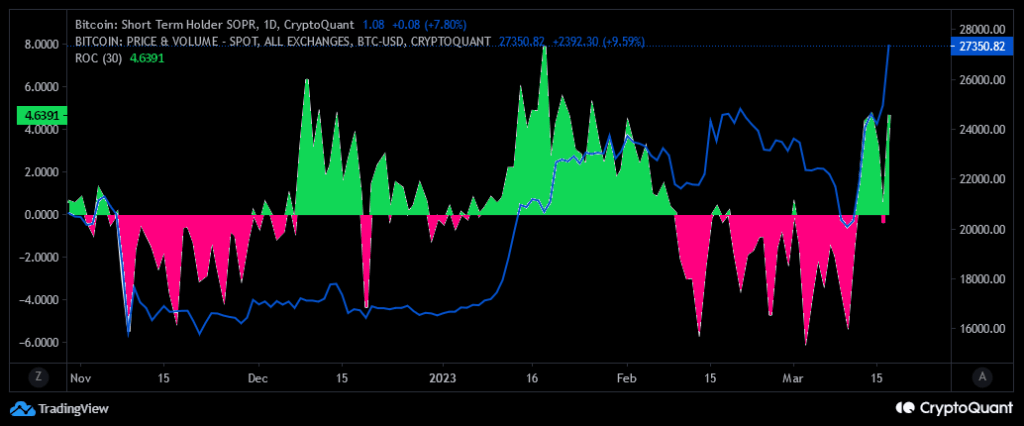

The Short Term Output Profit Ratio (STH-SOPR), which measures the ratio of spent output to profit, also shows that short-term investors dominate the market. The indicator is calculated by dividing the value spent in short buy/sell by USD. If the value is above 1, it means that investors are selling their BTC profitably. Conversely, if the value is below 1, it indicates that investors are selling their BTC at a loss.

According to experts, the STH-SOPR indicator touched 1.05 levels on March 14 and momentarily shows that investors dominate the market. The FOMC meeting, the results of which will be announced on March 22, comes with many other factors and may drive this trend. However, the price range for BTC price between $29k and $32,000 presents an important resistance level to consider. As the current price is already at $27,000, investors are preparing to gradually sell their BTC supply. The FOMC meeting to be held on March 20-21 is expected to have a significant impact on the market, so experts think investors should proceed with caution.

Popular analyst: “I don’t see how Bitcoin will perform so well in this environment. “

Another name that makes comments on the subject is the analyst Nicholas Merten. Merten states that although Bitcoin has been on the rise last week, he has a doubt about himself. Addressing 511,000 YouTube subscribers, the name says that although the Bitcoin-Nasdaq stock index correlation is on the rise, the macro environment is unfavorable.

That said, “I don’t see how Bitcoin is going to perform so well in this environment. The statements of the famous analyst on the subject are as follows:

I must say that the chart here is what excites me the most, with the Bitcoin-Nasdaq ratio, an absolutely positive sign that we were able to break above the 200-week and 200-day moving averages. But in the last transaction we lost the expansion of earnings. I have to show that I can hold on here because the last time we hit over $25,000 it didn’t take long.

And we are currently in a macro environment for a riskier asset like Bitcoin amongst many actions by regulators. Where will the liquidity come from? I’m not saying that long-term investors, speculators, and regular traders can’t handle it. However, we haven’t even witnessed a typical correction for the crypto bear market.

According to Merten, BTC is likely to be crushed by macroeconomic factors in the coming weeks. The leading cryptocurrency BTC is instantly traded at $27,167.13.