Anders Bylund, an analyst at The Motley Fool, a US-based consulting giant and finance company, drew attention to an altcoin project that can be taken from the bottom. Here are the details…

Analyst points to bottoming opportunity for this altcoin

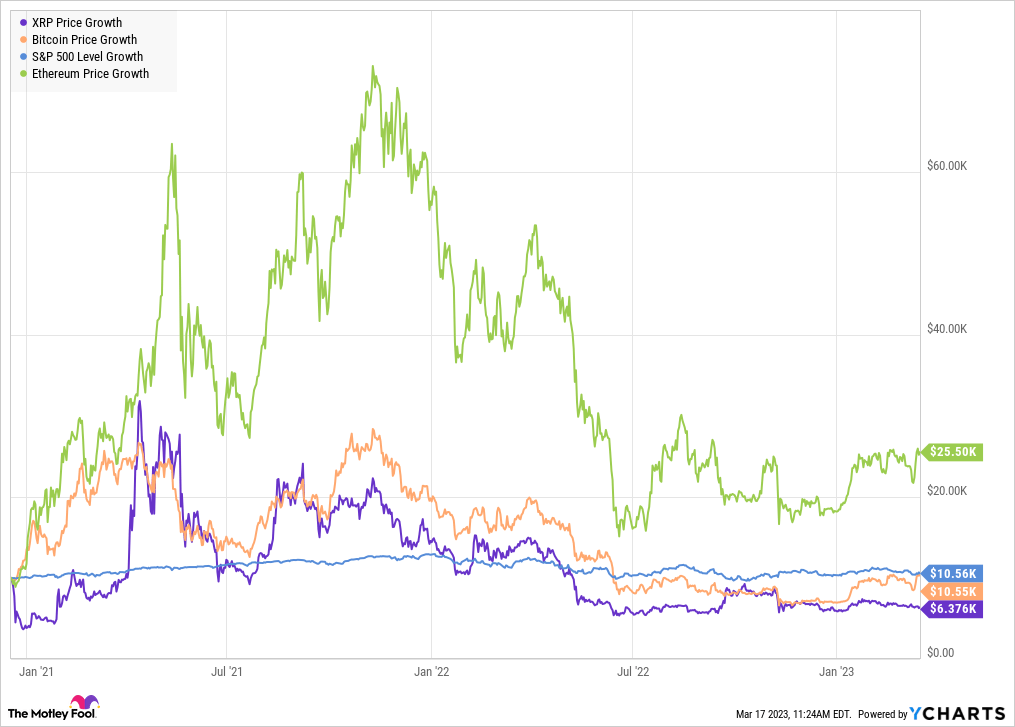

Most cryptocurrencies are rising in 2023. Bitcoin has increased by 60.5 percent from the beginning of the year to date, while Ethereum has increased by 45.3 percent in the same period. Solana is recovering nicely from her relationship with last November’s FTX meltdown, posting a 105.7 percent gain so far in 2023. However, XRP could not achieve such a rise. Ripple’s coin, which operates in the cross-border payments space, has gained only 10.8 percent this year, missing the industry-wide rise.

XRP’s stagnant valuation results in a 23.7 percent lower performance compared to Ethereum, a 29.6 percent drop over Bitcoin, and a 46.8 percent drop against Solana. Of course, the token price of XRP soared when measured in US dollars, even surpassing the S&P 500 stock market index. However, it did not show a significant rise compared to other coins in the crypto market. Entering the new year, one Bitcoin was worth 48,068 XRP. Today, one Bitcoin costs you 68,310 XRP tokens. So, should you buy XRP in this recession?

What are the disadvantages and advantages of XRP in the market?

According to analyst Bylund, first of all, we need to address one obvious event: the ongoing lawsuit of the US Securities and Exchange Commission (SEC) against Ripple Labs, the company that created XRP. cryptocoin.com As we have also reported, this legal battle has been going on since December 2020 and hinders the valuation of XRP. According to the analyst, until the case is concluded, one way or another, the price of XRP may remain stagnant or even fall further.

It seems that US crypto exchanges like Robinhood and Coinbase will not allow any XRP trading until the legal mystery is resolved. Because if the SEC wins, exchanges could also be penalized for allowing XRP tokens to be traded. However, there are reasons to believe that even a negative outcome in the case would not be the end of the road for XRP, according to the analyst. The analyst points out that the crypto market is hungry for a sensible regulatory framework. He even talks about a brutal frame being better than a lack of clarity. So, while the negative outcome for Ripple sets a tough precedent, it could make a breakthrough in the proper regulation of cryptoassets.

Ripple has a solid business model, according to the analyst

According to the analyst, Ripple is taking important steps in expanding its global payments network with partnerships in various industries and regions. Ripple plays a central role in the development of central bank digital currencies (CBDCs), working closely with governments in places like Eastern Europe and Southeast Asia.

Another factor to consider is XRP’s unique use case. While Bitcoin primarily serves as a store of value, Ethereum powers decentralized applications with smart contracts. XRP is different: It acts as a bridge currency for cross-border payments. This means that the success of XRP depends on the adoption of Ripple technology in the global financial system. Therefore, according to the analyst, XRP will find its way into the market despite the chilling effects of the SEC lawsuit.

Analyst: Investing in altcoins could be a bold decision

Despite XRP’s lackluster performance compared to other cryptocurrencies in 2023, the company’s unique use case and global expansion make it a promising investment opportunity. Bylund said, “While the SEC’s ongoing litigation against XRP is a major concern, it should be viewed as a minor hurdle rather than a game-changing event. Even a negative outcome in the case will not bring the final curtain to XRP. Remember, any outcome will support the development of much-needed regulation in the crypto market.”

As it is known, XRP lost 36 percent of its value during its struggle. At the same time, Bitcoin and the S&P 500 have largely moved sideways. However, with the active use of XRP and the sixth largest market cap in the crypto space, it may be a wise decision to invest in XRP during this relative decline. Investing in XRP could be a bold move that pays off in the long run, according to the analyst.