Bitcoin and 4 altcoins remain strong on the charts, raising the possibility of further gains in the near term, according to crypto analyst Rakesh Upadhyay. While anything is possible in crypto markets, the analyst advises traders to be prudent in their trades and immerse themselves in lofty goals. The analyst examines the charts of Bitcoin and 4 altcoins, which are showing signs of resumption of the upward move after a minor correction.

Let’s take a look at the market first

cryptocoin.com As you follow, Bitcoin is on its way to close the week with over 23% gains. The banking crisis in the US and Europe seems to have increased buying in Bitcoin, showing that the leading cryptocurrency is acting as a safe-haven asset in the near term. All eyes are on the Fed’s meeting on March 21 and 22. The failure of banks in the US has raised hopes that the Fed will not raise interest rates at the meeting. The CME FedWatch Tool shows a 38% probability of a pause and a 62% probability of a 25bps rate increase on March 22.

Crypto market data daily view / Source: Coin360

Crypto market data daily view / Source: Coin360Analysts are split over the consequences of the current crisis on the economy. Former Coinbase chief technology officer Balaji Srinivasan believes the US will enter a period of hyperinflation, while alias Twitter user James Medlock thinks otherwise. Srinivasan plans to make a millionaire bet with Medlock and another that the price of Bitcoin will reach $1 million by June 17. Now it’s time for analysis…

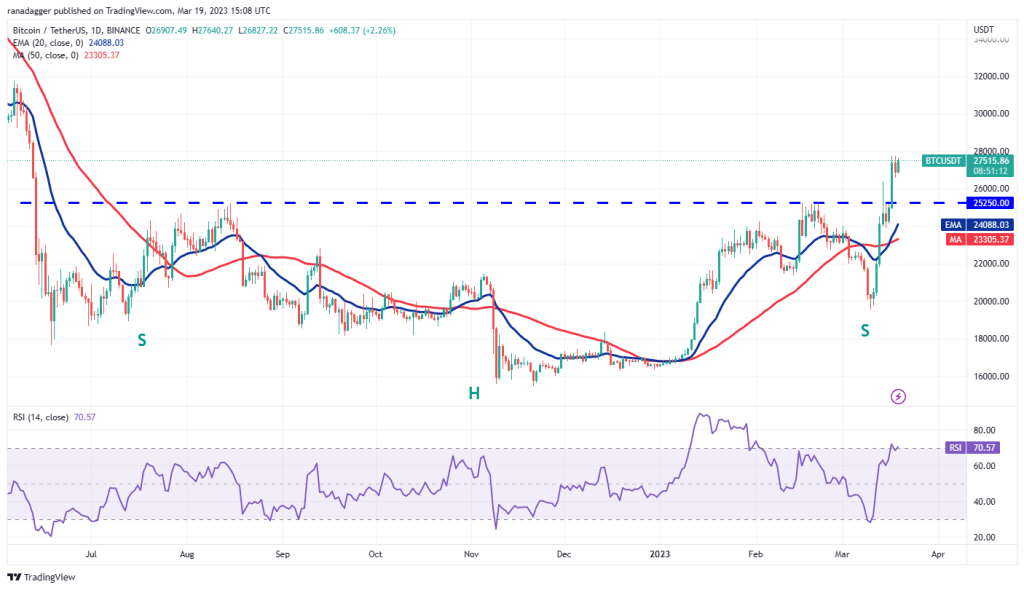

Bitcoin (BTC): H&S completes bullish pattern

Bitcoin completed an inverted head and shoulders (H&S) bullish pattern by breaking above the $25,250 resistance on March 17. Usually, a breakout from a major setup returns to retest the breakout level, but in some cases the rally continues unabated.

BTC daily chart / Source: TradingView

BTC daily chart / Source: TradingViewThe 20-day exponential moving average ($24,088) and the relative strength index (RSI), which are rising in the overbought zone, are taking advantage of the buyers. If the price climbs above $28,000, the rally could gain momentum and rally to $30,000 and then $32,000. This level is likely to witness strong selling by the bears. Another possibility is for the price to drop from the current level but recover from $25,250. This will also maintain the bullish trend.

The positive view will be invalidated in the near term if the price drops below the moving averages. Such a move will indicate that a break above $25,250 could be a bull trap. This could open the door to a possible drop to the psychologically critical $20,000 level.

4 altcoins that can surprise

Ethereum (ETH): Bears maintain strong $1,800

The bulls surpassed the $1,800 resistance on March 18 but failed to sustain higher. This shows that the bears are holding the $1,800 level strongly in ETH.

ETH daily chart / Source: TradingView

ETH daily chart / Source: TradingViewThe critical support to watch on the downside is the zone between $1,680 and the 20-day EMA ($1,646). If the price bounces back from this zone, it will show that sentiment has turned positive and traders are buying on the dips. Buyers will then try to resume the uptrend again and push the price towards the next target of $2,000. This level could be a major hurdle for the bulls to cross. Conversely, if the price drops and dips below the moving averages, it indicates that the bulls have lost their dominance. The altcoin could then drop to $1,461.

Binance Coin (BNB): H&S invalidated the bearish pattern

BNB broke above $338 on March 18, invalidating the H&S bearish pattern. Usually, when a bearish pattern fails, it attracts buying from the bulls and shorting by the bears.

BNB daily chart / Source: TradingView

BNB daily chart / Source: TradingViewThe bulls bear the responsibility to keep the price above the close support at $318. If they manage to do so, BNB could first climb to $360 and then skyrocket to $400. The ascending 20-day EMA ($309) and the RSI near the overbought zone suggest the path of least resistance to the upside. If the bears want to gain the upper hand, they will have to push the price below the moving averages. This may not be an easy task, but if completed successfully, the altcoin could drop to $280.

Stacks (STX): Bulls buy aggressively

STX rallied from $0.52 on March 10 to $1.29 on March 18 and quickly rose sharply. This indicates that the bulls are buying aggressively.

STX daily chart / Source: TradingView

STX daily chart / Source: TradingViewMeanwhile, STX witnesses profit reservations of around $1.29. But a positive sign is that the bulls haven’t left much ground for the bears. This indicates that small dips are bought. Typically, in a strong uptrend, corrections take one to three days. If the price rises and rises above $1.29, the altcoin could resume its uptrend. The next stop on the upside will likely be $1.55 followed by $1.80. The first sign of weakness on the downside will be a break and a close below $1. This could open the way for a drop to the 20-day EMA ($0.84).

Immutable (IMX): Started a new bull trend

IMX jumped above the overhead resistance of $1.30, completing an inverse H&S formation on March 17. This indicates the start of a potential new uptrend.

IMX daily chart / Source: TradingView

IMX daily chart / Source: TradingViewMeanwhile, the price could retest the $1.30 breakout level. If the price bounces back strongly from this level, it will show that the bulls have turned the level to support. Buyers will then try to push the price above $1.59 and continue the uptrend. IMX could then rise to $1.85 and then $2. The reversal setup’s model target is $2.23. This positive view could be rejected in the near term if the price dips below the moving averages. Such a move will indicate that a break above $1.30 could be a bull trap. The altcoin could then drop to $0.80.