Bitcoin (BTC) started the new week full of macro surprises with a target of $30,000. Despite the ongoing positive trend, a few critical developments of the week may put selling pressure on Bitcoin and altcoins.

Bitcoin (BTC) may be under the influence of 11 developments this week

Bitcoin and altcoins are trading at a nine-month high, after a week of chaos and consequent solid gains for macro markets. As last week, there are all sorts of potential hurdles to overcome this week. In one of them, the Fed will decide on the next rate changes and new macroeconomic data will be released.

Fed rate hike cycle questionable

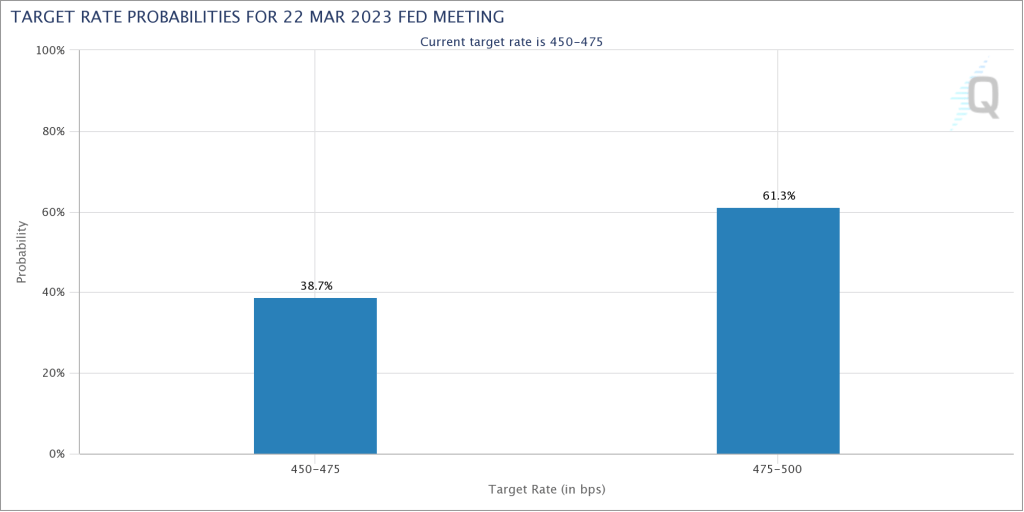

The macro event of the week is the Fed’s rate hike decision, which will be announced on March 22. The Federal Open Market Committee (FOMC) is facing a serious challenge to its current quantitative tightening (QT) policy, which it has implemented for the past eighteen months.

It is expected that raising interest rates could keep inflation in check but punish the economy even more and possibly trigger a new wave of bank failures. “Next week’s FOMC is poised to be one of the most interesting in a while, with no one really agreeing on what’s going to happen,” trader ‘Tree of Alpha’ summarizes.

According to CME Group’s interest rate forecasting tool, as of March 20, the consensus supports the Fed to increase it by 25 basis points instead of stopping rate hikes altogether. The previous week, Goldman Sachs predicted rates to remain flat, while Nomura even predicted a rate cut.

Bitcoin spot price targets $30,000

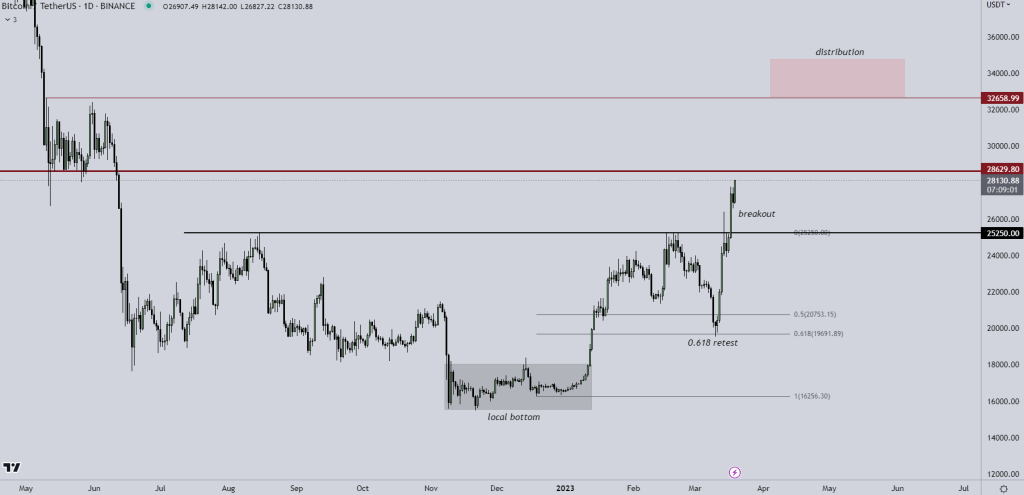

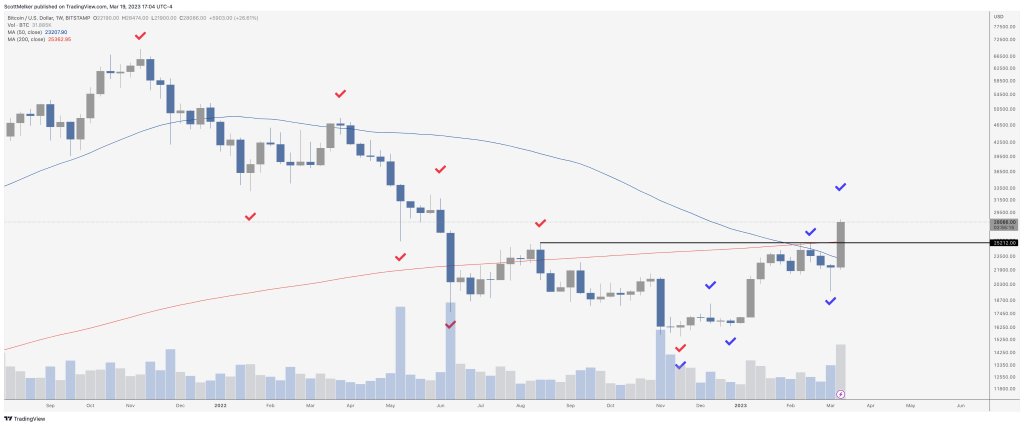

However, the mood of Bitcoin and altcoins has understandably taken a fresh turn for the better as the week begins. According to data from TradingView, this is currently consolidating over $28,000.

Already at a nine-month high, the pair managed to bounce back to target levels not seen in almost a year, surpassing the bears in a period of consolidation last week.

Chief among these is $30,000, a psychologically significant level surrounded by significant historical liquidity. Meanwhile, an important support level to hold will be the 200-week moving average (MA), according to Material Indicators and other analysts.

#FireCharts shows $30M in #BTC bid liquidity consolidated and moved down to defend the 200-Week MA. This is a KEY LEVEL for bulls looking for full candle bodies above the 200 WMA to call it a bull breakout. If the W candle closes below it, hope of a confirmation next week is lost pic.twitter.com/0doqQWchTQ

— Material Indicators (@MI_Algos) March 19, 2023

Experts focused on these levels in Bitcoin price

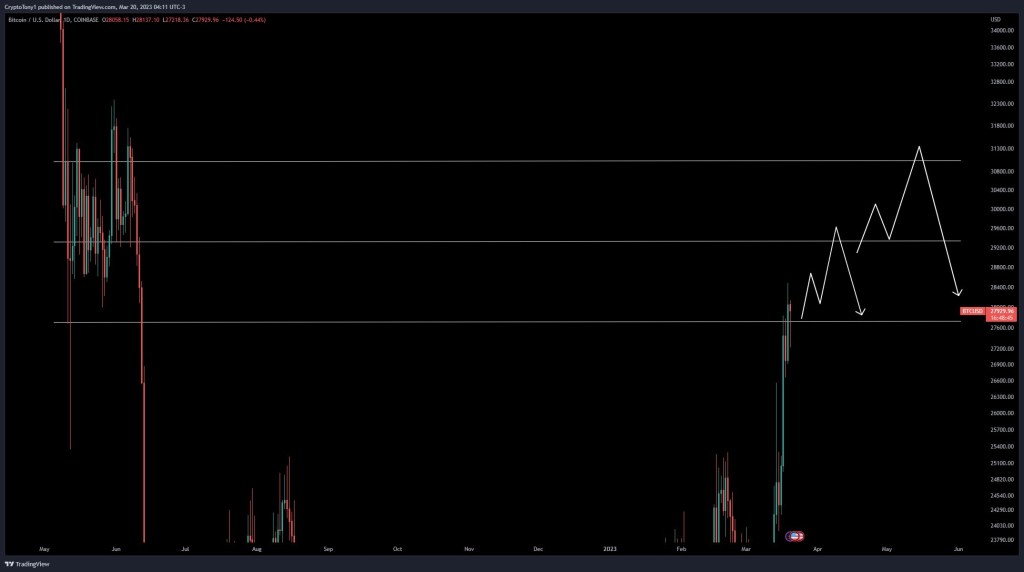

Popular trader Crypto Tony focused on the potential for an attack of $27,700 and $30,000 to support the bullish situation. In current analysts, $27,700 has us currently in the next range between $27,700 – $31,000… Definitely an interesting week. My main long-term stop loss remains at $25,500.”

Meanwhile, in a new analysis, crypto analyst Crypto Chase highlights $28,500 as a potential short position. According to the analyst, “Please note that I am not giving up on the idea of a $28,500 short. These could still present a great opportunity around the FOMC this Wednesday. But I can’t imagine a local peak right now. I think a rejection could occur there and I will still seek the position, but for those trying to keep a $28.5 short return at $12,000 this could be stopped at the 33,000 liquidity pool.”

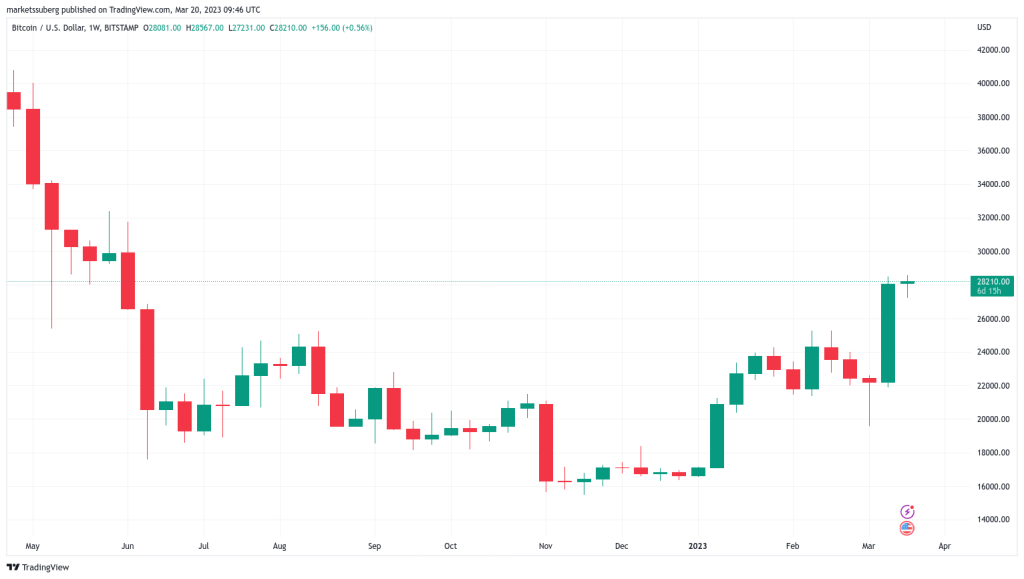

Analyst heralds the end of bear market

However, for some who analyze the long-term picture, Bitcoin has already emerged from a bear market since falling from ATH levels and the start of Fed tightening in late 2021. The weekly close came in at just over $28,000, making it Bitcoin’s highest since early June 2022.

“The bear market is officially over,” said the popular crypto analyst, nicknamed Wolf of All Streets, based on weekly chart data.

BTC made its first high ($25,212) since ATH. This confirms a new uptrend. The price may still fall, but this will be a new trend, not a continuation of the previous bear market. Congratulations everyone.

Melker linked to a similar post in August 2019, just after the BTC/USD pair crossed $13,000 in the rebound from the trough of the previous bear market.

Bitcoin difficulty registers new ATH

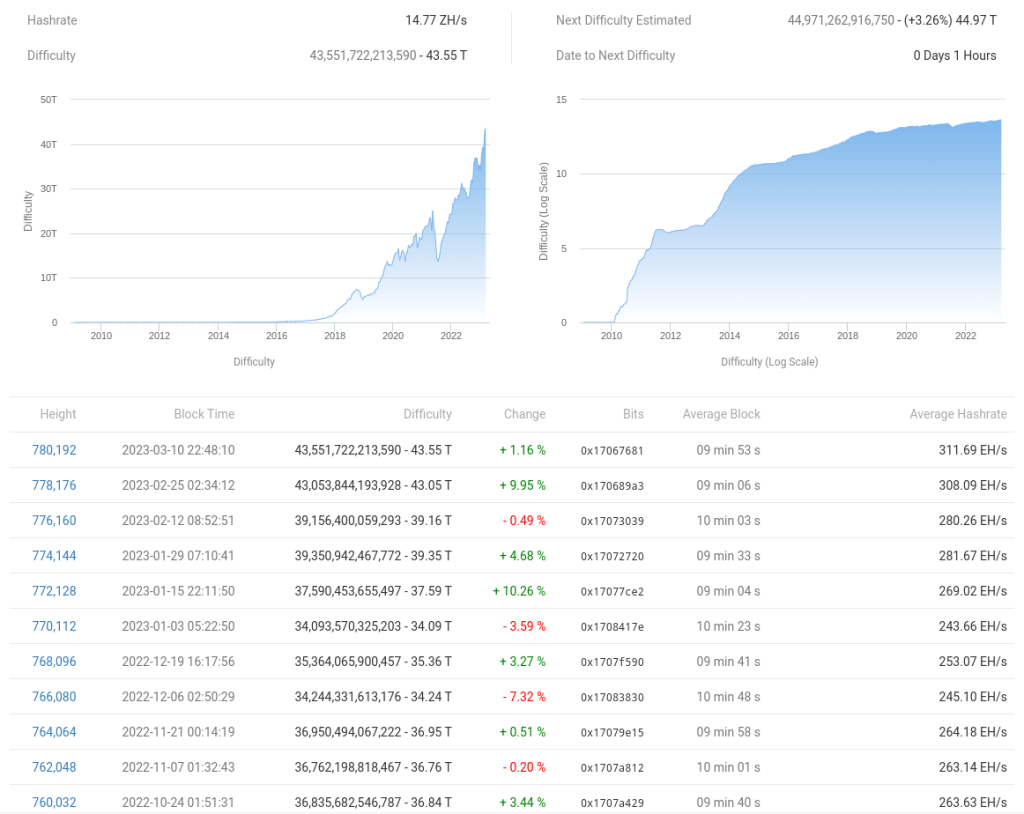

In a classic move, Bitcoin’s network fundamentals refuse to give up on their journey to the moon. Recent estimates from BTC.com and MiningPoolStats show that both hash rate and difficulty are in “up-only” mode this month.

Difficulty will increase 3.26% in the coming days to almost 45 trillion. The hash rate hit a local high on March 13, but it is now once again bullish as miners respond to the latest price action.

Bitcoin hash rate just casually reaching new all-time highs week after week pic.twitter.com/bYIpO0puvs

— Will Clemente (@WClementeIII) March 18, 2023

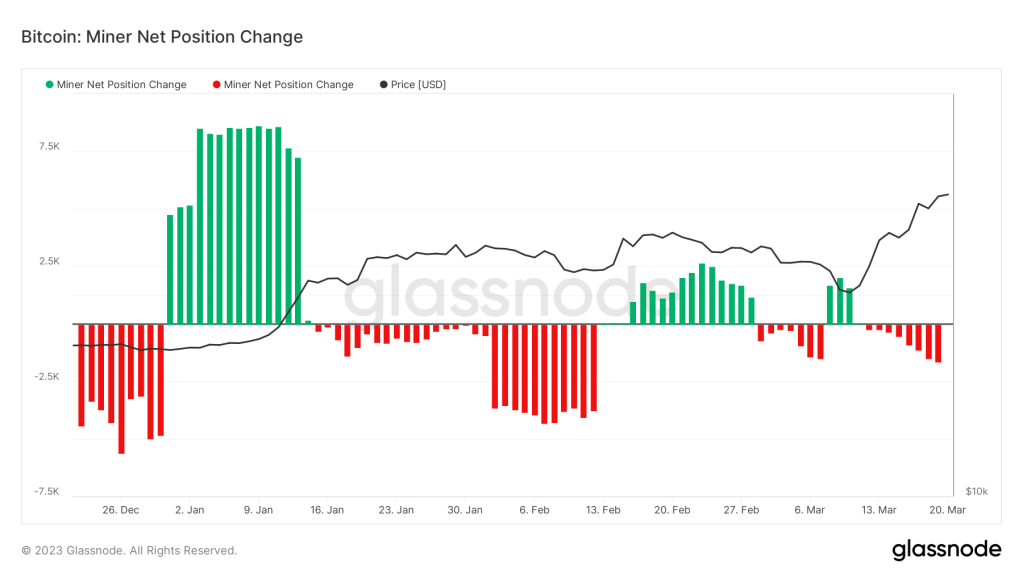

However, there is a difference between miners. According to data from on-chain analytics firm Glassnode, on a 30-day basis, miners’ BTC balances continue to drop.

The most greedy since bitcoin price was $69,000

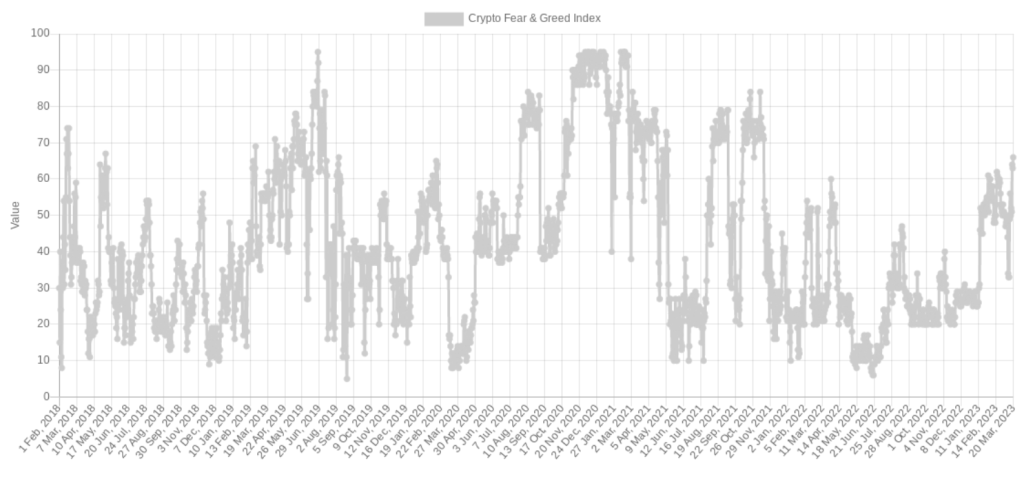

There may still be reasons to fear the current bullish volatility in bitcoin and crypto more broadly. A glance at the sentiment data shows that the majority of the market is starting to overconfidence in the good days ahead.

Using a number of factors to produce a normalized sentiment score for crypto, the Crypto Fear and Greed Index is currently at 66/100, firmly in the “greed” zone and its highest level since November 2021.

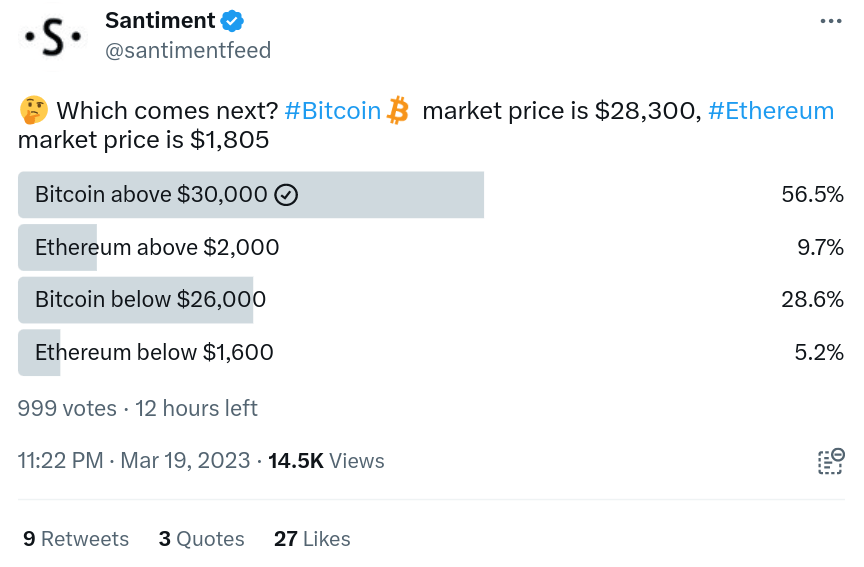

His warnings are also confirmed by social media users. A survey by research firm Santiment, which received nearly 15,000 responses, shows that many believe BTC/USD will surpass $30,000 as the next major crypto market event.

Other important financial developments in the week of March 20

- European Central Bank President Lagarde will make a statement on 20 March at 19:00.

- Binance Space ID (ID) launchpad closes registrations on Wednesday, March 22.

- The CBRT will announce its interest rate decision on Thursday, March 23.

- cryptocoin.comAs we reported, Arbitrum (ARB) is listed on Binance on March 23, the same day as the airdrop event.