Uniwap (UNI) topped Coinbase (COIN) in terms of market share last month as traders turned to decentralized exchanges (DEXs) amid the U.S. regulatory clampdown and a banking crisis that caused key stablecoins to depeg from $1.

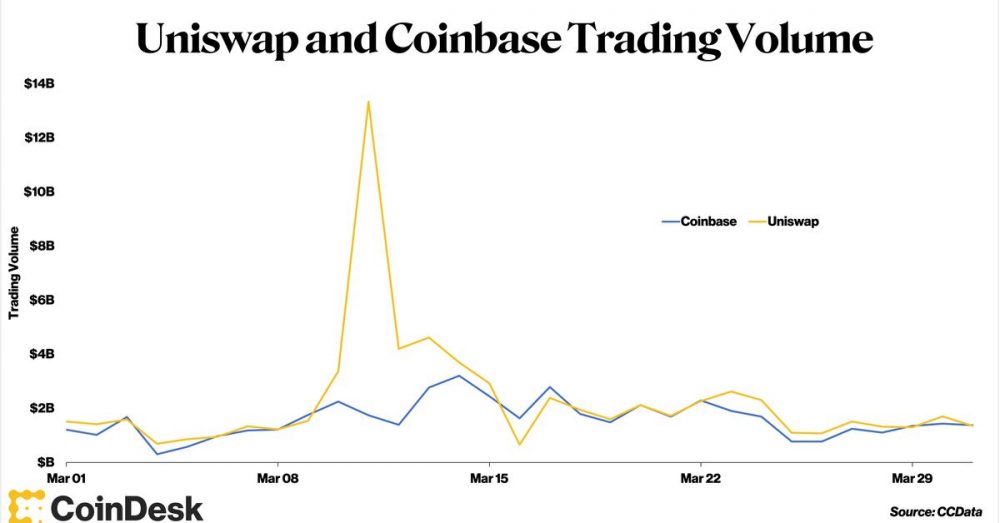

Uniswap handled more than $70 billion of trading in March, exceeding centralized exchange (CEX) Coinbase’s $49.2 billion, according to CCData (the company formerly known as CryptoCompare.) The surge coincided with overall DEX volume surging to a 10-month high.

Coinbase was told in March that the U.S. Securities and Exchange Commission (SEC) was pursuing an enforcement action.

Recommended for you:

- Why NFTs Are So Appealing – And How Anyone Can Start Learning for Free

- How Ethereum Will Be Transformed in 2022

- The Game Is On: The Hunt for Web 3 Gaming Models

- Join the Most Important Conversation in Crypto and Web3 in Austin, Texas April 26-28

Also, Silicon Valley Bank’s (SVB) collapse drove two key parts of decentralized finance (DeFi) – Circle Internet Financial’s USD coin (USDC) and MakerDAO’s DAI – down from their customary price of $1, prompting a flurry of DEX trading as scared investors shifted money around. Amid that crisis, Uniswap saw $13.3 billion of volume on March 11, whereas Coinbase had $1.7 billion.

CCData noted in an email to CoinDesk that Uniswap has previously seen big spikes like this during times of turmoil, only to see things quiet down – suggesting Uniswap may not maintain its lead over Coinbase, the largest U.S. exchange.