Are we ready for a busy and data-filled week? US and European indices were closed on the last day of the week due to the Easter holiday. Today, European stock markets will remain untraded.

After the employment data from the USA last week, the eyes of the markets were turned to the CPI data this week. In line with the future expectations on inflation, a data may be welcomed by the market.

After the CPI data, the minutes of the FOMC meeting will be announced. In these minutes, we will see the details of the Fed’s monetary policy and examine the clues for future interest rate decisions.

In the shadow of the banking crisis, big banks such as JPMorgan and Citigroup will announce their reports on Friday, while Goldman Sachs, Morgan Stanley and Bank of America will announce their reports a week later, which will be a data for the markets to watch closely.

In the crypto money markets, the eyes turned to Ethereum. The “Shapella” upgrade will take place on April 12, 01:27 CEST. Validators who have been staking Ether for more than 2 years will be able to get their Ether back with this update. Another important development is that Facebook and Instagram will stop supporting NFTs on April 11.

Economic Calendar

Wednesday, April 12, 2023

- USA – Consumer Price Index (CPI) Expectation (YoY): 5.2% Previous: 6% – 15.30%

- USA – Fed FOMC minutes to be released – 21.00

Thursday, April 13, 2023

- USA – Producer Price Index (PPI) Expectation: 0.1% Previous: -0.1% – 15.30

- UK – Annual Gross Domestic Product (GDP) Expected: 0.2% Previous: 0.3% – 09.00

- USA – Applications for Unemployment Benefits Expected: 205K Previous: 228K – 15.30

Friday, April 14, 2023

- USA – JPMorgan, Wells Fargo, Citigroup and First Republic Bank first quarter reports to be released.

Bitcoin Technical Analysis

Last week, we did not see large volumes in the cryptocurrency markets due to the low risk appetite. On the daily chart, Bitcoin continued to test the $29,000 levels. With the daily candle closings on the wicks, Bitcoin will start its journey to the level of $ 32,000, and under the key-zone area, which is the level of $ 26,400, our direction is bullish unless there is a candle close. In terms of the price retracement point, we will follow the next swing zone, $24,300 – $25,300.

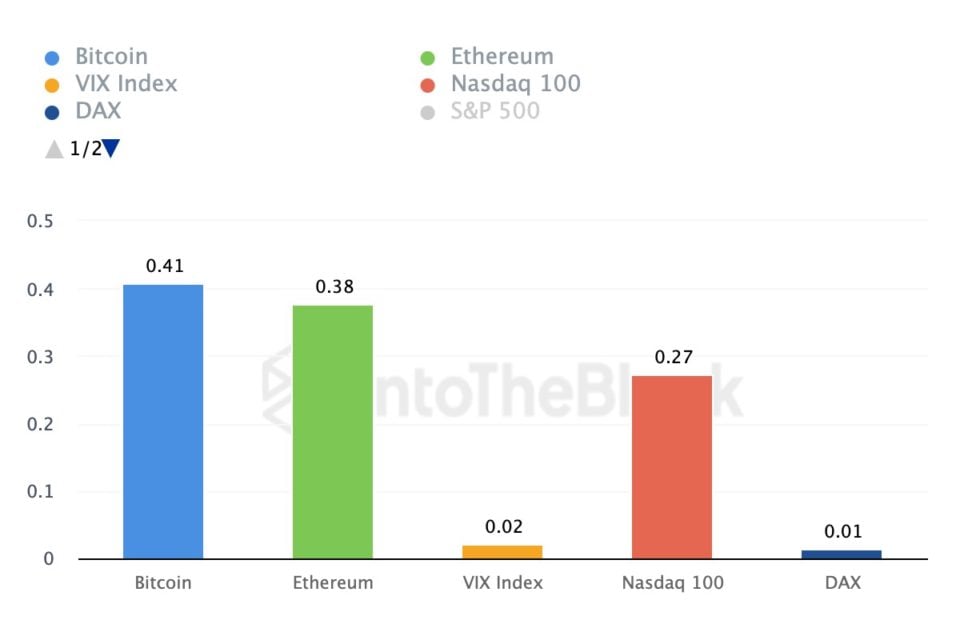

Sharpe Ratio

The Sharpe ratio is one of the most widely used metrics in traditional finance to evaluate an asset’s risk-return performance. The Sharpe ratio shows which asset performs best according to its volatility. In the example above, we observe that Bitcoin and Ethereum were the best risk-adjusted assets over the past 30 days, while the German Combined Stock Exchange Index (DAX) was the worst of the assets displayed.

Top Rising Cryptocurrencies of the Week

- Radix (XRD) 17.8%

- Bitget Token (BGB) 10.3%

- Curve DAO (CRV) 10.2%

- Injective (INJ) 10.2%

- THORChain (Rune) 8.7%

Last Week’s Featured Crypto News

Texas Takes Action for Gold-Backed Cryptocurrency

Lawmakers in the US have agreed that a US dollar-based central bank digital currency ( CBDC ), Texas chooses to take a different route with the creation of state-issued gold. This is a gold-backed digital currency.

IOSCO Prepares Crypto Regulatory Report for 2023

International Organization of Securities Commissions ( IOSCO), stablecoin, DeFi and influencerHe prepared a regulation report on ‘s.

On the other hand IOSCO will hold a meeting for the regulatory report on cryptoassets in the second quarter of 2023. The organization’s recommendations on regulations, It is slated to be published by the end of 2023.

Apple Computers Have Bitcoin Whitepaper

In April 2021, a user named bernd178 on the MacOS Community Forum revealed a function called Virtual Scanner II, which is embedded in the Image Capture Utility and is not enabled by default. Virtual Scanner II includes an image of a bay in San Francisco and a PDF copy of the Bitcoin Whitepaper.

Crypto’s First Quarter Scorecard: What Happened to Coins?

Ended with our step in April of 2023 In the first quarter, there was a lot of activity in the crypto industry . Not only in the cryptocurrency market, but globally, there were significant differences in many financial areas. From time to time Fed rate decisions, at times bank crisesThe crypto industry, hit by a blow, has somehow moved on managed to progress in the upward direction.