Crypto bulls and bears jockeyed for position as the March Consumer Price Index (CPI) offered hope that the U.S. central bank would be able to avoid lowering interest rates at its next meeting in May.

The latest inflation data coincides with shifts in whale activity and the unveiling of the Ethereum Shanghai upgrade later Wednesday.

The CPI rose 0.1% in March, better than the estimate for 0.2% growth. Core CPI, which removes traditionally more volatile food and energy prices, aligned with estimates for 0.4% growth, down from 0.5% the month prior.

The latest readings continue a months-long trend of easing inflationary pressures. The March 31 release of the Personal Consumption Expenditure price index (PCE), showed prices increasing 0.3%, down from 0.6% the prior month. PCE data is arguably Federal Reserve Chair Jerome Powell’s preferred inflation indicator. .

Declining inflation and recent turmoil in the banking industry have led investors to speculate whether the Federal Open Market Committee (FOMC) will pause rate hikes in 2023. The 2 p.m. release of FOMC minutes offered few hints of the central bank’s path forward.

As crypto bulls and bears tried to find meaning in the CPI, bitcoin’s price rose to $30,400 before sinking briefly below $30,000. BTC is currently trading just above that threshold.

Ether took a slightly different path, pushing higher initially before flattening. Ether investors on Wednesday were weighing not only inflation but the Ethereum Shanghai upgrade, which could send ETH’s price spiraling as stakers of ether un-stake their tokens to potentially sell them. A number of analysts believe the so-called hard fork will have little impact on prices as traders who have long known about the upgrade would have already sold off.

ETH was recently trading 60% higher year-to- date.

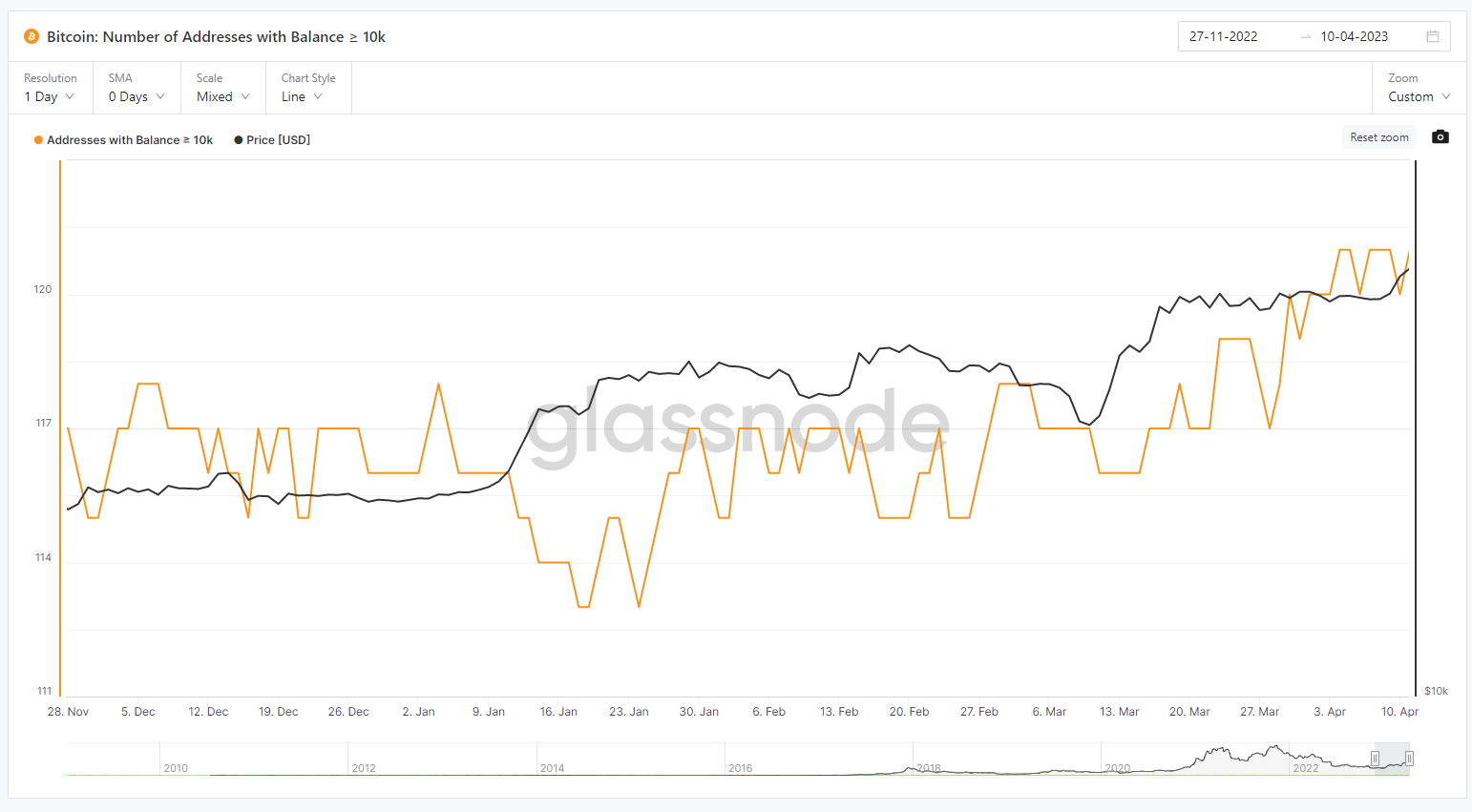

While BTC finds its footing, investors might want to monitor unique wallet addresses, particularly larger ones. Among these wallets holding significant amounts of crypto:

One explanation could be that investors on the precipice of 10,000 BTC are optimistic, locked in to the asset and increasing their exposure – ready to move into a higher tier.

This may represent a base of support for BTC prices, as investors who went long the digital asset in January are up 80% year-to-date.

Recommended for you:

- How Ethereum Will Be Transformed in 2022

- NFTs Are Now Collateral for Secured Loans. Are You Legally Protected?

- It’s Time to End Maximalism in Crypto

- Join the Most Important Conversation in Crypto and Web3 in Austin, Texas April 26-28