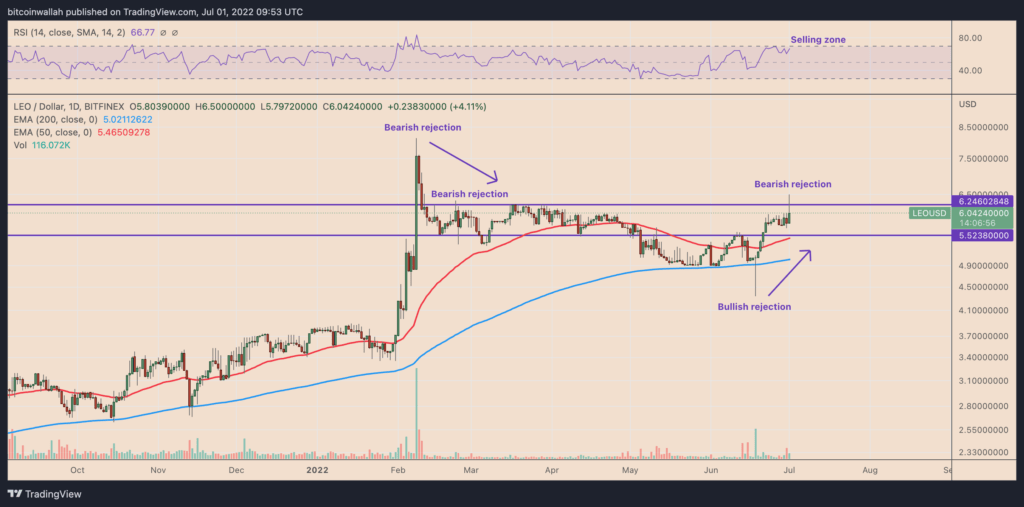

Unus Sed Leo (LEO) not only escaped the bloodbath of the crypto market in the first half of 2022, but also survived the massive altcoin crash, making high gains. Crypto analyst Yashu Gola lists the reasons behind the LEO rise.

LEO quietly records new highs, up 300% in 2022

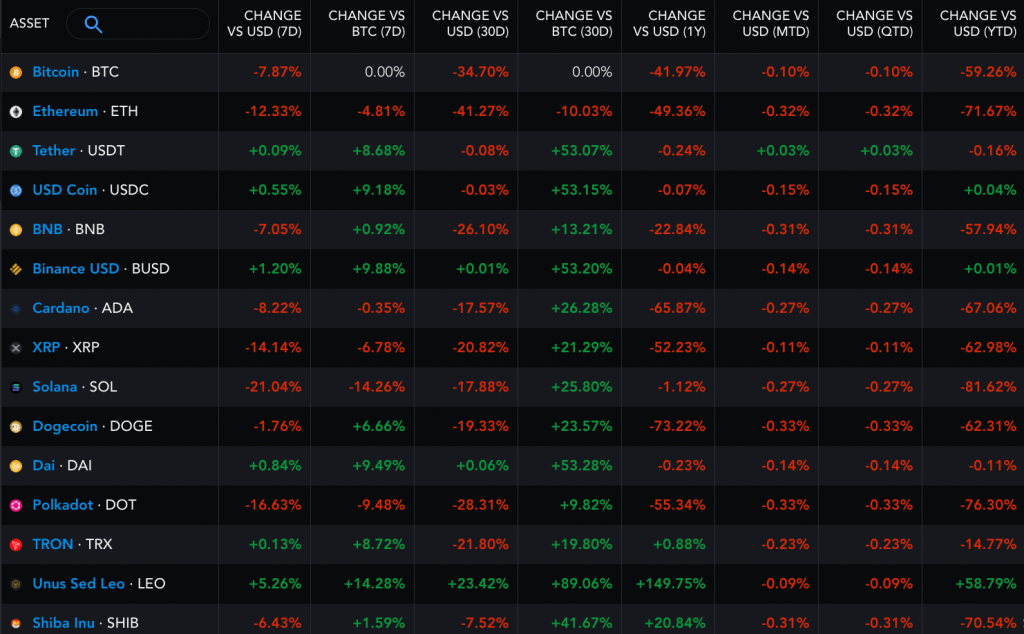

Used in the iFinex ecosystem, LEO completed the first half of 2022 with 32,793 satoshis, a 300% increase against Bitcoin. LEO also gained 55% against the dollar during the same period. Meanwhile, it reached $5.80 for the first time since February 2022. In contrast, Bitcoin and Ethereum fell by more than 60% and 70%, respectively.

So what makes the altcoin project the top performing crypto in 2022?

How is the LEO price rising as the altcoin market crashes?

cryptocoin.comAs we reported, the crypto market wiped out more than $2 trillion in the first half of 2022 with interest rate hikes and the Terra crash.

LEO price meanwhile fell by 25% after the ATH level hit $8.14. However, it performed better than overall, with the market falling nearly 60% over the same period. The reason behind this outlier may be completely different features compared to other cryptocurrencies.

Major catalysts of LEO

Bitfinex’s parent company IFinex launched LEO in a special round of sales to raise $1 billion in 2018. In return, the firm has committed to using 27% of its previous month’s revenues to repurchase LEO until all tokens are removed from circulation.

Also, iFinex has promised to buy back LEO using funds lost during the August 2016 Bitfinex hack. In February 2022, the US Department of Justice reclaimed 94,000 BTC from 119,754 BTC. This coincided with the rise of LEO to record highs in Bitcoin and dollar-based markets.

Is the overheated rally the cause of the altcoin rise?

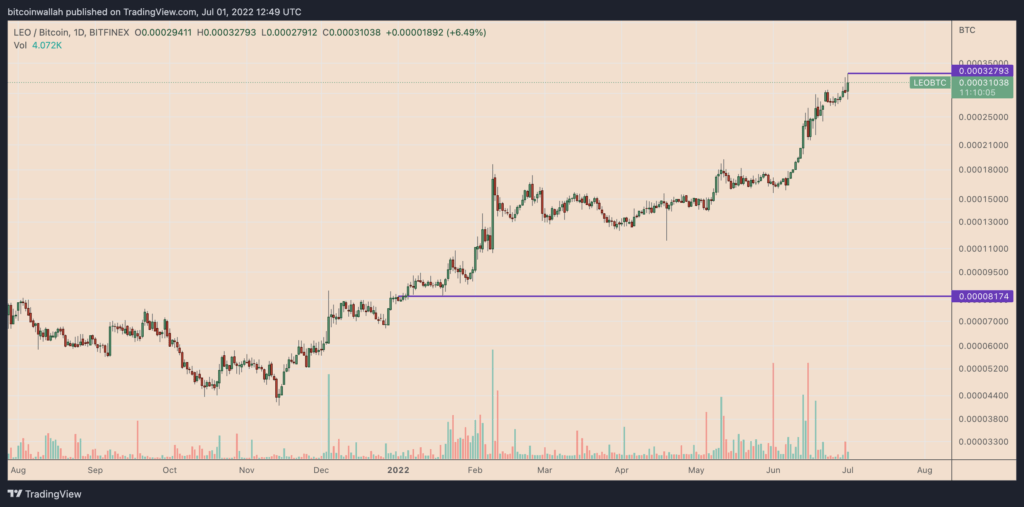

LEO’s bullish run against Bitcoin risks extinction as its price diverges with momentum. In detail, the price of LEO is making higher lows while the RSI is posting lower highs. As a rule of thumb of technical analysis, this difference shows that there is no positive opinion among investors.

The RSI is also traditionally above 70, which is the “overbought” area and a sell indicator. LEO now remains bullish while holding above intermediate support at 26,220 sats. It also coincides with the 0.236 Fib line drawn from the 4,382 low to 32,965 swing high of the Fibonacci retracement chart.

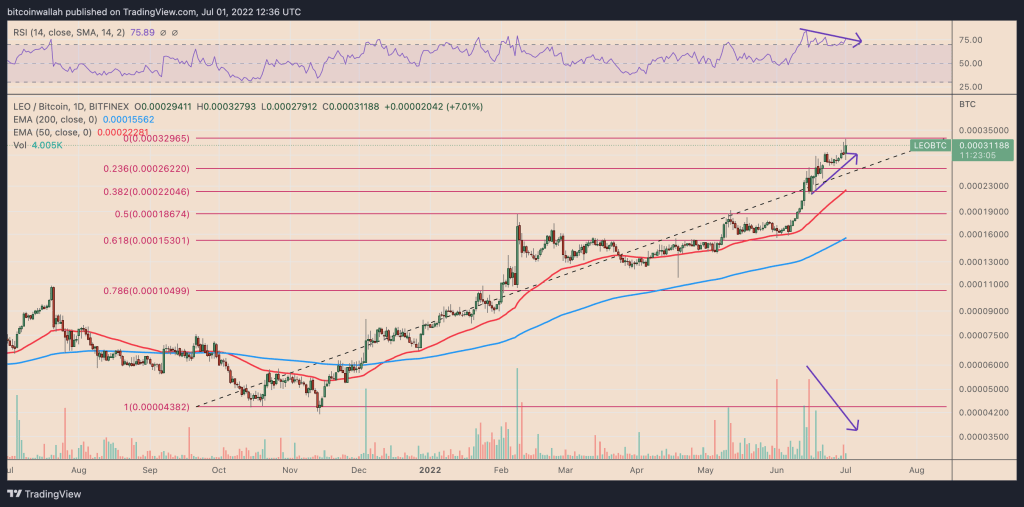

LEO/USD bearish rejection

The continued price increase of LEO caused it to close above the critical resistance level near $6.24.

The level was effective in limiting LEO’s upward attempts between February and April earlier this year. It again spurred traders to take profits on July 1, leaving LEO with a huge upside wick. Thus implied a bearish trend.

LEO’s recent price trends are full of bearish candles, including a 57% intraday price increase that preceded a 28.5% correction at the end of this quarter on Feb. Conversely, the token’s bullish rejection candle on June 18 resulted in a 50% price recovery as discussed above.

If the given fractal materializes, LEO risks returning to the temporary support level of $5.52. This represents a modest 9-10% drop from the price on July 1. However, if support fails to hold as it did in late April, LEO risks testing $5. This means a 17% decrease in total.