Digital asset investment management stands to benefit greatly from the techniques and lessons learned in traditional finance. From portfolio construction methodologies to regulatory frameworks, leveraging best practices from decades of research in traditional asset management will help accelerate crypto’s broader adoption.

In certain ways unlike traditional asset classes, however, blockchain assets may warrant a closer look beyond familiar concepts. That includes using market capitalization as a weighting methodology for passive portfolios.

Portfolios across both traditional and digital asset classes often use market cap to determine how much to invest in each underlying asset. Doing so provides investors straightforward passive exposure to the overall market. For digital assets, though, complementing market cap with some measurement of a blockchain’s usage may enhance portfolio construction.

You’re reading Crypto Long & Short, our weekly newsletter featuring insights, news and analysis for the professional investor. Sign up here to get it in your inbox every Wednesday.

One way to do that is with total value locked (TVL), which represents the value of assets deposited on a blockchain. A higher TVL suggests greater economic activity and potentially better prospects of future activity or a larger active user base. (A lower TVL implies the opposite.)

By taking the ratio of market cap-to-TVL (MC-TVL), we may glean a more fundamental sense of an asset’s utility beyond the superficial view from market cap, similar to how equity investors use ratios like price-to-book (P/B) to discern a stock’s value. A higher MC-TVL suggests an asset’s capitalization may be bloated, with a valuation that disproportionately exceeds its usage. Conversely, a lower MC-TVL may imply an undervalued blockchain, where markets haven’t yet priced in its activity.

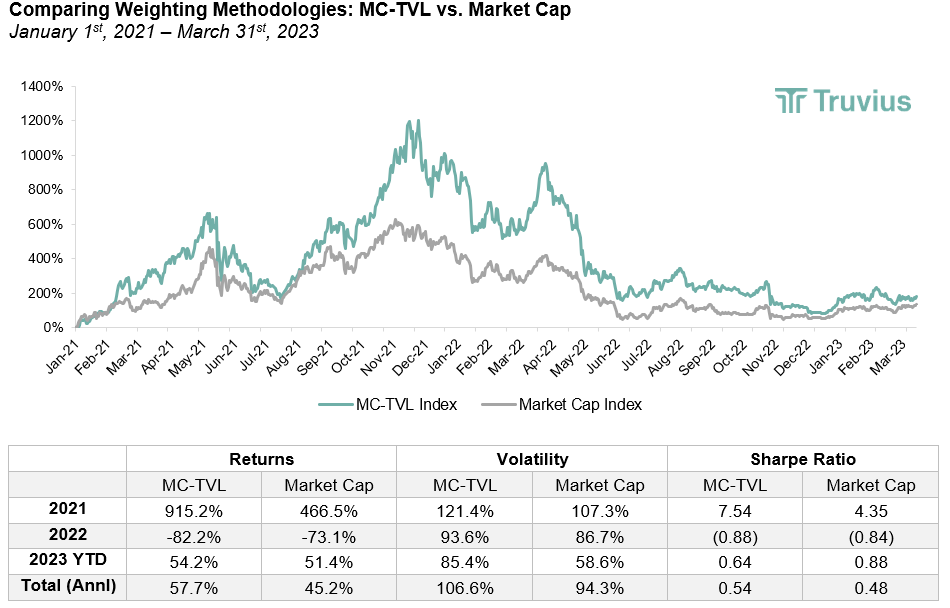

We ran a simulation on a top-10 index weighted by market cap versus one weighted by MC-TVL. The results are below:

The MC-TVL approach produced better full-period returns in this hypothetical scenario, driven by outsized positive performance in 2021. Over the period, daily returns between the two had a 0.85 correlation, suggesting that while the weighting methodologies are similar (by design), meaningful differentiation still exists between them. Over the long run, integrating blockchain usage into passive products may improve overall market exposure and help investors better align themselves with crypto fundamentals.

Conclusion

This experiment, while a highly simplified and mostly illustrative simulation, is intended to encourage more nuanced analyses of crypto-specific properties and how they can be integrated into portfolio construction. Despite limited backtest duration, over the long run lower MC-TVL may prove a useful indication of assets with greater network usage versus higher MC-TVL assets, whose size alone may not completely reflect their value within the digital asset universe.

As crypto’s track record unfurls in real time and new, richer on-chain data emerges, investors should monitor how fundamentals-based adjustments to portfolio construction could assist digital asset investment management.

Recommended for you:

- Crypto Investors Can Rely on ‘Frankly Nothing’ in Current Regulatory Environment, Says Former FDIC Official

- Canada Close to Tightening Rules for Crypto Exchanges: Sources

- El Salvador Grants First Digital Asset License to Bitfinex

Description of simulation: Data is for the period Jan. 1, 2021-March 31, 2023. These indexes represent hypothetical backtests rebalanced monthly and do not consider transaction costs or whether assets are feasibly investable. The indexes exclude stablecoins, wrapped/pegged tokens, centralized exchange tokens and any assets that have not received a price in the last 365 days. Indexes only include proof-of-stake assets for which TVL data is readily available. “Market cap” refers to the circulating market cap of an asset. TVL includes all forms of how assets are used, or “locked” on a chain, including staked deposits, unstaked assets held in wallets, assets sitting in DeFi protocols, dapps, or smart contracts and so on. This article only summarily describes TVL, but there are ways it can be further quantified and more richly defined. This hypothetical backtest has been prepared by Truvius solely for illustrative purposes. Truvius makes no representation or warranty as to the accuracy or completeness of this information or its construction and shall not have any liability for any representations (expressed or implied) regarding information contained in, or for any omissions from, this information. Past returns do not guarantee future performance.