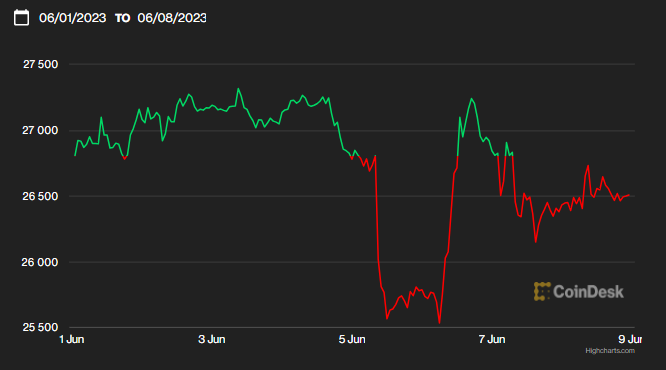

One of the more challenging aspects of investing is thinking about events and the expectations of price movements around them. What we saw last week in the crypto market after the U.S. Securities and Exchange Commission (SEC) took action against Binance and Coinbase was a perfect example.

Specifically, how do you explain the broad market sell-off following the new allegations against Binance (the world’s largest exchange) but a rebound following the case filed against Coinbase (the biggest U.S. exchange) soon after?

Part of this puzzle could be potentially solved (or at least untangled) by considering market expectations and related positioning.

You’re reading Crypto Long & Short, our weekly newsletter featuring insights, news and analysis for the professional investor. Sign up here to get it in your inbox every Wednesday.

(CoinDesk)

Crypto market expectations

Additional regulatory action against Coinbase was probably more certain than against Binance, as the firm had already received a Wells Notice. Juxtapose this with the enforcement action against Binance, a firm with no official physical headquarters, making it less clear how it would be investigated by the SEC. (Answer: via their U.S. entity, Binance.US). If these expectations are somewhat reasonable (caveat for the ex-post analysis), then it could be reasonable to conclude that the difference in market reaction between Binance and Coinbase was related to events that were less and more “priced-in,” respectively.

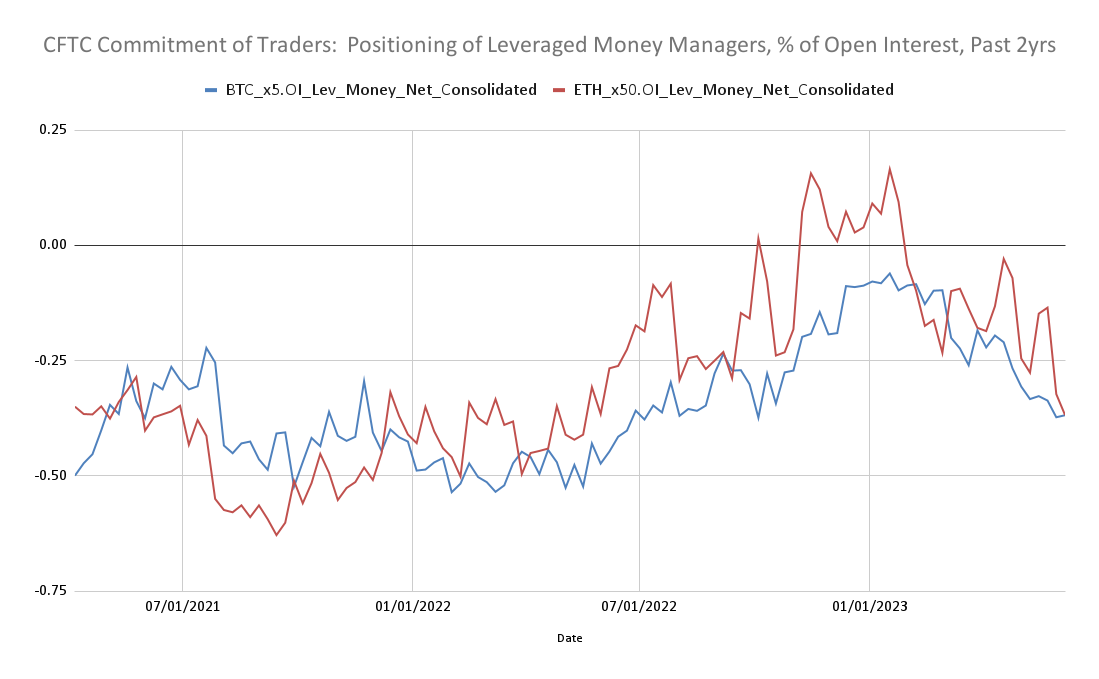

Positioning

Looking into the regulated futures market positioning data helps us determine what actions investors have taken to align with their market views. Why the positioning data, and why regulated markets? Well, it’s good to understand how traders and investors were positioned going into the event, and there have been many allegations of wash trading in unregulated markets.

A good mental model for investor positioning is to think about passengers on a boat. If everyone is spread out across the boat, a specific passenger moving from one side to another does not impact the net balance much. But if everyone is on one side of the boat (and it’s not capsizing) and someone decides to break from the crowd and catch some fresh air on the other side, that contrarian move will have an outsized impact on the net balance of the system. Positioning alongside investor deleveraging dynamics can also help explain relief rallies.

I prefer to look at the data from the perspective of leveraged money managers as opposed to asset managers, swap dealers, or other reportables, as they are more likely to have unhedged positions. I consider the group’s positioning to be a contrarian indicator, as this category of traders is more susceptible to short squeezes.

(CoinDesk)

From digging into the positioning data (see Figure 2), we can see that both bitcoin (BTC) and ether (ETH) futures net positioning for leveraged money managers are net short and are at or near one-year lows, which confirms the relatively bearish expectations for both tokens and, by proxy, the greater crypto market. With positioning at these bearish levels, the market is more resilient to bad-event news and has an increased sensitivity for positive developments to flip short positions to positive.

Both positioning and market expectations dig into a bigger concept of reflexivity within financial markets, as pioneered by George Soros. In short, market reflexivity suggests that investor perceptions and behavior impact market conditions, which, in turn, impact and shape investor beliefs and actions. This circular, self-referential feedback loop leads to non-linear market dynamics as cognitive biases and expectations build on each other to impact market prices and investor positioning. This can explain the emergence of price trends that can become self-fulfilling over the short run and self-correcting over the longer term as traders chase prices until expectations and positioning for continued price moves can only result in a reversal and correction, much to the disappointment of traders who recently started following the trend.

While it’s never a good look for a regulator to target two of the largest exchanges in a single week, last week’s regulatory headlines provided us with a real-world case study in highlighting the importance of market expectations and positioning in providing the setup for event price moves.

Takeaways

From CoinDesk Deputy Editor-in-Chief Nick Baker, here’s some news worth reading: